Methodology

Index structure

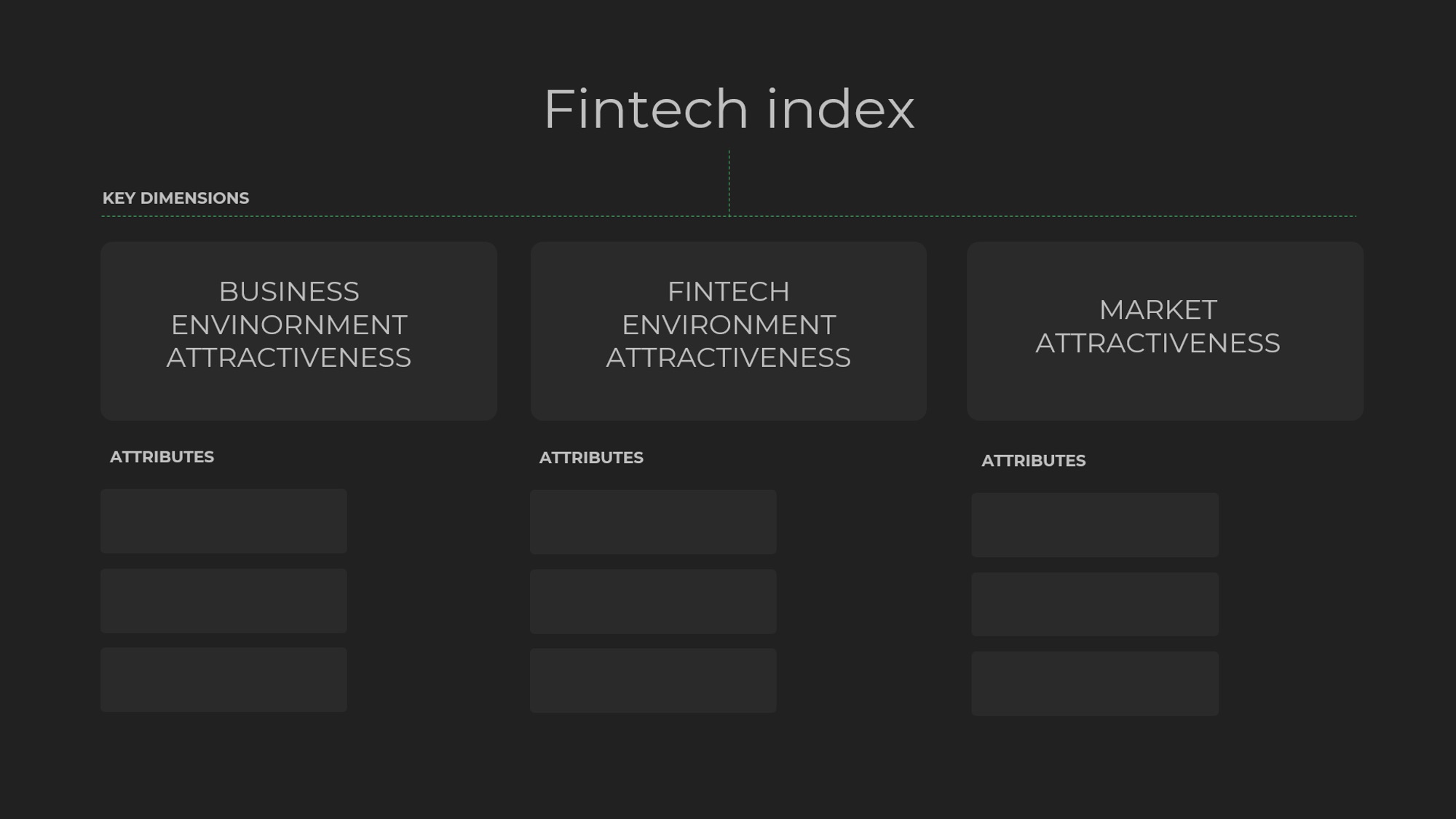

The ranking system consists of three dimensions: Business environment attractiveness, Market attractiveness, and Fintech environment attractiveness.

