Applying for a ConnectPay account

List of Prohibited Jurisdictions and Class Of Trade

List of Restricted and Prohibited Jurisdictions: Afghanistan, Belarus, Burundi, Central African Republic, Congo, Cuba, Guinea, Guinea-Bissau, Iran, Iraq, Lebanon, Libya, Mali, Myanmar (Burma), North Korea, Palestine, Russia, Somalia, South Sudan, Sudan, Syria, Tunisia, Ukraine Regions of Luhansk, Donetsk, Crimean, Sevastopol, Kherson and Zaporizhzhia, Venezuela, Yemen, Zimbabwe.

List of Prohibited Class of Trade: Intellectual property or proprietary rights infringement, Counterfeit or unauthorized goods, Weapons and munitions, Get rich quick schemes, Mug shot publication or pay-to-remove sites, No-value-added services, Drugs and Drug Paraphernalia, Unlicensed Businesses, Hate and Violence, Pornography, Prostitution, Body parts, Animals.

Full list of Prohibited Jurisdictions and Class Of Trade can be found here.

How can I open an account?

New ConnectPay customers can open a business account by completing the online application here. Simply follow the instructions on the screen.

How can I open an additional account?

Existing ConnectPay customers can open an additional account by submitting request via Online Banking. Log into your account here.

What are the key conditions for segregated account opening?

Segregated accounts can be opened for business customers if they have an obligation to segregate their clients’ funds according to the legal acts and the segregation can be done by using account opened by electronic money institution.

Where can I find more information about the Onboarding / KYC Process and required documents?

You can find the detailed guidelines for Onboarding / KYC Process and required documents here.

How long will it take to open an account after I apply?

In days, assuming all documents are readily available.

How is the pricing category assigned to me?

ConnectPay evaluates each client applying for an IBAN account for business based on the following criteria:

• ID issue country for directors, UBOs, shareholders

• country of incorporation of the company

• country of incorporation of the companies forming the ownership structure (if any)

• country of location of headquarters

• nature/risk of business activity

After the evaluation of the above-mentioned criteria, the client is assigned one of the four business categories. Only the pricing listed for that particular category will apply.

How will you verify my identity?

ConnectPay offers remote identity verification methods. We request to verify identities of Authorized Representatives and all Users of the accounts remotely. In some cases, we may also request to remotely verify identities of Directors and Ultimate Beneficial Owners.

Submitted corporate documents are verified remotely in jurisdictions where public access to the company registers are available. In case public access to the corporate register is not available in the jurisdiction, all Corporate documents from these jurisdictions must be originally certified by Apostille and uploaded in your Online Business Application form or sent directly to [email protected].

More information on remote ID verification process and general requirements for corporate documents can be found here.

Note: ConnectPay may use a third-party provider/tool to verify your identity. The third-party operates under the same regulations of data confidentiality and security as ConnectPay.

Is there an application fee?

The application processing is free of charge. Please note that entities with complex ownership structures, such as where Ultimate Beneficial Owners are Trusts, Foundations, etc. will incur an additional charge and you will be contacted directly by our sales team after an initial review to confirm whether to proceed with the application. You can check the prices here.

Cards

How do I apply for a VISA Business card?

The card can be ordered through our Online Banking, by signing in here and filling in the Card Ordering Form.

What are the fees for VISA Business card?

You can find indicative fees related to the VISA Business card here. To receive the full pricing, please submit an inquiry.

How long does it take for a card to reach me?

Usually the standard delivery takes from 3 to 6 working days and express delivery takes from 1 to 2 working days.

How to activate my card and get my PIN code?

Cardholder can activate VISA Business payment card via Online Banking. PIN code will be displayed during card activation process.

How can I check my balance?

You have to login to your Online Banking. Your card is linked to the company account. Card balance is the same as the account balance.

Where and how can I use my card?

You can make a purchase wherever VISA card is accepted. This card is also contactless so you can use it for small purchases up to 150 euros without using your PIN code. You can also withdraw cash from any ATM that accepts VISA.

