Use cases

Other use cases

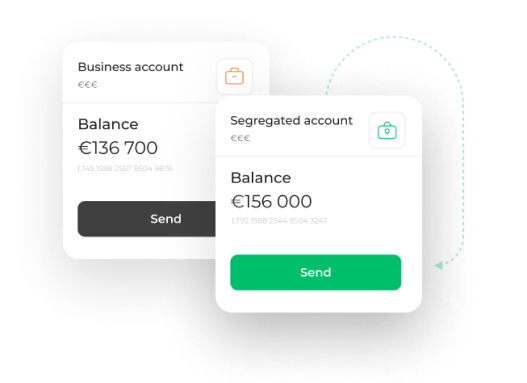

Products

IBAN accounts