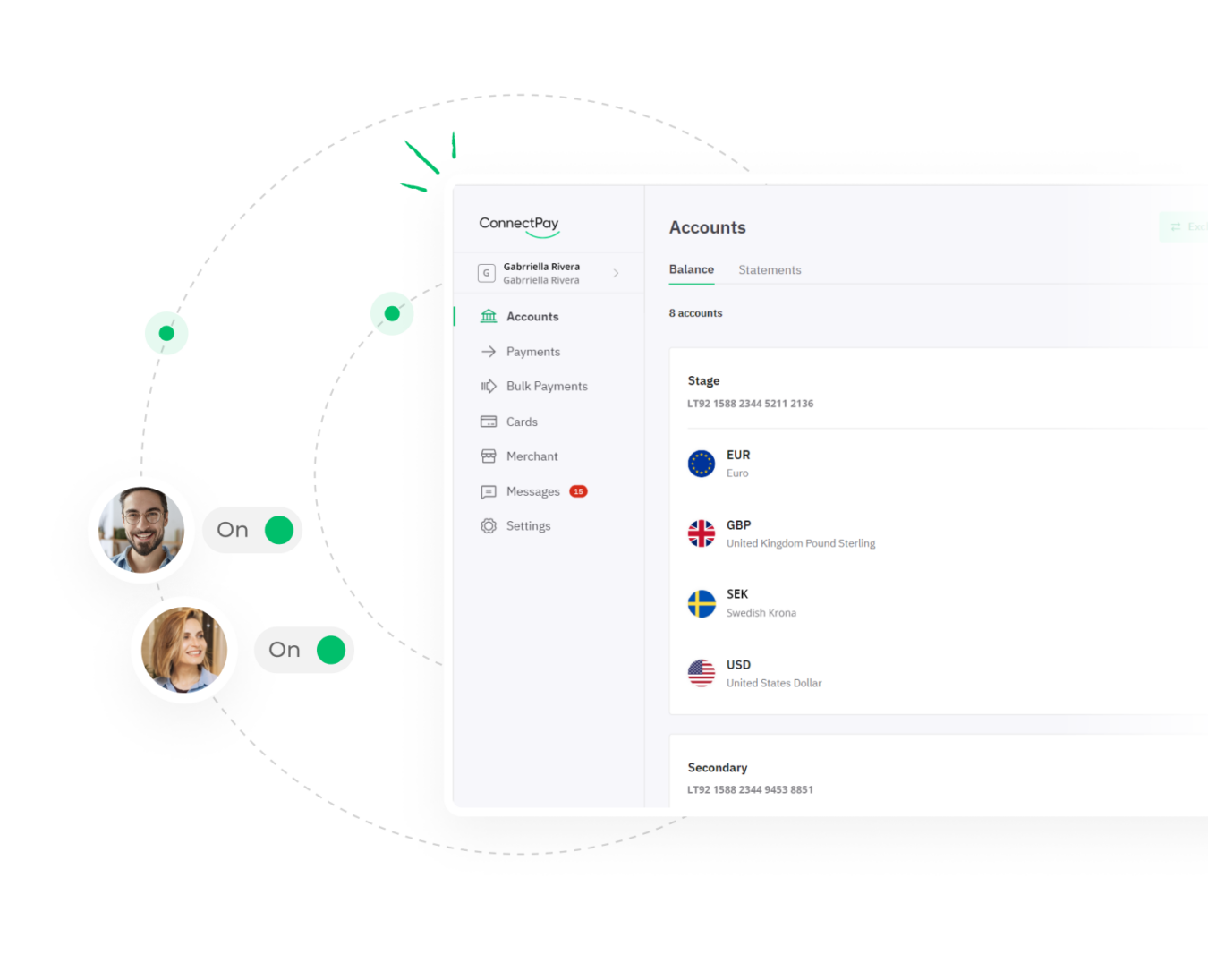

Ensure smooth B2B2B and B2B2C transactions and frictionless flows of your platform transactions between you, merchants, and buyers with our efficient business wallet solutions.