How can I load my VISA Business card?

Your company account is linked to the card. Just make a transfer to your account and you’re ready to go.

What should I do if my Card got lost or stolen?

You can block your card via Online Banking or ConnectPay app, or you can call our Customer Support team at +370 666 44600 I +356 279 22875 (available 24/7).

What is 3D Secure?

From the 1st of January 2021, new regulations came into effect across Europe which require most types of internet payments to be made with an extra security layer called 3D Secure (or 3DS). These requirements are set out in the updated Payment Services Directive (PSD2). Regulations expand the range of card transactions for which more secure authentication is required. Strong customer authentication (static password and one time password in ConnectPay case) must be applied by merchants for customer identification in addition to the details printed on the payment card. This provides extra safety for customers who use cards for payments.

These same regulations also require card issuers to decline certain payments if they weren’t processed using this extra security layer called 3D Secure (3DS).

Will my card payment get declined if if the merchant does not support 3DS?

Which card payments are affected by the 3DS?

The new regulation only applies to a transaction if both sides (cardholder and merchant) are in the European Economic Area. For example – payments made on the internet within the EU/EEA.

Customers outside EU/EEA will not be affected by these new regulations.

Closing account

How can I close my ConnectPay account?

If you decide to close your ConnectPay account, you need to inform our Customer Support team by sending an email to [email protected] or through the Online Banking message.

If you have a debt in your account, you need to make sure you cover it before we can close your account. If there are any funds left in your account, you need to transfer it to your chosen bank account before we close your ConnectPay account. Alternatively, we can make the transfer for you. In this case, you will have to cover administrative/transfer costs.

Are there any fees incurred to close my ConnectPay account?

If you decide to close your account with ConnectPay after 6 months from account opening have passed, we will not charge you any additional fees and once you have settled any outstanding debts, we will close the account for you. If, however, you decide to close the account before 6 months have elapsed from the account opening we will ask you to pay an amount equal to minimum monthly fee that you would incur until the end of the 6 months period. For example, your minimum monthly commitment is 10 EUR, and you decide to close your account after 2 months from account opening, so we would ask you to cover the remaining 4 months worth of minimum monthly commitment, which in this case would be 40 EUR.

How long does it take to close my ConnectPay account?

Once there are no pending operations in your ConnectPay account, it takes up to 3 business days to close it. We will inform you by email when all the procedures have been completed and your account is no longer valid.

Company license and regulation

How safe is my money with ConnectPay?

Unlike traditional banks, ConnectPay does not invest your money. Therefore, your money is always instantly available. Regulation set by the Central Bank of Lithuania (government institution directly regulated by the European Central Bank) requires all funds deposited in ConnectPay accounts to be stored within segregated accounts in credit institutions and always to be kept readily available for client withdrawal.

As a result, your money is always safe with us.

Is ConnectPay a licensed institution?

Yes. ConnectPay is an Electronic Money Institution, company code 304696889, authorized and regulated by the Lithuanian supervisory authority – Central Bank of Lithuania. Central Bank of Lithuania is the part of the Eurosystem and cooperates with the European Central Bank and other Euro Area Central Banks.

Our licensed activities include the issuing of electronic money, the redemption of electronic money, the issuing and /or acquiring of payment instruments, the execution of payment transactions, the provision of payment initiation, account information services, and cash deposit and withdrawal services. Our license and all activities covered by this license can be checked here. All our business activities are regulated by the applicable laws related to the electronic money, including, but not limited to the legal acts related to the financial institutions and financial services.

Online account management

Can I change my e-mail / phone number?

Yes, you can. Please contact us via online banking if you would like to change your registered e-mail or phone number. You can do that by logging in to your account and clicking on the message icon in the top right corner. Alternatively, you can call us at +370 666 44600 I +356 279 22875 (Customer Support is available 24/7) or email us at [email protected].

How can I grant permissions for another person to manage the account?

