Accept payments from your merchants smoothly with our solution via multiple integration options.

BeMyBond, an investment in bonds platform, uses ConnectPay embedded finance solution for flexible B2B2C payment flows.

With smoothly onboarded customers in 8 seconds and 20 data points for tailored offers, they’re now poised to scale, demonstrating their commitment to seamless financial solutions.

Accept payments from your merchants smoothly with our solution available via multiple integration options.

One payment solution for all your needs: pay out to your merchants, pay salaries and invoices, issue refunds, and analyze detailed accounting statements.

We work with trusted partners and use a unique algorithm to channel your SWIFT payments using the fastest route possible.

Optimize cashflow by keeping track of all of your payments in real time.

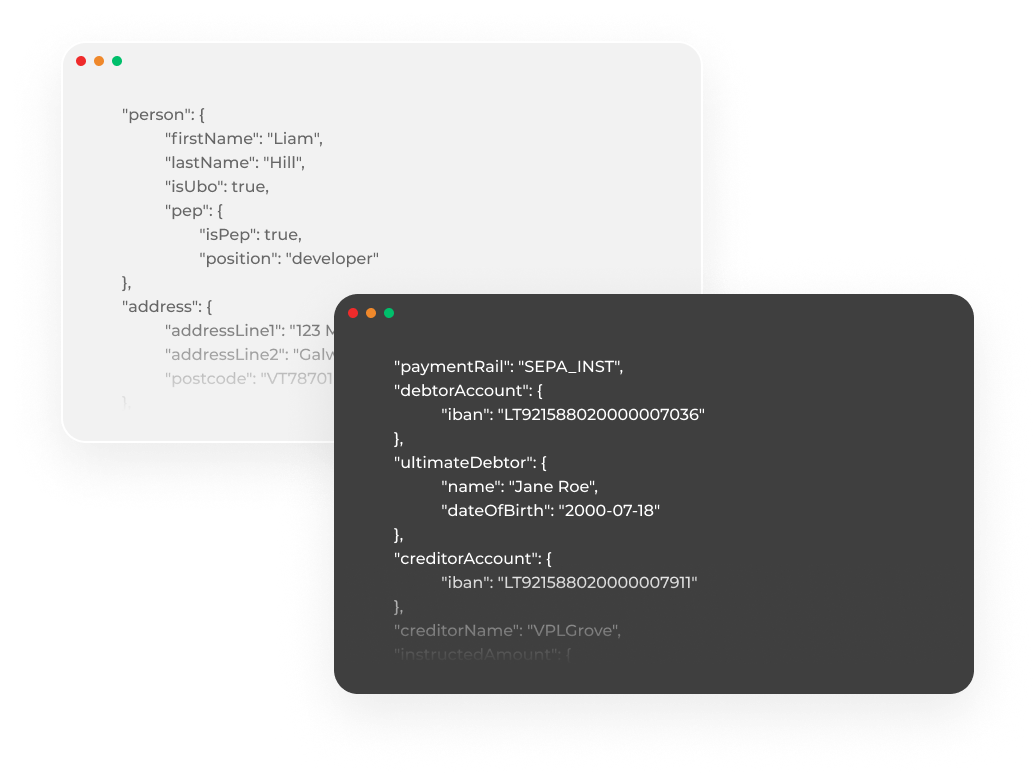

We give you the ability to send funds in they way that’s best for your business – single payments, bulk file uploads or via APIs.

We take care of all KYC and Compliance procedures and take care of onboarding and ongoing due diligence, making sure that you and your clients are protected and properly compliant with all regulatory requirements. Not only that, we also take care of AML procedures for all transactions and reporting to authorities, meaning you can focus on your business.

Yearly Payment Turnover

Processed transactions in 2023

Client funds held by ConnectPay