Each dimension is comprised of these variables:

- Business environment attractiveness defines the overall context for conducting business within the given country.

- Market attractiveness highlights favorable market conditions for establishing a fintech type of business.

- Fintech environment attractiveness covers aspects that make it a favorable market for fintech to conduct commercial operations and to successfully scale.

In all these dimensions, comprised of a total of 1,056 data points, each variable is evaluated equally, regardless of its complexity. Once the country's ranking is determined for each variable, a new ranking for each dimension is calculated by averaging the positions across all variables for that dimension. For the overall ranking, the scores from all three dimensions are combined, and the country's overall position is recalculated. The overall ranking accounts for all of the three dimensions combined together. This is the most holistic evaluation of market conditions to a new fintech business.

Equal weights have been applied to both indexes as well as numerical attributes.

The goal was to include the largest scope of available open data resources. If you have suggestions about how the Index can be improved, please contribute ideas that could shape the European Fintech Index here.

VALUE AND SOURCE SELECTION

The majority of the values and indices have been selected by reviewing what national business and fintech players consider key indicators of showcasing fintech scene attractiveness in each European country. The values and sources have been shortlisted if they have been directly used in promotional content or if they relate to the general arguments and leadership claims that are being made by different countries. All sources are listed at the bottom of the page.

The three dimensions have been outlined to reflect the country’s attractiveness argument typology as the most common claims resolved around: A) the general business environment; B) the attractiveness of the home market; C) the special conditions and factors that apply to fintechs specifically.

REGULATION ASSESSMENT

In the ranking system for World Bank regulations, variables related to these regulations are integral to the comprehensive assessment of each country. Unlike other metrics, World Bank regulation variables are binary, identified solely as "yes" or "no." As a result, countries are not directly ranked based on these variables.

The methodology for incorporating World Bank regulations into the country evaluations follows a systematic process: the average score for each country is first calculated within a specific dimension. This score is then modified by adding the total number of World Bank regulations a country adheres to. The presence of a regulation augments the country’s average by one point, enhancing its ranking. Conversely, the absence of a regulation reduces the average by one point for each unmet regulation, thus lowering the ranking.

This method ensures that the influence of World Bank regulatory compliance on a country's ranking is uniform and on par with the effects of other individual variables within the ranking system.

MISSING VALUES

In the event of missing values during the computation of the overall dimension ranking for a country, any variable for which data is absent will not be included in the calculation of that country's average score. Consequently, the missing value does not impact the country's ranking.

Out of a total of 1,056 data points, only 31 values are missing, indicating a high level of data completeness overall. In the database, Ukraine has the highest number of missing values, with 8 out of 33 variables incomplete, and Serbia follows with 7 missing values out of 33 variables. For all other countries, the number of missing values does not exceed 3 out of 33 variables. This demonstrates that the dataset is comprehensive and reliable.

THE CONCEPT OF A FINTECH

The compilation of this index has been challenged by the lack of a formal and unified definition of what is considered a Fintech business. The most common denominator across different definitions is the use of innovative and disruptive technology within the financial sector, but this alone poses a number of comprehensive data comparison challenges since it is too vague. Such a variety of innovation dimensions makes it hard to truly discern a traditional finance player from a Fintech. For the purpose of creating the European Fintech Index, the definition of Fintech was based on the one used by the European Central Bank, which defines it as „a business model in which the production and delivery of banking products and services are based on technology-enabled innovation”.

This definition of Fintech is also used by the sources cited in the index, for instance: McKinsey & Company (indicators for Workforce (fintech jobs), Fintech funding per capita, Fintech founded per million capita) and the World Bank Group (the Global Fintech-enabling regulations database).