You can add additional account users by logging in to your online banking account and navigating to user settings. Click on the User settings -> USERS -> Invite additional user. After reading the disclaimer and entering user’s email address, click INVITE. You will be asked to sign the action with OTP (one – time password) or through ConnectPay App.

How can I exchange currency?

You can exchange currency by logging in to your account and clicking on the PAYMENTS->Payments->Currency exchange option.

You will be able to see the currency exchange rates while you perform a currency exchange.

What currencies are supported for sending and receiving funds?

Currently the following currencies are supported:

AUD, BGN, CAD, CHF, CZK, DKK, EUR, GBP, HKD, HUF, JPY, NOK, PLN, RON, SEK, SGD, USD.

How can I change transaction limits in my ConnectPay account?

The Master Authorized Representative is able to set Individual Daily, Monthly, and Max. Amount per Transaction user limits.

User Limits Management feature can be found via Settings > User > User Details > Limits.

*Please note: feature is only available for Master Authorized Representatives.

What details should I use to receive funds to my ConnectPay account?

In order to receive funds to your ConnectPay account, you have to use your IBAN account number, SWIFT code, name and surname or company name.

Beneficiary name: < Insert name and surname or company name that holds the ConnectPay account >

Beneficiary account: < Insert your ConnectPay IBAN account number >

Financial institution name: UAB ConnectPay

Financial institution SWIFT/BIC code: CNUALT21XXX

Financial institution address: Algirdo str. 38, 03218, Vilnius, Lithuania

Can I receive funds to my ConnectPay account?

Yes, you can receive SEPA and SWIFT payments to your ConnectPay account. SEPA participant countries can be found here. SEPA is the fastest and cheapest way to send and receive funds, most SEPA transactions clear the same day, while SEPA Instant payments take only few seconds. SWIFT payments are available under certain conditions. Please contact us for more information. Also you can receive funds from you card Issued by other financial insitution if it’s added to Apple Pay and Google Pay wallet. Just select “Add money” option in online banking and follow our instructions.

Can I send funds from my ConnectPay account?

Yes, SEPA and SWIFT transfers are available.

SEPA (Single European Payment Area) transfers are executed only in the EU and EEA countries, in EUR currency.

SWIFT transfers are executed in other currencies and/or in Euro currency to banks in countries outside the EEA or SEPA.

Services are restricted and are not available to the following categories listed in our Prohibited Class of Trade.

In order to send funds from your ConnectPay account, you must login to your online banking account, click on the Payments option in the main menu and select Send Money button.

What should I do if I forget my Login or Password?

If you forgot your Login, please send us an email [email protected] or call us at +370 666 44600 I +356 279 22875 (Customer Support is available 24/7) and we will help you recover your details after confirming your identity. If you forgot your Password, select “Forgot password” button on online banking front page and follow instructions

Private data protection and website use

Does ConnectPay disclose my personal information to any partners?

As specified in our Privacy Policy, customers’ personal data may be transferred to:

1. payment service users (payees and payers);

2. financial institutions (subject to Customer’s consent and in the scope of the personal data of the solely specified by Customer);

3. The Bank of the Republic of Lithuania and the SEPA participant (personal data for these beneficiaries is due to the use of the Single Euro Payments Area – SEPA).

Customers’ personal data may be transmitted to the third parties not specified above for the specified and legitimate purposes only, and only to third parties who have the right established by laws and other legal acts to receive personal data in the countries of the European Union and the European Economic Area.

How safe is to disclose my personal information through email and website?

ConnectPay is fully compliant with the General Data Protection Regulation, effective of 25 May 2018, with the Legal Protection of Personal Data of the Republic of Lithuania, with all of the other Laws and/or legal acts, as well as all of the European Union acts that are applicable in accordance with the personal data protection regulations applicable for the specific country in which the services are provided.

We do not use the private information you disclose to us by email contact form, phone communication, account application or any other channel that enables the collection of personal data to market our product unless you have expressed your consent.

