SEPA payments, in general, are reliable and quick – taking under 24 hrs for businesses within the euro-zone. But there is also SEPA Instant, allowing you to transfer to a EUR IBAN accounts in seconds.

SEPA cross-border payments in Europe operate just like domestic ones. It’s the preferred transaction method across the euro-zone that’s quick, reliable and supported by the majority of financial institutions.

SEPA INSTANT payments are executed in a matter of seconds and SEPA credit transfers are executed under one day.

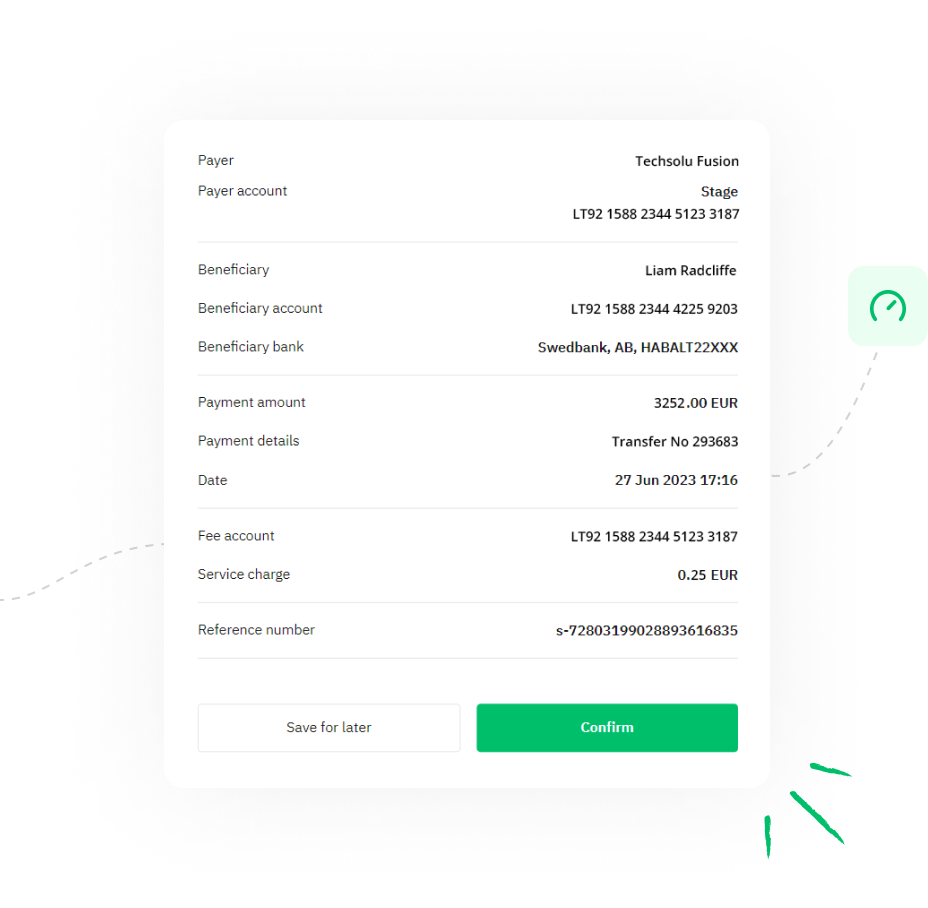

