Optimize customer lifetime value with subscription payment processing

Thanks to our unified payments system, subscriptions facilitated by ConnectPay are compliant and secure by default.

Retain subscribers by providing them with a variety of plans to choose from without changing their main card subscription contract.

Use automated schedules and payment retries to reduce the risk of customer churn and protect your revenue.

With us, you have the freedom to execute subscriptions on demand; not all of them need to be pre-scheduled. Enjoy the flexibility and convenience of managing subscriptions whenever you wish.

Offer installment payments so your customers can spread the transaction over multiple payments and adapt to their needs.

Experience the convenience of instant approval with our streamlined process, granting access to our services without delays. We approve customers as long as their card has available funds, ensuring quick and efficient access to our offerings.

With our 0% interest offer, your clients can enjoy making purchases without worrying about additional charges. Eliminate interest and late fees to make it easier for your clients to make decisions confidently.

Get regular templated reports on sales and declined transactions and keep informed. And with activity logs, you can see what transaction was done and when.

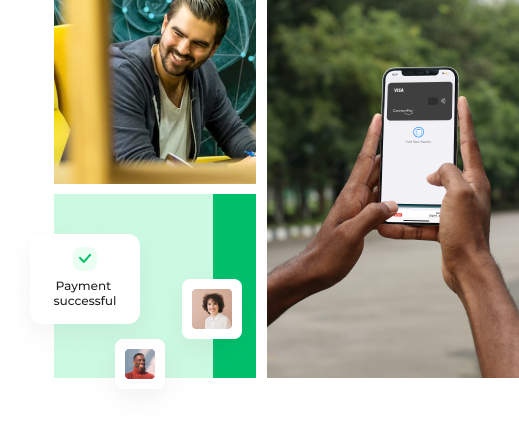

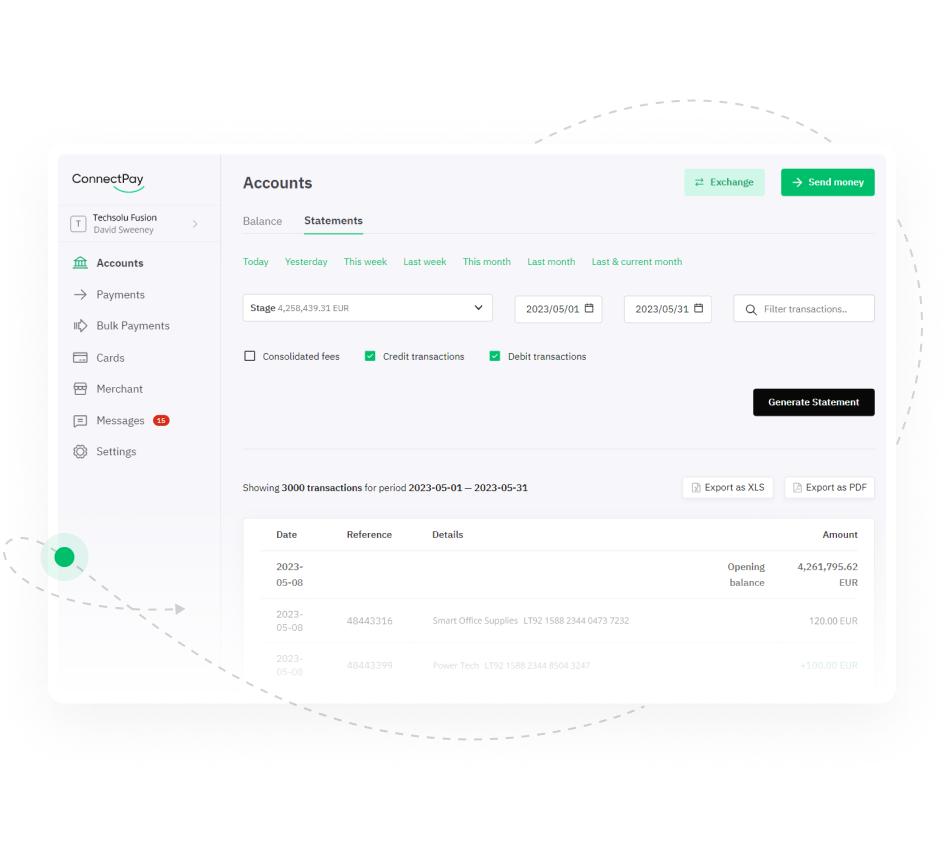

Simple and universal, our Merchant Dashboard gives you all the tools to manage the entire payment workflow.

Say goodbye to manual processes

Issue refunds with ease

Manage payments and payouts to customers and partners

Get access to in-depth payment analytics

Get VISA debit cards that fit your and your clients’ needs: from regular business and personal cards to exclusive cards that match your brand. Tell us what you want, and we’ll make it possible for you.