All subsequent communication initiated by ConnectPay is mandatory to complete your request, in view of:

1. Provision of services of issuance, distribution and redemption of electronic money and provision of payment services;

2. Conclusion and execution of the agreements;

3. Customers’ identifications;

4. Implementation of the obligations under the Law on Money Laundering and Terrorist Financing Prevention.

All the information regarding the use and protection of your personal data is fully disclosed in the Privacy Policy.

Does ConnectPay website collect information about me through cookies?

When you visit our website, you are required to accept or deny the use of cookies. We do not collect cookies unless we have your expressed consent to do so.

If at a certain point you have expressed your consent regarding the use of cookies and now you wish to delete the cookies collected, please find instructions on how to proceed according to your browser here. During your following visit to our website, make sure you click the Deny option in the Cookies Consent pop-up.

This website uses Google Analytics cookies which record information that describe how many pages you visited on this website, the traffic source that brought you on our website, how much time you spent on the page. The information collected is used to measure, monitor and improve our website performance. No sensitive personal information is collected through Google Analytics. You can find out more about Google Analytics here. However, if you still want to opt out of Google Analytics cookies, you can find more information here.

All the information regarding the use of cookies on this website is fully disclosed in the Privacy Policy.

Accept Payments

I have received an email or SMS from ConnectPay with the request to connect to my bank account. Is it legit?

ConnectPay does not send any emails or texts to customers asking for access to the customer’s bank account or online bank credentials. Never enter your ID, PIN codes, passwords, etc. if you are not logging in or performing any purposeful actions with your online bank. If you have any concerns regarding this, please email us at [email protected].

How do I link the Accept payments service to my to my website?

How you link our Accept Payments service to your website depends on how it is built. We have tools for self-built webshops and service portals or the most popular iGaming and e-commerce platforms.

For self-built webshops and service portals, please check our developers portal.

For e-commerce and iGaming platforms, please follow the instructions of the platform provider.

Which IP addresses does ConnectPay use? From which IP range can I expect requests?

ConnectPay does not offer static IP addresses for inbound requests. Always send requests to DNS aliases api.connectpay.com and api2connectpay.com.

Can I use the payment screen in an iFrame?

Although you can embed our widget in your webpage as an iFrame object, we strongly advise Merchants not to do so. During the payment journey, the customer will be redirected to their bank, and most banks do not allow redirects inside an iFrame.

To be on the safe side, open the widget in the same window or in a new window.

How to start with Accept Payment service integration?

To start accepting payments from your customers, you should integrate Initiate Payment API.

I have found a suspected vulnerability in the ConnectPay widget or system. What should I do?

At ConnectPay, we believe that the security of our systems, our network and our products is very important. We pay close attention to this during development and maintenance. However, sometimes vulnerabilities escape detection. We kindly request you to report suspected vulnerabilities to [email protected].

Who should I contact with integration-related questions?

All questions on integration should be sent to [email protected].

How long does the Accept Payments service integration take?

It depends very much on the Merchant’s systems complexity and the resources allocated for the integration project. In our experience, one month is enough time to allocate for integration development and testing.

How do I know whether a customer has paid?

Every transaction is followed by the payment status notice provided by the Payer’s bank. Each payment is processed according to the Payer’s bank terms and conditions. Every completed transaction appears in your account held with ConnectPay and can be monitored via ConnectPay online banking.

My customer says they've paid, but funds are not settled in my merchant account at ConnectPay. How is this possible?

If the bank stops a payment for AML verification or fails to send the payment on time for EBA clearing, the funds may not appear on the merchant account. The customer should inquire for transaction information directly with their bank requesting payment confirmation or other instructions regarding payment execution.

How often do I get paid?

If you are using Bank transfer method, you will be paid on the same business day if the Payer’s bank sends the payment before the last EBA clearing cycle or it is instant payment. If payment is submitted after the last daily clearing, then funds will be settled on the next business day.

