Access scalable and compliant accounts for your business with ease – designed to meet your specific needs and ensure efficient, secure financial management

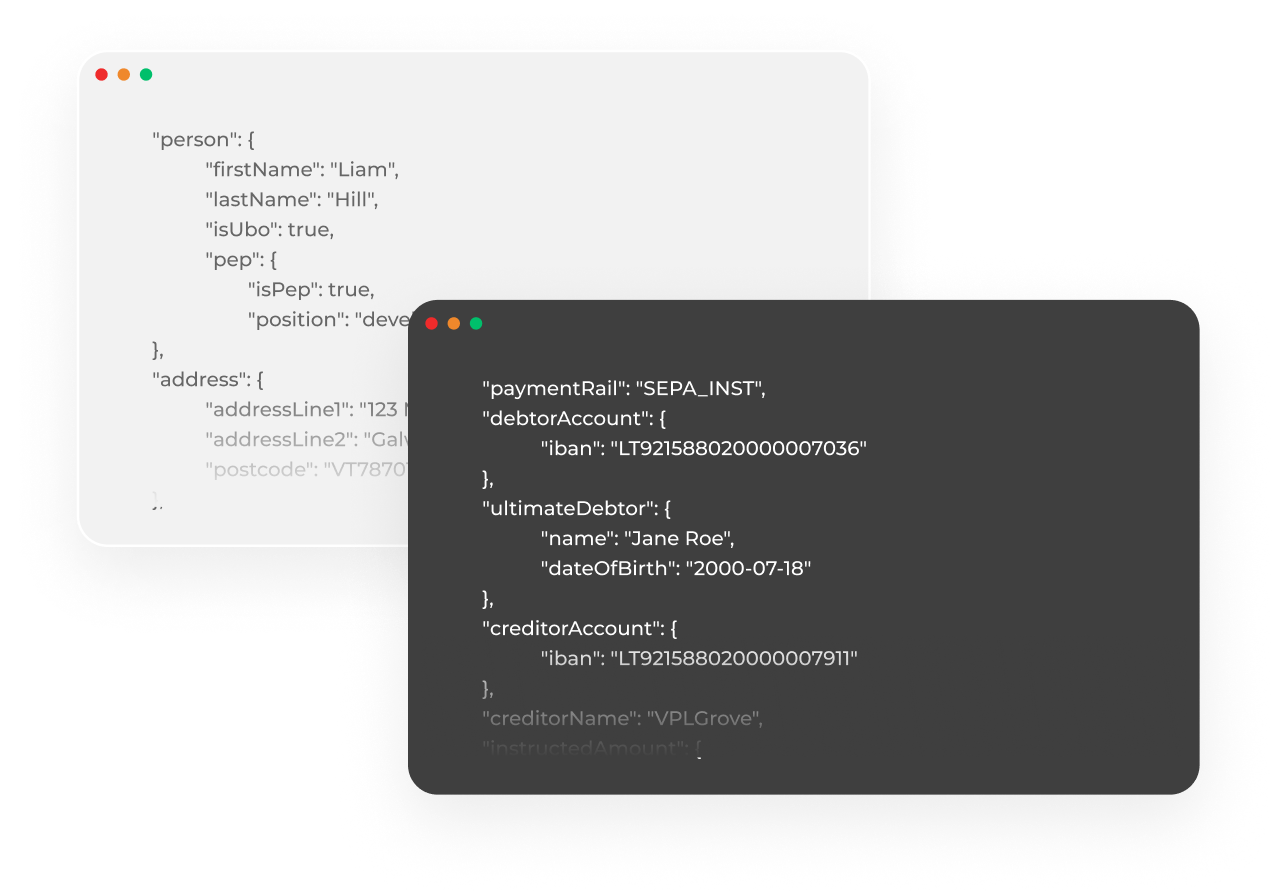

As a licensed financial institution, we take care of all our solutions related compliance matters. We’ll cover KYC procedures, AML/CTF monitoring, and reporting to authorities, meaning you don’t need to hire an AML compliance team of your own to embed our solutions.

