The Single Euro Payments Area (SEPA) is a harmonised system for euro-denominated bank transfers, widely touted for its positive impact on financial transactions across Europe. Particularly impressive are its standardised processes – the cornerstone of efforts geared towards eliminating disparities in both domestic and cross-border payments, fostering economic integration and enhancing trade within the Eurozone.

With benefits including faster processing, reduced costs, and heightened transparency, SEPA has also been continuously intensifying competition among banks and payment service providers, which ultimately favours consumers.

This guide – your essential resource for understanding the significance of SEPA – delves into all the key facets of this landmark directive to help you squeeze out its benefits to the last drop. We hope you find it useful.

SEPA transfers – everything you need to know

For the purposes of facilitating economic integration and trade within the Eurozone, SEPA provides standardised payment processes and eliminates differences in domestic, as well as cross-border payments.

In addition to faster, cheaper, and more transparent financial transactions, individuals and businesses can enjoy the benefits derived from increased competition among banks and payment service providers.

Understanding the Single Euro Payment Area (SEPA) transfers

By using a common set of rules and formats, SEPA transfers ensure fast and efficient transactions, often with same-day processing, regardless of the sender and recipient’s location, while SEPA direct debits enable businesses to collect payments directly from customers’ bank accounts, with the customer’s authorisation.

In practical terms, this automated process streamlines recurring payments such as utility bills or subscription fees, thereby reducing administrative overhead and ensuring timely payments.

Both SEPA credit transfers and direct debits are geared towards simplifying cross-border transactions, enhancing transparency, lowering costs, promoting economic integration, and facilitating smoother Europe-wide transactions.

What countries are SEPA Member States?

All 27 EU Member States are SEPA countries, as well as Switzerland, the UK, San Marino, Vatican City, Andorra, Monaco, and the three EEA countries of Iceland, Norway, and Liechtenstein.

SEPA excludes some countries that use the euro, such as the Danish Faroe Islands, Greenland, Kosovo, and Montenegro – a crucial thing to understand if you want to avoid issues that may arise due to varying regulations.

Additionally, countries like Albania, Belarus, Brazil, and some others use IBAN, e.g., IBAN accounts for B2B2B and B2B2C, but aren’t part of SEPA while, as already noted, the non-EU countries Switzerland and the UK – the latter even post-Brexit – are. With regards to Switzerland, however, keep in mind that SEPA transfers may incur currency conversion fees.

