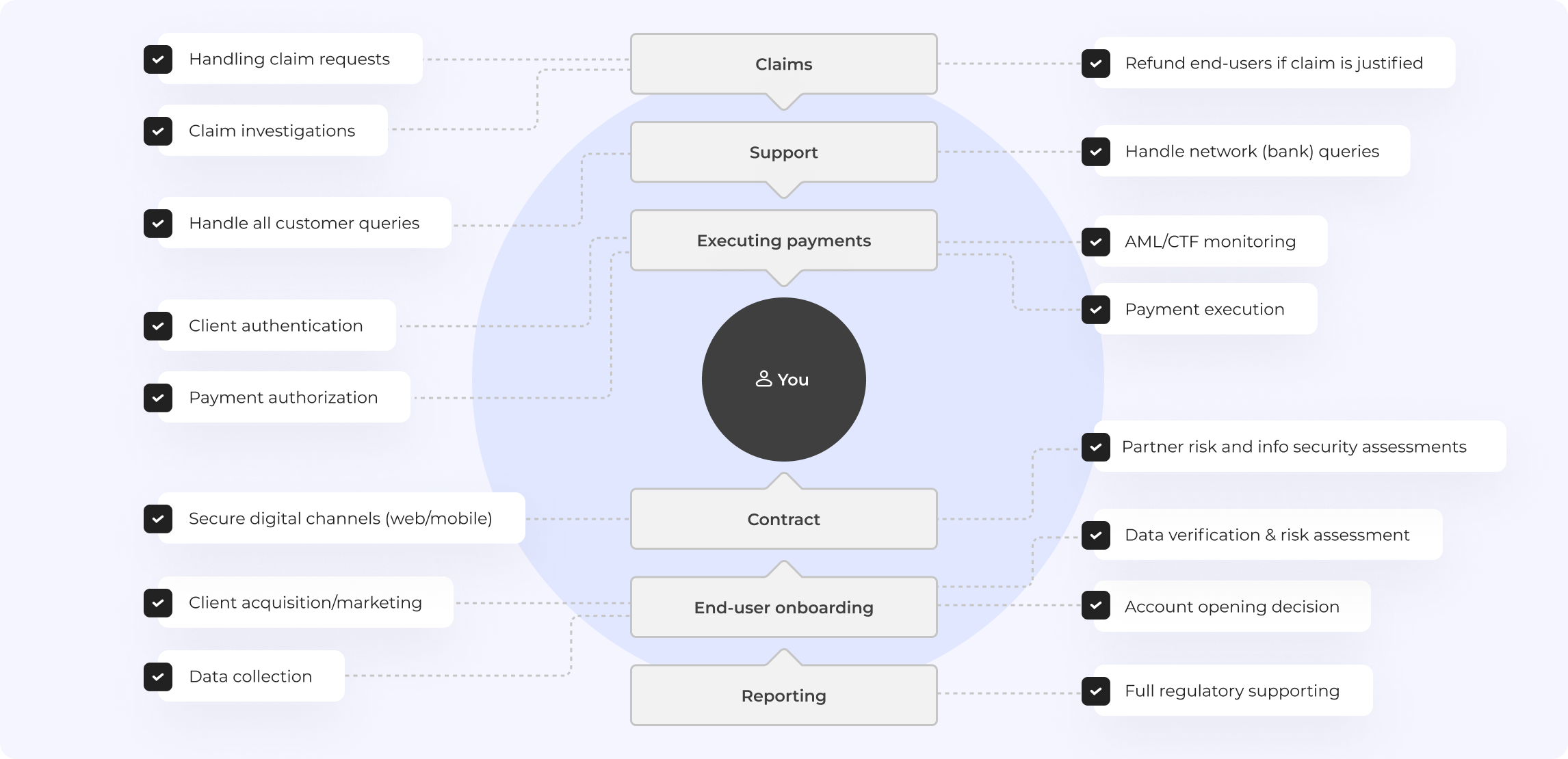

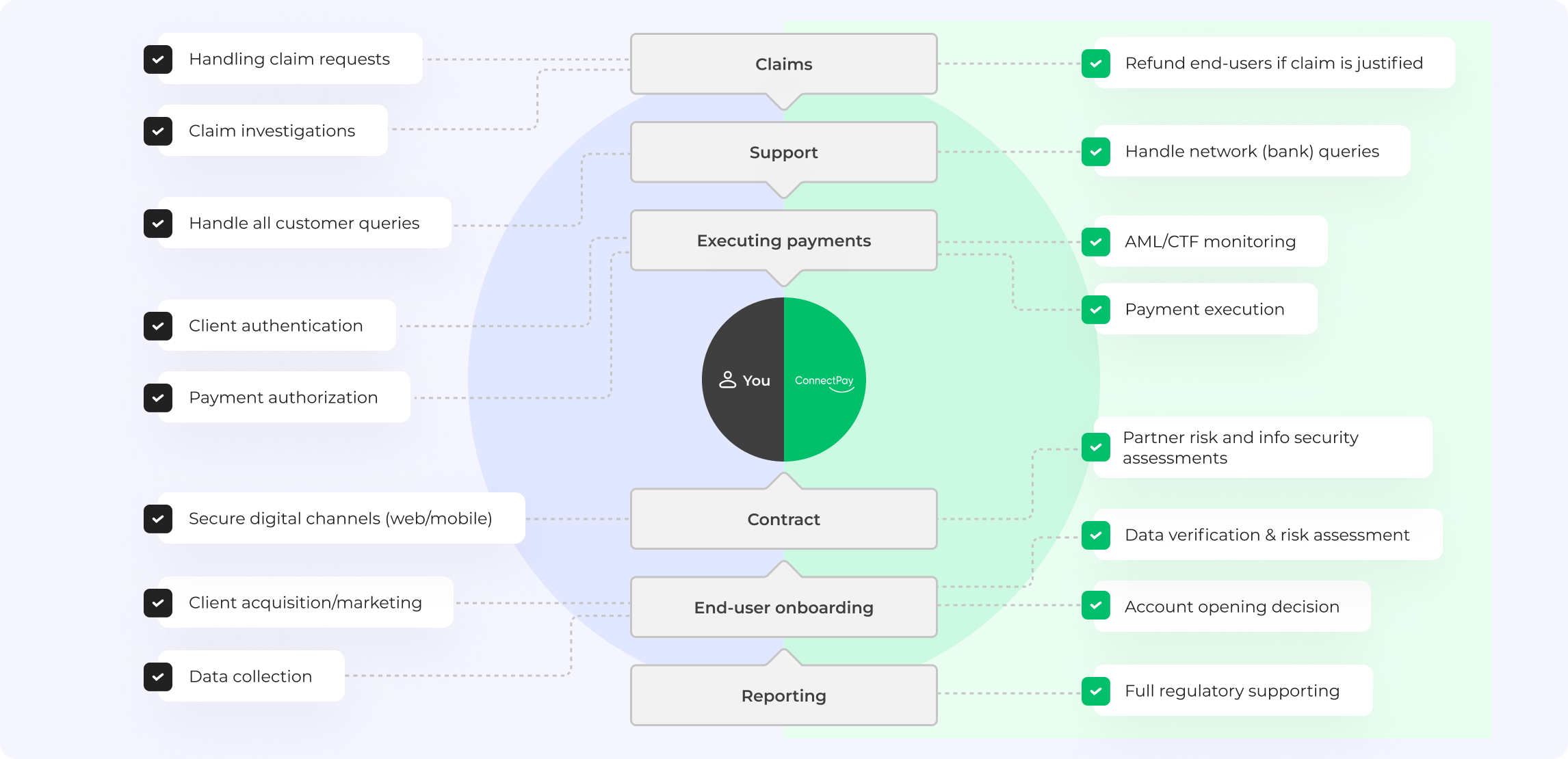

With embedded finance powered by ConnectPay, you can integrate financial solutions with both financial and non-financial products and ecosystems. The best part? We shoulder all the associated complexities where compliance is embedded into our offering, freeing you to concentrate on what truly counts – elevating your core products and delivering exceptional value to your customers.