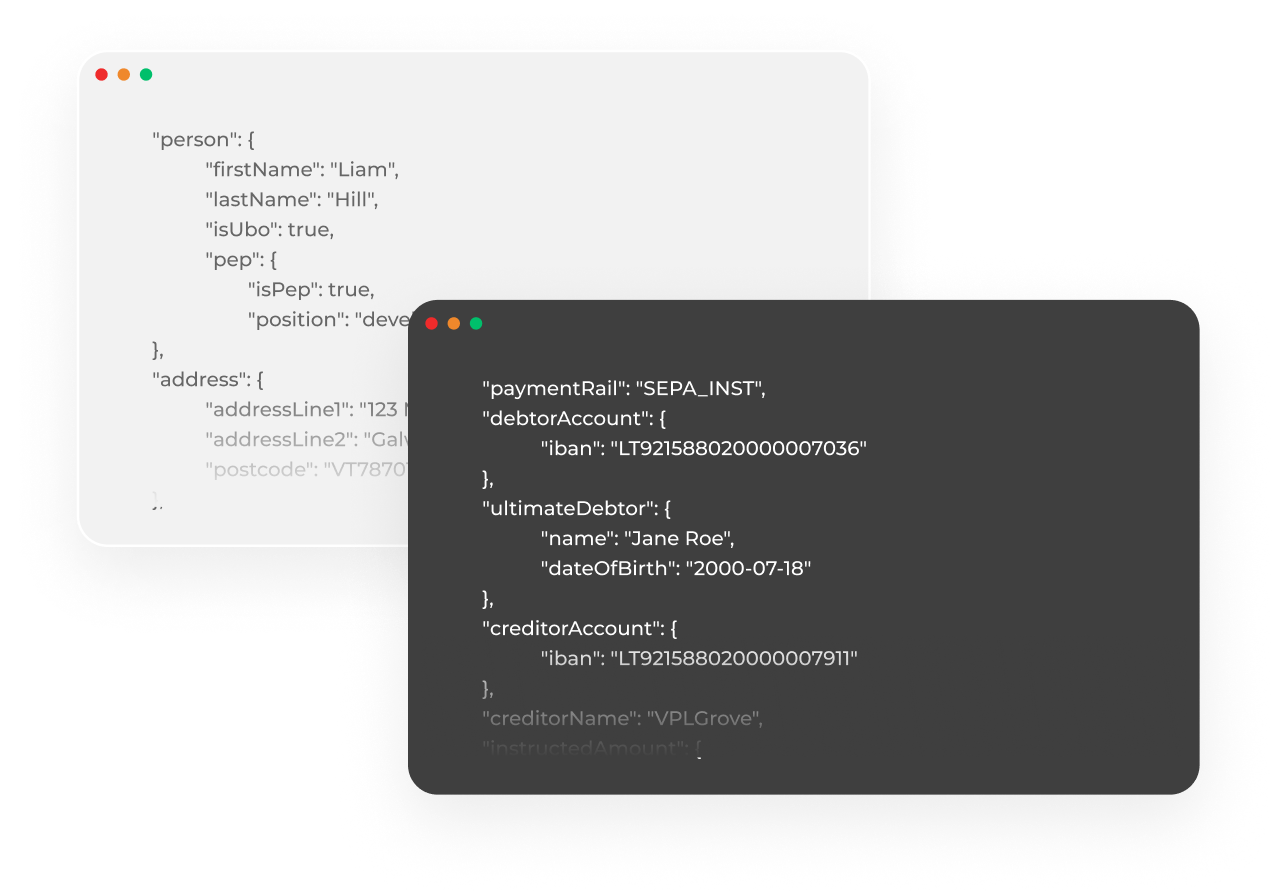

To execute a SEPA payment, all you need to know is the beneficiary’s name and IBAN. Payments can be executed via Online Banking platforms, apps and API calls.

SEPA payments are already available in 36 European countries, including several countries outside of the euro area and the European Union.

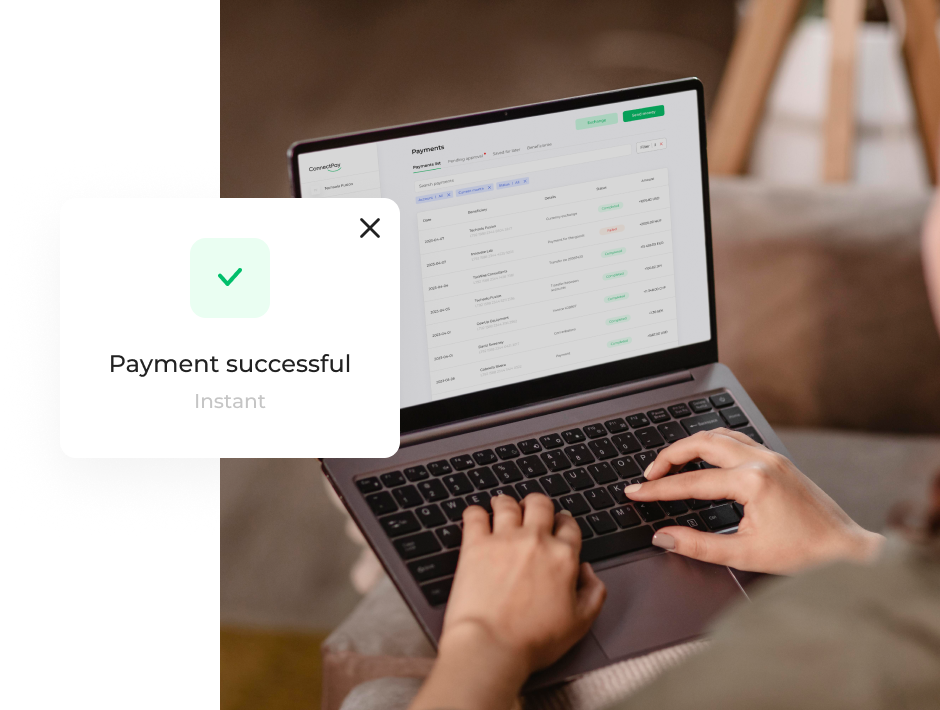

Millions of companies across the euro-zone utilize the efficiency and speed of SEPA money transfers. Looking to integrate this essential financial service into your business operations? Onboard online with ConnectPay.