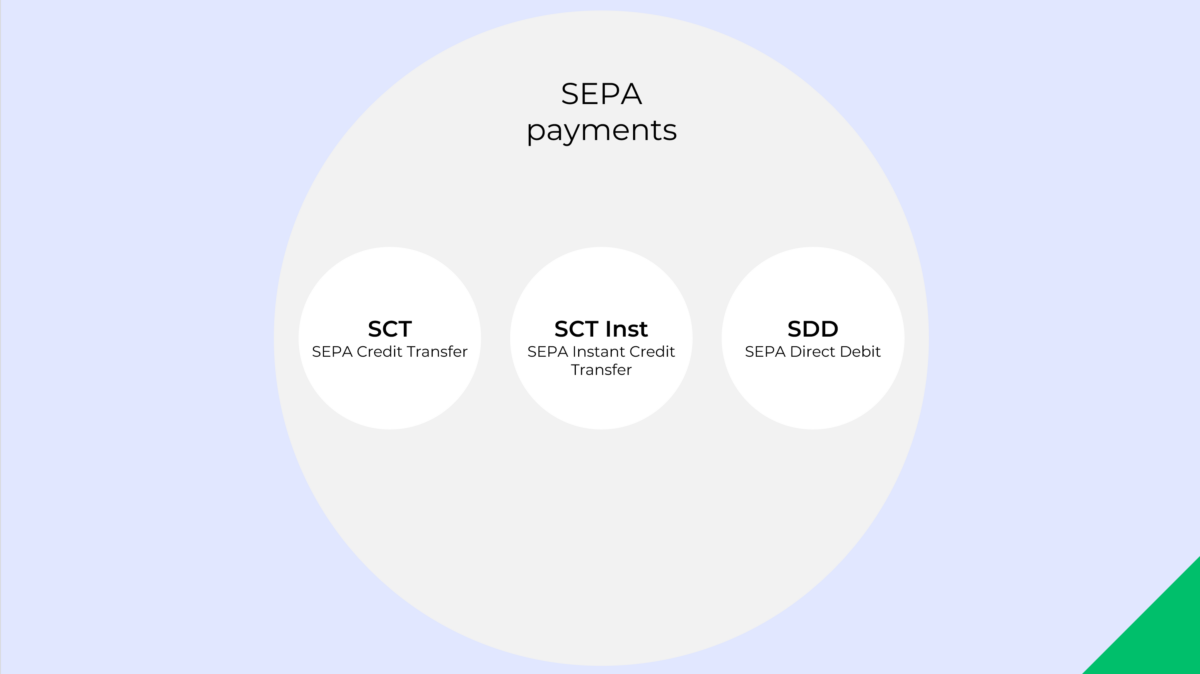

What are the types of SEPA transfers?

There are, in total, 3 types of SEPA transfers:

- SEPA Credit Transfer (SCT): Allows for the electronic transfer of funds in euros from one bank account to another. Transfers are typically completed within one business day.

- SEPA Instant Credit Transfer (SCT Inst): A variant of the credit transfer that enables near-instantaneous transactions, usually within seconds, 24/7. This service supports fast, cross-border payments up to a specified limit.

- SEPA Direct Debit (SDD): Enables businesses to collect euro payments from accounts in other countries. This is ideal for recurring payments like subscriptions or utility bills. SDD comes in two forms: Core (for consumer transactions) and B2B (for business transactions), each with different authorisation requirements and rights.

How long does a SEPA transfer take?

As already indicated above, the duration of SEPA transfers depends on the type used.

SCT transfers are generally processed within 1 business day. If initiated early in the morning, it may even complete on the same day, depending on the banks involved.

SCT Inst transfers are designed for near-instantaneous processing, usually completed within 10 seconds, regardless of the day or time. This allows for real-time transfers 24/7, including weekends and holidays.

SDD transfers can take longer, with the duration also depending on the form selected. SDD Core transactions must be submitted at least 2 business days before the due date, while SDD B2B transactions require 1 business day.

Also, with regards to SDD transfers, keep in mind that the actual debiting of the payer’s account may take an additional day to reflect.

The benefits of using SEPA for businesses

Although SEPA benefits European businesses in numerous ways, the key SEPA advantages are as follows:

- First, by standardising euro transactions, SEPA minimises transaction fees and eliminates exchange costs within the eurozone, lowering overall banking costs for businesses.

- SEPA also simplifies and harmonises the process for cross-border payments. This uniformity allows businesses to manage all euro transactions through a single bank account, enhancing operational efficiency.

- In addition, SEPA adheres to strict regulatory standards, which boosts the security of payment transactions. The format also includes mandatory use of IBANs, which reduces errors in payment processing

- And finally, with the predictable processing times and faster settlement enabled by SEPA, businesses experience improved cash flow management, allowing for more precise financial planning