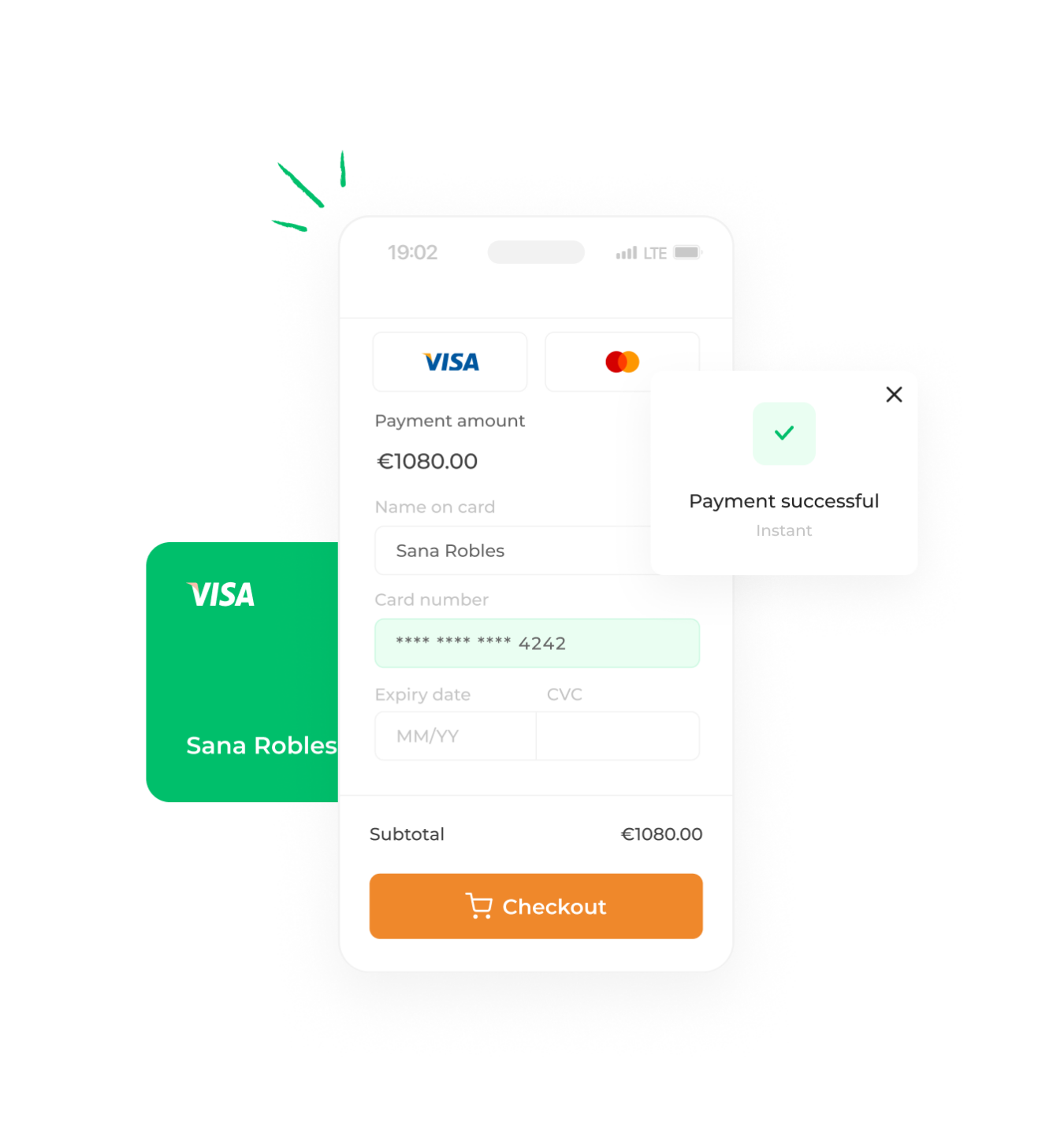

Streamline payment processing for your clients effortlessly through our comprehensive solution, combining card acquiring and seamless payment initiation services