Acquiring your own EMI licence is complicated and expensive, and that’s before you factor in maintenance. Partnering with us will make it all much easier for you.

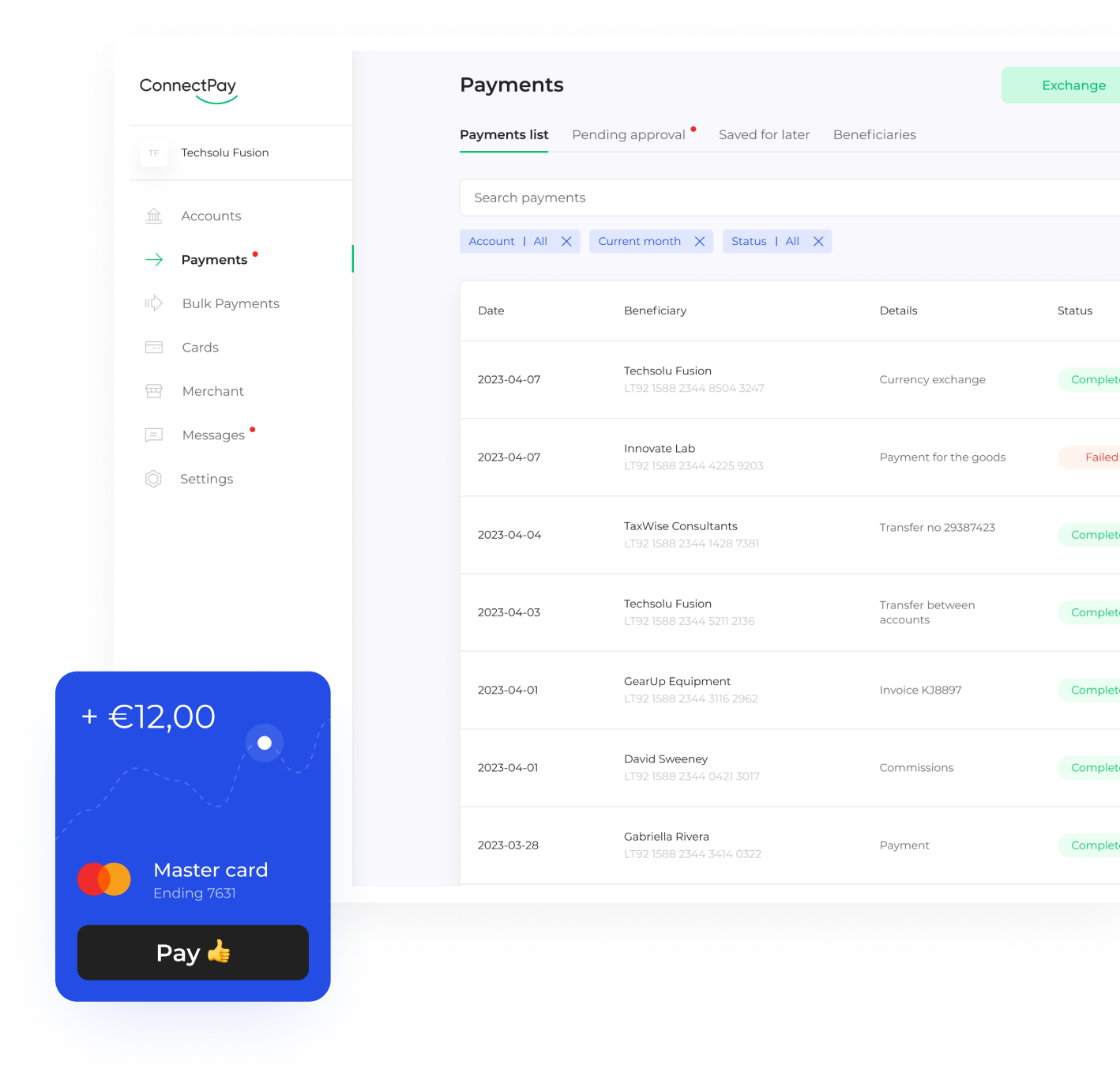