If you are using Card method, it depends on various card schemes requirements, usually you can expect to be paid after 3 days from initial transaction date but no later than 10 workdays.

When will I be paid?

SEPA credit transfers are processed according to settlement and processing cycles defined by EBA Clearing, if it is regular SEPA credit transfer. Five daytime cycles are set out during the business day, where incoming payments are cleared at 9:00, 11:00, 13:25, 16:00 and 17:35 EET/EEST. We do not settle SEPA credit transfers on SEPA banking holidays. If it is SEPA instant credit transfer, you will receive it approx. the same minute. Card payments are settled when they are captures and processed by card schemes using delayed settlement. All funds from Payers will be sent directly to the Merchant’s account held with ConnectPay.

How will I be paid?

All funds from Payers will be sent directly to the Merchant’s account held with ConnectPay. All payments will be settled individually.

Can I make a refund or payout using API?

Yes, for bank transfer payment method you can automate the refund or payment process by integrating our Business API with your back-office or customer-facing applications.

For card payments refund API is planned for the upcoming future.

Can I refund multiple transactions at once?

Yes, for bank transfer payment method it is possible to upload bulk SEPA payment files via ConnectPay online banking or use our Business API.

For card payments you can refund them from Online Banking one by one.

How do I refund a payment to one of my customers?

To refund a payment initiated via SEPA credit transfer, you can use ConnectPay’s online banking system to make a single SEPA credit transfer or initiate multiple refunds by uploading a bulk file or using Business API with all needed SEPA credit transfers.

To refund a payment initiated by card, you can initiate a refund from merchant transaction list in Online Banking after selecting a refundable transaction. For this action you’ll need to have “Manage transactions” role. Refund API is planned for the upcoming future.

Why has the Accept Payments service been disabled for my website?

If the Accept Payments service is disabled for the Merchant’s website, an email with the reasons behind such action will follow.

Possible reasons are:

• Your website is/was offline for an extended period of time.

• You are offering a product or service that is not covered by our policy.

• We started to receive a significant number of claims from your customers.

We advise you to first read the email and resolve the issues. After the reported issues are cleared, please send a request to reset the service, and we will conduct a review to see if your website is ready for service renewal.

What are the minimum and maximum amounts per payment?

ConnectPay doesn’t set any specific limits for transactions made via our Accept Payments service, but your customer’s bank may have its own policies regarding SEPA credit transfers or card payments. We suggest you check on those.

What kind of fees are applicable for the Accept Payments service?

ConnectPay sets two different types of fees for Accept Payments service users: fixed transaction fees and variable transaction fees. ConnectPay evaluates each merchant applying for a service based on the following criteria:

• Average monthly or yearly transaction volume, as well as business forecast for the next 12 months;

• Average purchase value in EUR;

• Industry type;

• Client category.

To get a quote, please submit an application here.

You can check indicative pricing here.

What do I need to provide to ConnectPay when signing up for the Accept Payments service?

To set up the Accept Payments service with ConnectPay, you’ll be asked to provide the following details:

• Legal name and trade/brand name

• eCommerce website URL

• Target markets of your e-shop

• List of live merchant support contacts (name, surname, position, email, phone, etc.)

• Industry type

• Description of products/services sold

• Country and date of incorporation

• Number of employees

• Country of residence of the Company Owner

Which information should be provided on the merchants website?

When you offer products or services on your website, your company falls under the Distance Selling Act. This act states that merchants are required to put the following information on their websites:

• Your trade name

• The VAT number

• The address of residence

• A phone number or other live contact method

• An email address or contact form

In addition, we ask you to provide or ensure the following on your website:

• Specification of the products and services offered

• Prices and currencies of the products and services

• The purchase cancellation and return policy. The buyer must be required to accept the cancellation and return policy before making a purchase.

• Fair and easily accessible Terms and Conditions

• Shipping policy with the delivery terms and prices. The merchant must be able to provide customers with shipment status on demand.

• Privacy and Data Protection policies in compliance with prevailing legislation.