However, the attribute of Licenses in the Fintech attractiveness dimension required a definition of fintechs that can be objectively and uniformly tracked and compared based on their licensing. For this reason, we reference the definition of the European Banking Authority for this attribute, which outlines them as fintechs related to “payments, clearing and settlement services.” Hence, the attribute included fintechs that have a Payments Institution, an Electronic-Money Institution, or an Account Information Service Provider license.

DIMENSIONS AND ATTRIBUTES

The Index focuses on analyzing country potential through three key dimensions: Fintech attractiveness, Business attractiveness, and Market attractiveness. Each dimension covers specific indicators that would best reflect the overall potential of a country in each section. The dimensions were comprised of all the main indexes and rankings used by European countries together with other crucial open data sources for an objective, informative, and all-encompassing fintech index.

The Fintech environment attractiveness dimension highlights favorable market conditions for establishing fintech type of business and encompasses metrics like fintech-related regulation presence in each market, fintech funding per capita, fintech workforce share, and number of fintech licenses.

Fintechs founded per million capita

The data on "Fintechs founded per million capita" highlights the rate of fintech startup formation in a country, indicating the level of entrepreneurial activity and innovation within the sector.

SourceFintech funding per capita

"Fintech funding per capita" serves as a crucial metric for evaluating the intensity of investment in a country's fintech industry relative to its population size.

SourceFintech deals per million capita

"Fintech deals per million capita" measures the number of fintech transactions relative to the population, providing a clear indication of the fintech sector's activity and engagement in a country.

SourceUnicorns per capita

"Unicorns per million capita" tracks the number of startup companies valued at over $1 billion relative to the population size, serving as an indicator of a country's high-value entrepreneurial success and innovation potential.

SourceWorkforce (fintech jobs) as share of total workforce

The measure of "workforce (fintech jobs)" gauges the number of employment opportunities within the fintech sector of a country, reflecting the industry's size and health. A substantial fintech workforce suggests a robust sector, well-supported by local talent and resources, making the country more attractive to investors and companies considering where to establish or expand their operations.

SourceLicenses: Payments institution + Electronic-money institution + Account Information Service Provider

The metric "Payments institution + Electronic-money institution + Account Information Service Provider" provides insights into the regulatory environment and openness of a country to fintech innovation by measuring the number of granted fintech operating licenses.

SourceNumber of banks per capita

The "number of banks" data indicates a country's fintech attractiveness by reflecting its banking sector's size and potential for digital financial innovation and partnerships.

SourceDigital banking (banking license or separate license)

The metric indicates whether provisions and regulations have been established to ensure the effective operation of digital banking systems.

SourceInnovation facilitators (innovation hub, regulatory sandbox, regulatory accelerators)

The metric indicates whether provisions and regulations have been established to ensure the effective operation of innovation facilitator systems.

SourceCryptocurrency regulation

The metric indicates whether provisions and regulations have been established to ensure the effective operation of crypto currency systems.

SourceMarketplace lending (regulation, possibility to operate)

The metric indicates whether provisions and regulations have been established to ensure the effective operation of Marketplace lending systems.

SourceE-money (ability to issue to pre-paid payment instruments)

The metric indicates whether provisions and regulations have been established to ensure the effective operation of e-money systems.

SourceCBDC (working on or actively investigating Central Bank Digital Currencies)

The metric indicates whether provisions and regulations have been established to ensure the effective operation of CBDC systems.

SourceOpen Banking

The metric indicates whether provisions and regulations have been established to ensure the effective operation of Open Banking systems.

SourceAnti-Money Laundering

The metric indicates whether provisions and regulations have been established to ensure the effective operation of Anti-Money Laundering systems.

SourceThe Business environment attractiveness dimension spans several parameters that define the overall context for conducting business within the given country. The most notable metrics include friendliness to startups, ease of doing business, taxation competitiveness, and related aspects.

Ease of doing business

Economies are ranked on their ease of doing business, from 1–190. A high ease of doing business ranking means the regulatory environment is more conducive to the starting and operation of a local firm.