Electronic wallets are the preferred payment method for millions of businesses and customers worldwide.

Digital wallet integration within business payment structures positions you as a modern enterprise, attracting tech-savvy clientele.

Never worry about going overboard. With us you can hold as much funds as you need.

With our API you can instantly and without hassle create e-wallets for any money management experience.

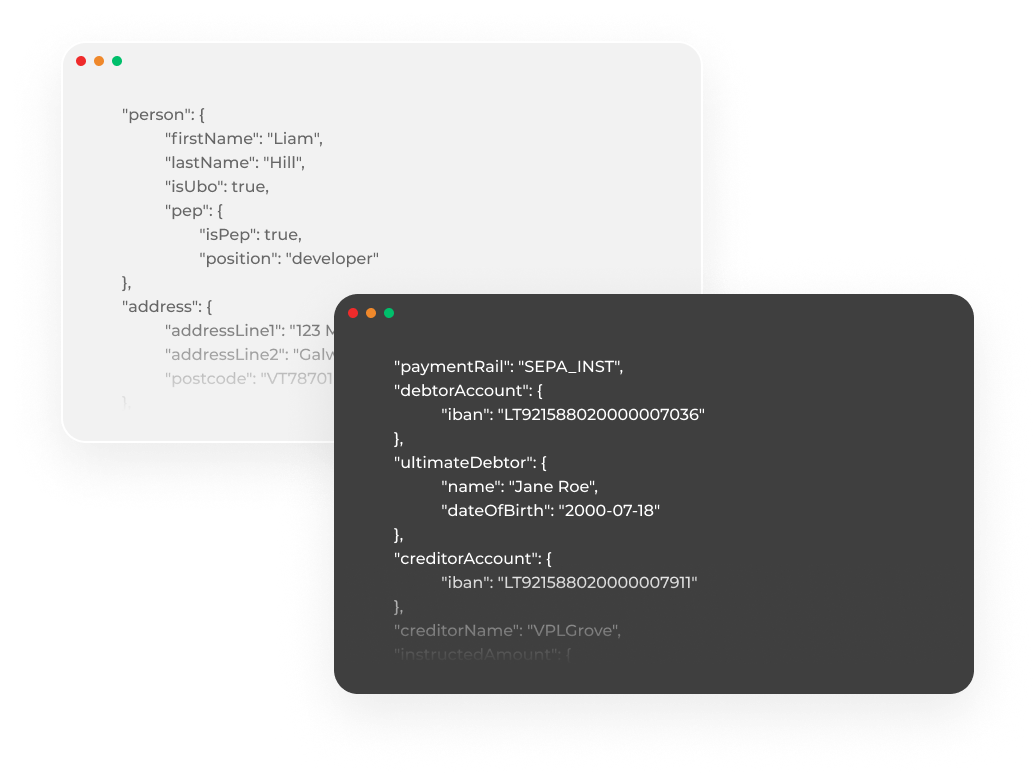

Get your own IBAN account that guarantees automatic transaction reconciliation.

Set up automatic workflows that distribute funds within your network, saving the precious time of your payment and accounting teams.

Wallet balances can be used for intra-platform, transactions, create fast and cost-efficient (feeless) money flows.

Stand out from the competition with payment experiences that look and feel on-brand.