If your website is incomplete, we will contact you to assist in the process. The Accept Payments service will not be enabled until the website is complete.

Which currencies are acceptable for the Accept Payments service?

For bank transfers we proccess only EUR payments. For card transactions we can process EUR, USD, GBP, NOK, DKK, SEK, PLN.

Which products and services to be sold are not accepted by ConnectPay?

We don’t accept partnerships with merchants operating with products or services that may trigger intolerable risk for ConnectPay. You will find the list of Prohibited Jurisdictions and Classes of Trade here.

Can I use the Accept Payments service in my country?

Our Accept Payments service for bank transfer payment method is available in Dutch, German, Finish, and Lithuanian markets at the moment, but please stay tuned as the network is expanding constantly.

Our Accept Payments service for card payments is available in all EEA.

Do I need to sign an additional contract for the Accept Payments service?

To enable Accept Payments service, the Merchant will have to sign Online Payment Acceptance Agreement via Online Banking. The General Terms of the Online Payment Acceptance Agreement are available here.

Do I need to have an account in ConnectPay to start using the Accept Payments service?

In order to enable ConnectPay Accept Payments service, the merchant has to open an account with ConnectPay while clients using the services of the merchant don’t need to have ConnectPay accounts.

Does ConnectPay have a licence for Accept payments service?

ConnectPay is an Electronic Money Institution (EMI license No. 24) authorized and regulated by the Bank of Lithuania. Payment initiation, account information services and facilitating card payments are within the scope of extended EMI license.

What kind of payment options are offered?

ConnectPay offers SEPA credit transfers and SEPA instant credit transfers, as stipulated in the Revised Payment Service Directive (PSD2, Directive (EU) 2015/2366), cross-border payments, and currency exchange payments. Also, collecting PCI DSS compliant single and recurring card payments.

How will I know if my payment to the merchant has been processed?

Whenever a transaction is successfully processed, you will receive a confirmation email from ConnectPay.

I have a question or complaint about my order

For questions or complaints regarding your order, please contact the merchant your order was placed with.

Am I a victim of fraud?

Please try to settle any disputes you may have about an order with the merchant directly. If you have not received your product or service, it may simply be a mistake, rather than fraud.

We check every merchant that signs up with us according to strict laws, regulations and our own policy.

If you still believe you are a victim of fraud, please contact your bank and report an incident.

How can I cancel or return my order?

To cancel or return an order, please contact the merchant your order was placed with. ConnectPay processes payments on behalf of merchants and is therefore not able to cancel or return an order for you.

I can’t reach the merchant to resolve my payment issue

Please report your issue to [email protected]. Make sure to include the payment reference that consists of the letters ‘CP’ and a series of symbols (f.e.: “CP-ISFqYvqZTCOyxwEi0oppew”). It was sent to you via email with the payment receipt.

How can I get a refund?

Only the merchant your order was placed with can initiate a refund. ConnectPay only processes your payment and has no right over the funds, and therefore is not able to initiate a refund.

Why have the funds been debited from my account for a transaction I have not made?

Questions related to a specific transaction should be directed to the merchant that is marked as a receiver of funds in your online Banking. If you don’t recognize the payment and you can’t get any response from the merchant, you can report the issue to [email protected]. Please clearly describe the situation in your message including the payment reference that consists of the letters ‘CP’ and a series of symbols (f.e.: “CP-ISFqYvqZTCOyxwEi0oppew”).

Payment Approval / "4 eyes" principle

What is payment approval?

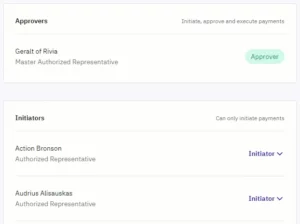

Payment Approval or so called “4 eyes” principle is a feature that ensures effective control and monitoring of your company funds & transactions. Once enabled, outgoing standard and bulk payments must acquire 2 signatures to be executed, except currency exchange and payments between own IBANs. The Master Authorized Representative assigns members of the team into hierarchical groups: “Initiators” (1st signatories) and “Approvers” (2nd signatories). “Approvers” are granted special rights to execute payments on their own without any additional approval.