SourceLabor Force with Advanced Education (% of Total Working-Age Population with Advanced Education)

This data is crucial for assessing a country's business environment because it reflects the availability of a highly educated workforce, essential for industries requiring advanced skills. A greater proportion of educated workers enhances a country's attractiveness to investors, innovation capacity, and overall economic resilience.

SourceThe Financial Action Task Force (FATF)

The Financial Action Task Force (FATF) is crucial for determining a country's business environment attractiveness because it sets international standards aimed at preventing money laundering and terrorist financing, enhancing the integrity of financial systems. A positive FATF rating can signal to investors that a country has strong regulatory frameworks, which can increase its appeal as a secure and stable business environment.

SourceFATF vs Moneyval: both of the indices cannot be used since they overlap. FATF was chosen as it covers a wider range of criteria than Moneyval, which was beneficial for a more in-depth view during research.

Venture capital investments % of GDP

Venture capital investments are a key indicator of a region's innovation potential and attractiveness to entrepreneurs, signaling a supportive environment for startups and economic growth.

SourceEmployed ICT specialists

The data on employed ICT specialists is vital for evaluating the business environment as it indicates the availability of tech-savvy professionals who can drive innovation and efficiency across industries. For businesses, this metric highlights a region's capacity to support advanced technological deployments and adapt to digital transformations, key factors in maintaining competitive advantage.

SourceFriendliness to startups

Evaluating the friendliness of a region to startups is significant because it shows the potential for new businesses to successfully establish and develop there.

SourceInternet speed index

Internet speed significantly impacts the evaluation of a business environment, as it enhances the efficiency and productivity of nearly all contemporary businesses. Fast internet supports smooth operations across cloud computing, online transactions, communication, and data transfer, which are crucial for staying competitive in a digitally driven market.

SourceGlobal innovation index

The Global Innovation Index is important for evaluating a business environment because it provides insights into how conducive a country is to innovation and technological advancement.

SourceInfrastructure index

Infrastructure is key in determining its potential business viability, as robust systems like transportation, telecommunications, and utilities ensure smooth operations and cost efficiency.

SourceTax competitiveness index

The structure of a country’s tax code is a determining factor of its economic performance. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities. In contrast, poorly structured tax systems can be costly, distort economic decision-making, and harm domestic economies.

SourceMarket attractiveness covers market aspects that make it a favorable market for fintech to conduct commercial operations in and to successfully scale. The dimension includes metrics that showcase population engagement with digital and financial services, health and size of the economy, as well as regulations that govern digital interactions.

Digital Economy and Society Index

The Digital Economy and Society Index (DESI) is a composite index that summarizes relevant indicators on Europe’s digital performance and tracks the evolution of EU Member States, across four main dimensions: Human capital, Connectivity, Integration of digital technology and Digital public services.

SourceGross Value Added

Gross Value Added (GVA) is a measure of the value of goods and services produced in a country. This metric provides investors and businesses with information about the size of the economy.

SourceGDP per capita (PPP)

GDP per capita expressed in Purchasing Power Parity (PPP) is a key indicator for comparing the standard of living among countries.

SourcePrivate consumption (annual variation in %)

Private Consumption data highlights year-over-year changes in consumer spending within an economy, providing insights into consumer confidence and economic health.

SourceGDP growth rates (CAGR)

Compound Annual Growth Rates (CAGR) of Gross Domestic Product (GDP) quantify the mean annual growth rate of the GDP over a 5-year period. The indicators offer a smoothed indication of a country's economic performance.

SourceDATA PROTECTION (existing laws and regulations)

The metric indicates whether provisions and regulations have been established to ensure the effective operation of DATA PROTECTION systems.

SourceDigitally-enabled ID (systems and regulation)

The metric indicates whether provisions and regulations have been established to ensure the effective operation of digitally-enabled ID systems.

SourceCyber-security (regulations)

The metric indicates whether provisions and regulations have been established to ensure the effective operation of cyber-security systems.

Source