Allow customers to pay with Mastercard & Visa debit and credit cards

Easily issue refunds, no matter the amount

Offer customers recurring payments & subscriptions

Receive payments directly to your IBAN account

Process orders without delay

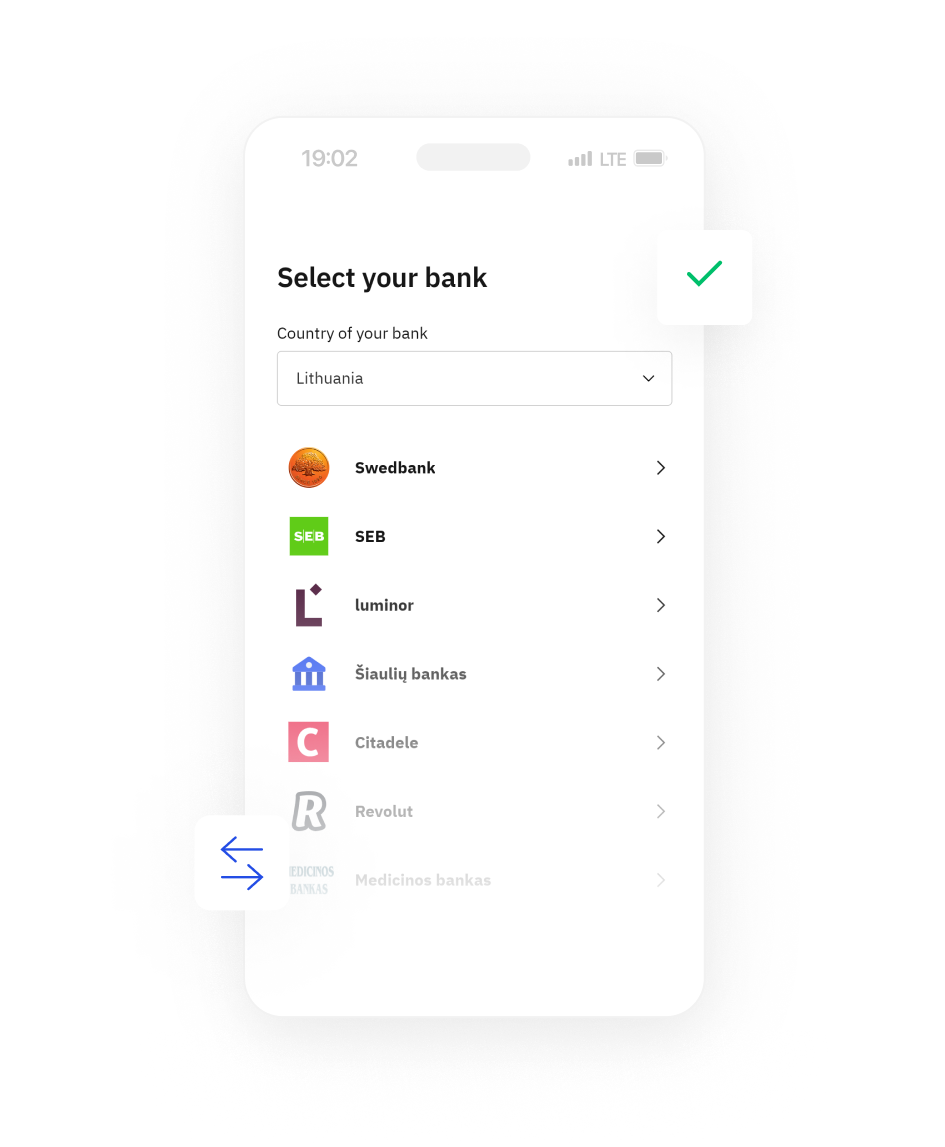

Collect EUR payments from customer bank accounts in DE, NL, and LT

Reconcile payments automatically and effortlessly

Create customized payment experiences with our Payment Gateway API

Effortlessly send payments to borrowers and lenders worldwide, expanding your financial reach and facilitating seamless transactions across borders

Send & receive payments in EUR with direct SEPA / SEPA Instant transfers. Avoid needless layers of complexity.

Send & receive funds all over the world with SWIFT payments in 80+ currencies: AUD, BGN, CAD, CHF, CZK, DKK, EUR, GBP, HKD, HUF, JPY, NOK, PLN, RON, SEK, SGD, USD, and more.

We work with trusted partners and use a unique algorithm to channel your SWIFT payments using the fastest route possible.

Get your verticals run faster – keep track of all of your payments in real time.

Cut costs and save time utilising multiple ways to send funds with us – single payments, bulk file uploads or via APIs.

Choose embedded finance with built-in compliance solution modules based on your business needs

Each use-case is different, that’s why we have built our APIs in a way that can be tailored to your business model. As long as it entails opening an IBAN account for a client and making payments, we got you covered. Find out more about our flexible APIs.

Yearly Payment Turnover

Processed transactions in 2023

Client funds held by ConnectPay