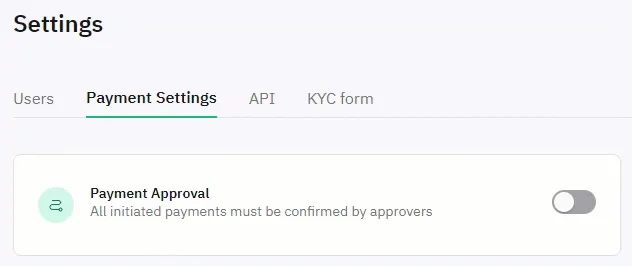

How to turn on/off the Payment Approval?

Only Master Authorized Representatives (MAR) can enable or disable Payment Approval.

1. Log in to Online Banking here.

2. Navigate to Settings > Payment Settings

3. Click on the switch to move it to the desired position: “On” or “Off”

How to assign hierarchical groups for Payment Approval feature?

1. Navigate to Settings > Payment Settings > Payment Approval

2. Click on the person‘s role and select the desired role from the dropdown menu

How an Approver can approve or reject a payment?

Standard payments

1. Navigate to Payments > Pending Approval

2. Select payments

3. Click on the Approve or Reject button to take a decision

Payments can be approved or rejected individually from the payment details screen.

Bulk payments

1. Navigate to Bulk Payments

2. Click on the “Confirm & Send” button to sign the bulk payment and start the bulk payment execution

How are the limits applied when using the Payment Approval feature?

During the usual 2 signature payment flow, only the personal limits of the “Initiator” will be accounted for. The company limit will be accounted as per usual, however, during the approval of the payment, we will always verify if by approving payments you stay within the overall company limits of that day or month.

How to use the Payment Approval feature?

Payments started by “Initiators” will be placed in the “Pending Approval” tab in the Payments menu. “Approvers” must grant their approval to execute these payments. Payments can be approved one by one or in bulk. If rejected, such payments will be deleted.

What happens if Payment Approval is turned off?

If Payment Approval is turned off, the system will revert to the default payment method with all users having equal payment execution rights. If there are any pending approval payments in progress, we’ll place them in the “Saved for Later” Payments tab.

Payments

What the payment cancellation options are?

Payment cancellation can be initiated from the Payment Service User’s (PSU) side by contacting Customer Support. It will be initiated immediately but does not necessarily mean that the payment will be returned to the PSU’s account, as the receiving bank needs to approve the return of funds. Cancelation can take up to 15 business days.

What does the term ‘reserved funds’ mean?

Reservation of funds takes part during payment card’s authorization process. Authorization is real time cardholder’s transaction verification by both sides: by card issuing and card acquiring side. It is permission to a cardholder to get and to a merchant to provide goods and services using a card payment method. During this process transaction amount is being “reserved”/”freezed” reducing available client’s account balance, but is it still not reflecting in the client’s statement, therefore during this reservation time client sees this transaction as pending in the e-banking system. During reservation time the client cannot cancel or change the authorized transaction.

How payment transactions made by payment cards are executed?

Processing of payment card transaction consists of two parts:

- authorization which has been described above;

- financial transaction – it is a message about payment card transaction for debiting or crediting (in case of refund) account of cardholder. This message comes a few days after authorization and during its processing reserved amount is being released from the reserved amounts list, reflects in the client’s statement and client sees this transaction as processed in the e-banking system.

During the whole payment card transaction processing time (both parts) cardholder cannot suspend/cancel transaction which has been already authorized.

When and in what procedures the cancellation of a funds' reservation is possible?

Successful authorization during which funds are being reserved for payment card transaction cannot be suspended or canceled on card issuer side. Cancelation of authorization (during which “reserved funds” are being “unfreezed”) can be executed on merchant side.