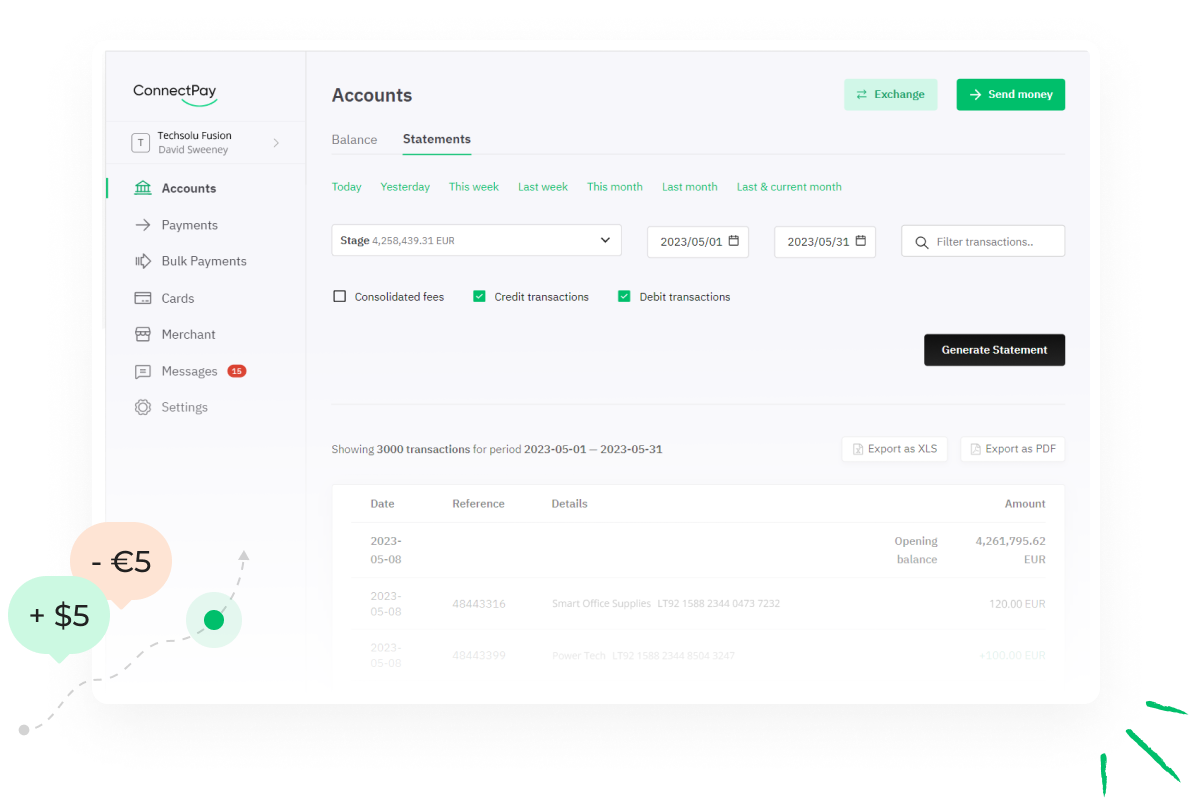

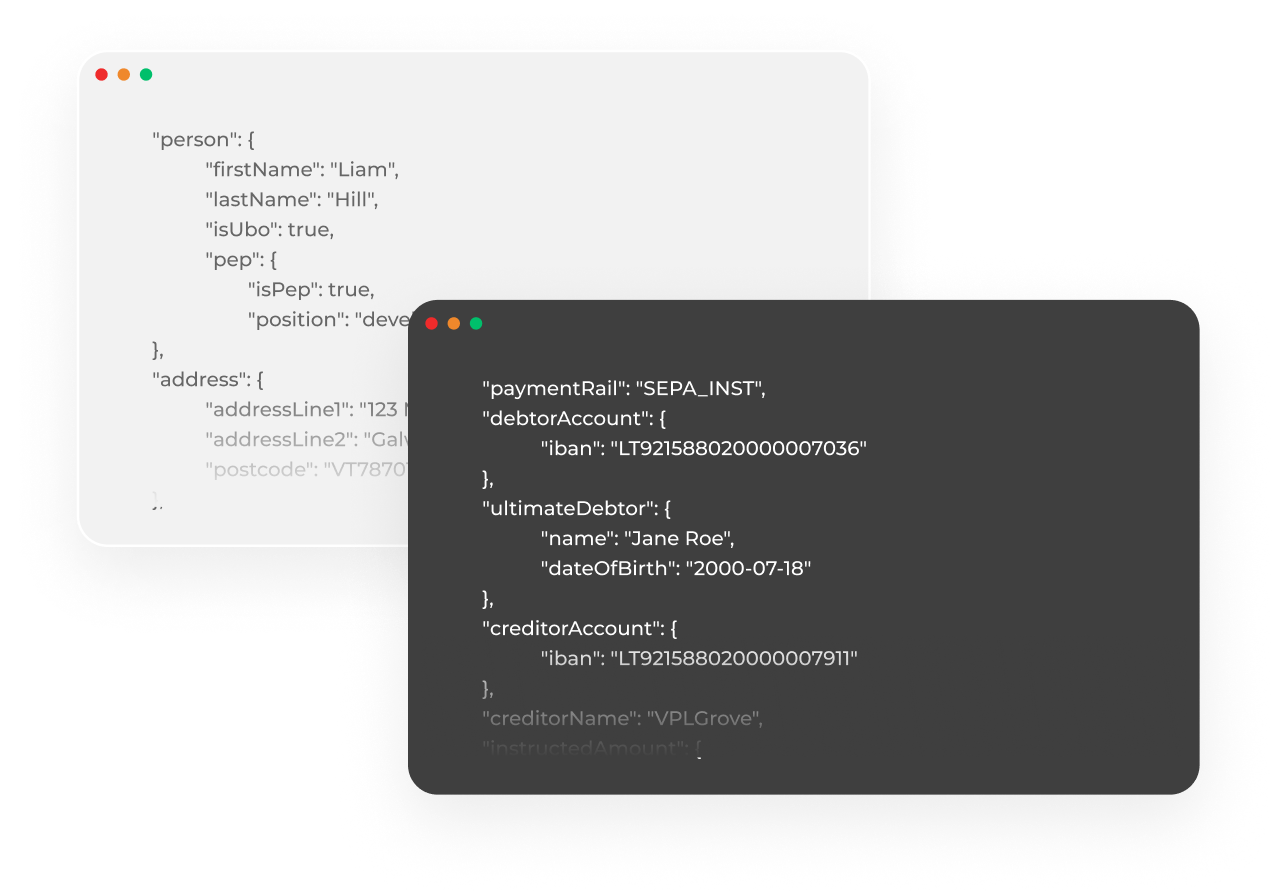

When your online business is growing, you need flexible financial solutions reflecting your expanding needs. That’s what embedded finance is for – modular solutions that can be integrated into your interfaces via API.

The convenient flows begin with IBAN accounts – they can be used by your business and personal clients, or your own business. Enjoy the speedy and seamless transactions by using it as a digital wallet or exchange, send and receive payments in multiple currencies.