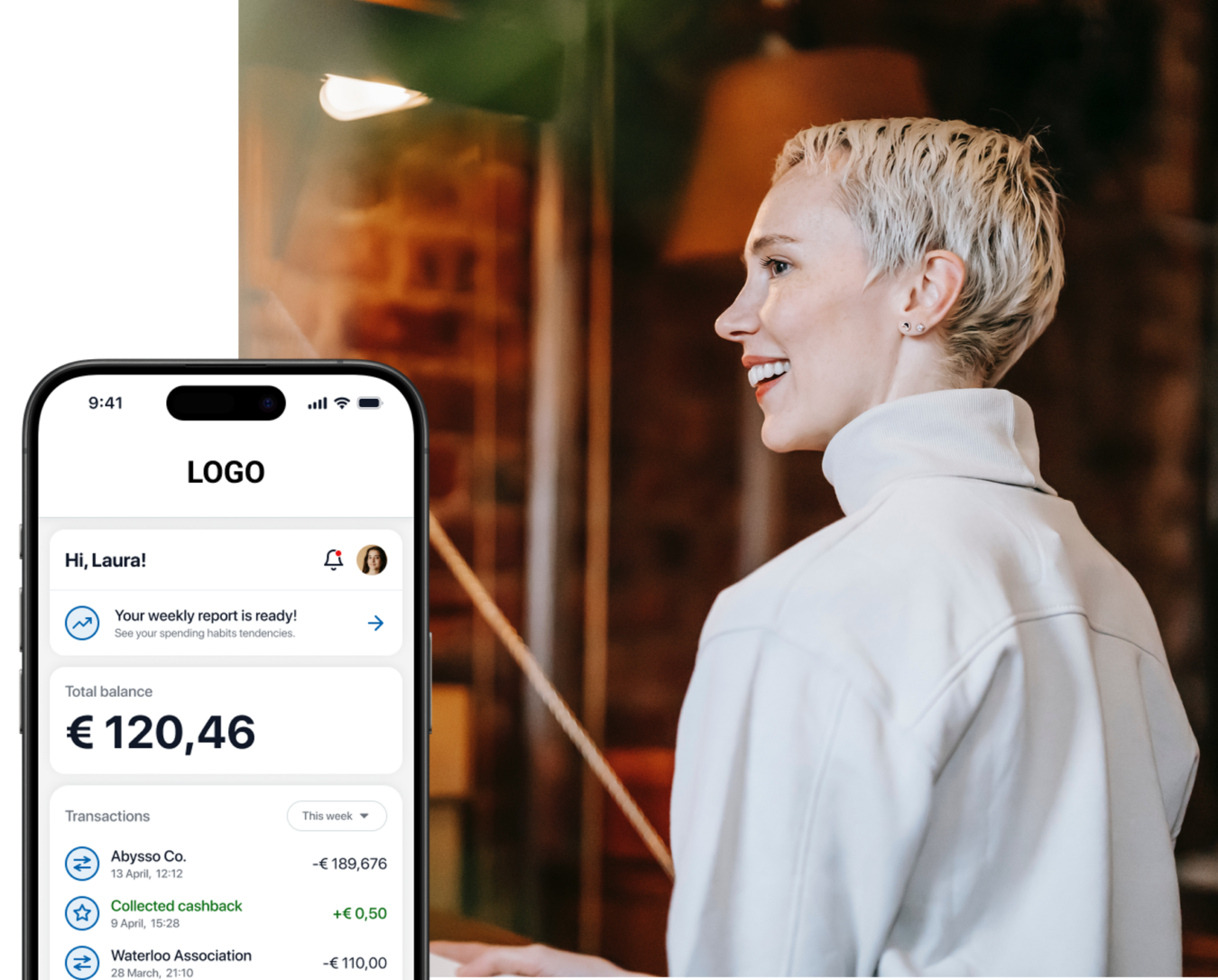

Connect to our developer-friendly API and easily integrate banking services (accounts, payments, currency exchange, white-label VISA debit cards and more) into your client interface.