As a licensed financial institution, we take care of all our solutions related compliance matters. We’ll cover KYC procedures, AML/CTF monitoring, and reporting to authorities, meaning you don’t need to hire an AML compliance team of your own to embed our solutions.

We know that every use-case is different. That’s why our APIs were purpose-built to accommodate virtually any business model. Integrate this and other functionalities with a single set of APIs.

When your online business is growing, you need flexible financial solutions reflecting your expanding needs. That’s what embedded finance is for – modular solutions that can be integrated into your interfaces via API.

The convenient flows begin with IBAN accounts – they can be used by your business and personal clients, or your own business. Enjoy the speedy and seamless transactions by using it as a digital wallet or exchange, send and receive payments in multiple currencies.

Scale your online business across the globe with vast payment possibilities. From lightning-fast SEPA Instant and euro-zone payments to global SWIFT and cross-border transactions in more than 80 currencies – we have your business needs covered.

From the usual business and personal cards to white–labeled ones with extra functionalities. Just tell us what kind of cards you need.

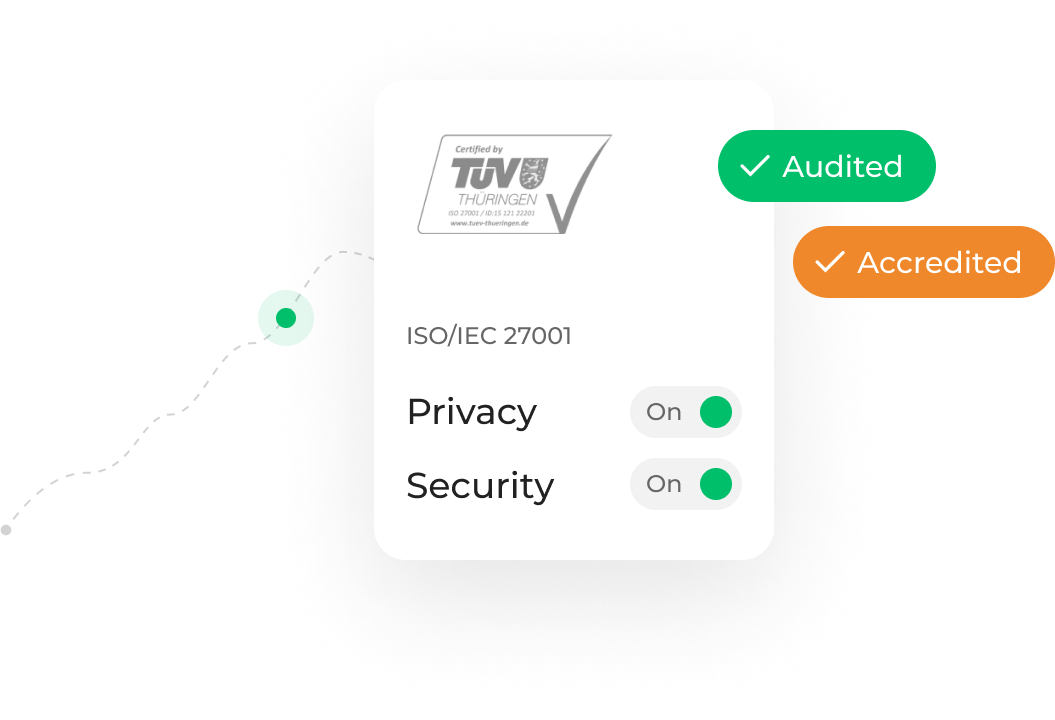

We’re ISO certified to keep your data safe. ISO/IEC 27001 and ISO 22301:2019 are some of the world’s most robust data security certification schemes.

We’re authorized and regulated by the Central Bank of Lithuania, which is subject to the regulation of the European Central Bank.

Enjoy peace of mind with our team always ready to support you.