Scale your online business across the globe with vast payment possibilities. From lightning-fast SEPA Instant and euro-zone payments to global SWIFT and cross-border transactions in more than 80 currencies – we have your business needs covered.

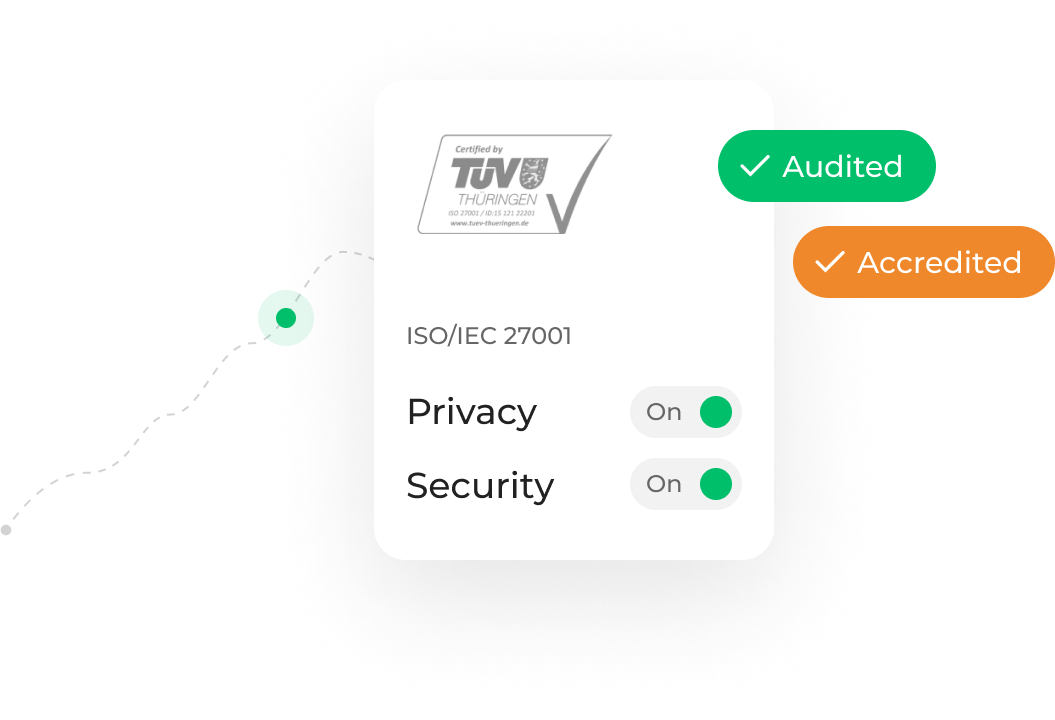

We’re ISO certified to keep your data safe. ISO/IEC 27001 and ISO 22301:2019 are some of the world’s most robust data security certification schemes.

We’re authorized and regulated by the Central Bank of Lithuania, which is subject to the regulation of the European Central Bank.

Enjoy peace of mind with our team always ready to support you.