Yearly Payment Turnover

Processed transactions in 2023

Client funds held by ConnectPay

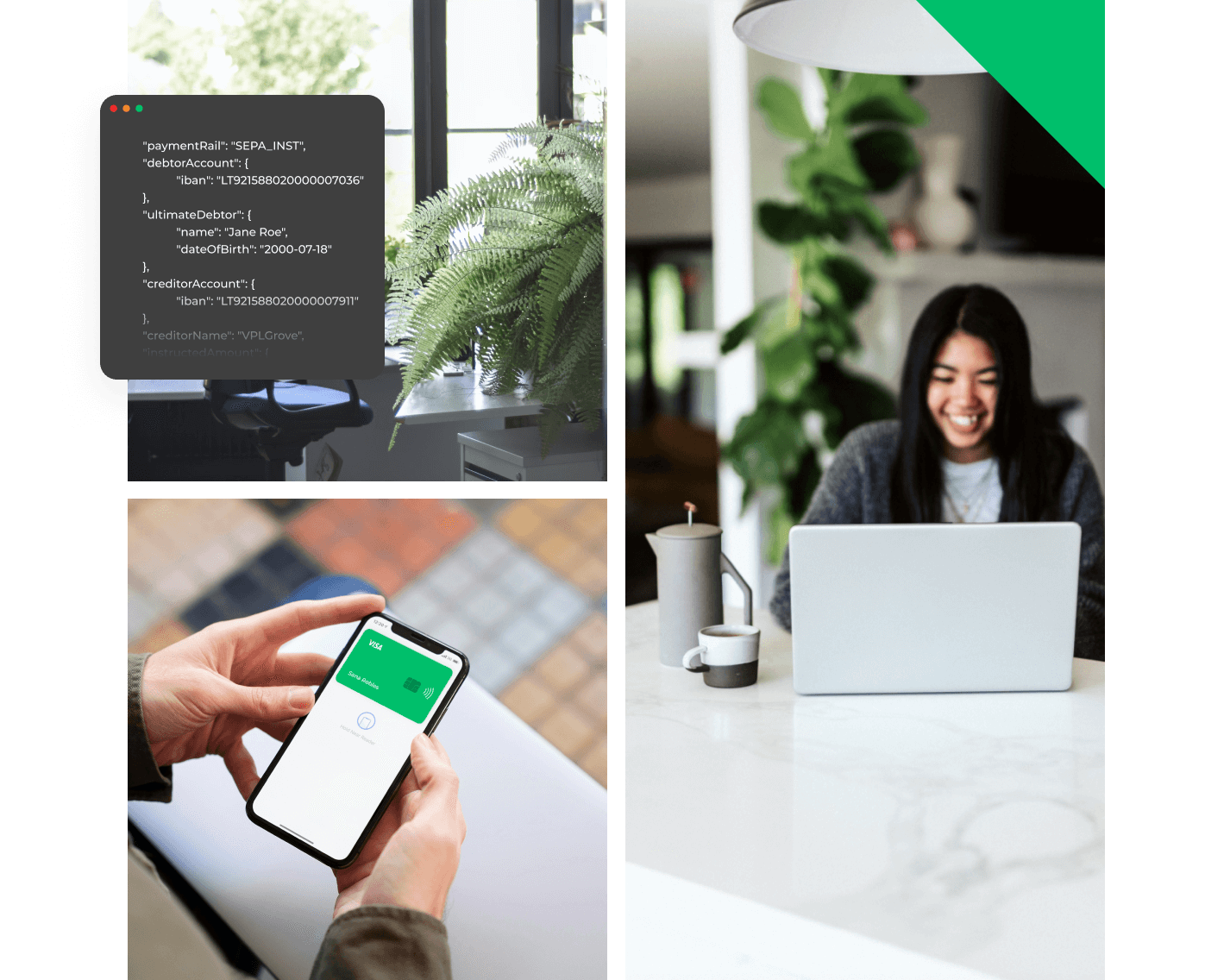

Every digital wallet transaction adheres to full PSD2 and PCI DSS compliance, ensuring constant protection for both the payer and you because we cover onboarding and ongoing due diligence. Besides, you can focus solely on scaling your business, while we take care of our solutions related transaction AML monitoring, transaction sanction/PEP screening, etc.

Remove payment delays and reconciliation issues by consolidating your payments with an IBAN for your e-wallet.

Share a dedicated IBAN with customers who want to pay via digital wallet.