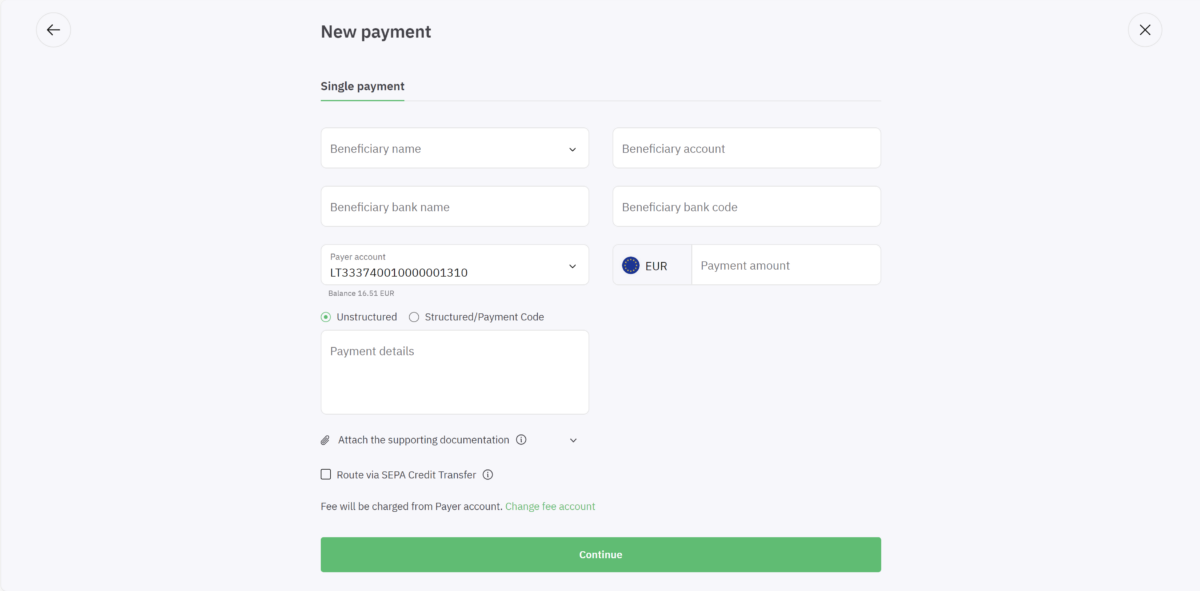

How to execute SEPA transfers with ConnectPay

It’s really quite simple. All you need to do is follow the concise step-by-step guide below:

- Access your ConnectPay online banking account.

- Go to the “Send money” section.

- Enter the recipient’s IBAN and other required details.

- The transfer is automatically routed via SEPA Instant Credit Transfer. However, you can route it via SEPA Credit Transfer if you want.

- Review the payment details for accuracy.

- Complete the transaction using your secure authentication method.

SEPA vs. traditional cross-border payments

Compared to traditional cross-border payments, SEPA transactions are faster, often completing on the same day, and instant transfers are possible 24/7. Traditional methods typically take 2-5 business days.

Due to standardised processing across the Eurozone, which eliminates exchange fees within member countries, SEPA transactions also cost less to individuals and businesses alike. Traditional cross-border transfers, conversely, often involve higher bank fees and currency exchange costs.

Last but not least, SEPA makes for much simpler financial management by enabling businesses to use a single bank account for all euro transactions. This way, it contributes to streamlining financial operations, which previously required managing multiple online business accounts and formats.

The overall effect of SEPA is that of enhancing transaction speed and reducing financial overhead for businesses operating in the EU, as well as those in several other European countries (see above for a list).

Compliance and regulatory framework

The regulatory landscape for SEPA transactions is shaped by several key EU regulations designed to enhance efficiency and security across European payments:

- PSD2 (Payment Services Directive 2): This directive regulates payment services and providers throughout the EU, aiming to increase competition and participation in the European payments industry, including non-banks. It emphasises strong customer authentication and open banking standards.

- SEPA Regulation (EU) No 260/2012: This regulation mandates the migration of national credit transfers and direct debits to SEPA-compliant formats, ensuring uniformity in electronic payments across Europe. It specifies the technical requirements like the use of IBAN and BIC.

- GDPR (General Data Protection Regulation): While not specific to SEPA, GDPR impacts how financial data is handled during transactions, emphasising the protection and privacy of personal data.

Compliance with these regulations ensures that SEPA transactions are secure, standardised, and accessible to all participating entities within the EU.

Tips for optimizing your business payments with SEPA

To get the full benefit of enhanced operational efficiency and financial management, consider integrating your account system with your banking interface, as this will allow you to automate and reconcile payments seamlessly. If you’re looking for improved cash flow, you may also want to opt for SEPA Instant Credit Transfers, which offer real-time processing – ideal for urgent payments.

Additionally, utilising SEPA Direct Debits for recurring payments can reduce administrative overhead and ensure timely collection. To reduce costs even further, review your transaction fees regularly and negotiate with banks for better rates based on volume.

Are you ready to explore SEPA powered payment solutions with ConnectPay?

In summary, the experience of numerous European businesses shows that SEPA is one of the key instruments promoting streamlined transactions across the continent. Its standardised approach not only accelerates processing times but also significantly reduces transaction costs, enhancing operational efficiency and improving cash flow management.

By utilising SEPA payments for businesses, the latter can ensure compliance with EU regulations with relative ease, benefiting from a secure and efficient cross-border payment system.

ConnectPay, as a cross-border payment platform, offers specialised support when it comes to integrating SEPA transfers into your financial operations and enabling customers to receive payments in multiple currencies. We’re here to help you navigate the complexities of payment processes and optimise your transaction workflows. Drop us a line today and we’ll contact you as soon as possible!