E-wallets are compatible with hundreds of everyday gadgets.

Through our rigorous verification process, we greatly minimize the risk of transcription and account ID errors.

Get instant payment insights, allowing you to stay on top of what’s happening when it’s happening.

Because a single feature is never enough, we give you what you need to grow

Set up as many e-wallets as you need to make sure your funds are properly segregated

Hold funds in your e-wallets for as long as you want

Our e-wallets can hold any amount, no matter how big.

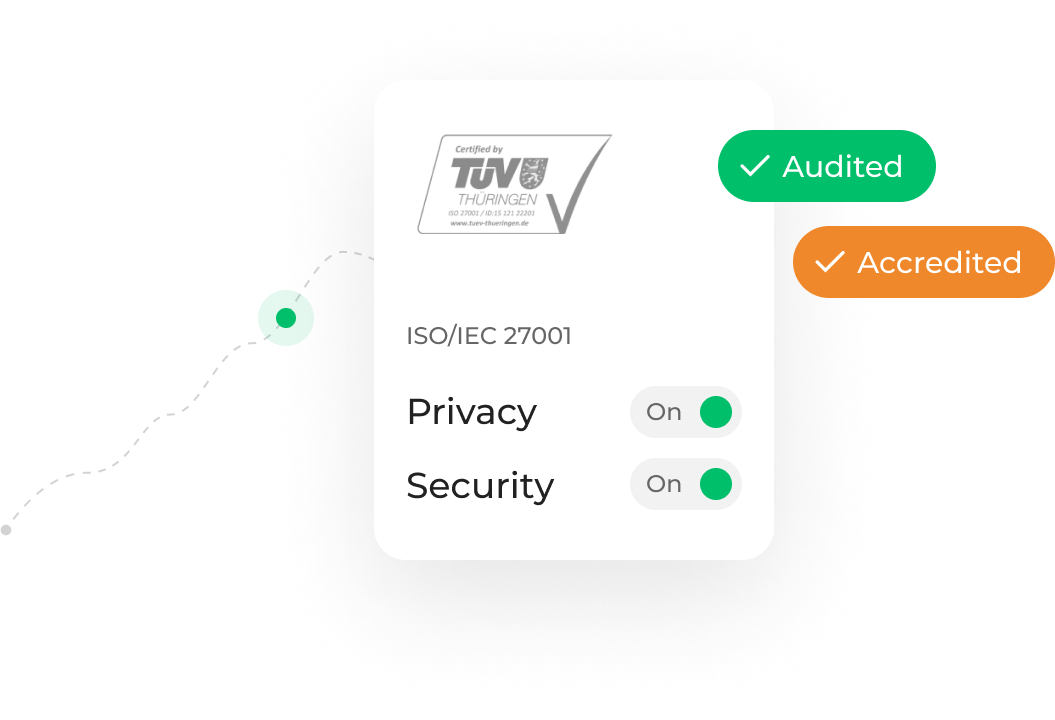

We’re ISO certified to keep your data safe. ISO/IEC 27001 and ISO 22301:2019 are some of the world’s most robust data security certification schemes.

We’re authorized and regulated by the Central Bank of Lithuania, which is subject to the regulation of the European Central Bank.

Enjoy peace of mind with our team always ready to support you.

Our digital wallet is a digital platform exactly the same as a bank account that allows top ups of balance, get rewards, cashback, make various transactions, send and receive payments. A debit card can be assigned to your IBAN account, yet it’s not an extremely popular use amongst our clients. They prefer to use our e-wallets as a stand alone accounts for everyday transactions.

Yes, a company can have as many digital wallets as it needs. Digital wallets for businesses, often referred to as corporate wallets, provide several benefits and functionalities tailored to meet companies’ needs.

E-wallets benefit a wide range of businesses, including e-commerce stores, marketplaces, SaaS companies, and platforms. Any business that processes a high volume of transactions can benefit from their efficiency and security.