-

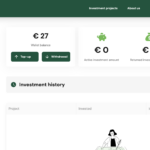

Access to investments, repayments with interest, etc.

-

Digital wallets

-

High KYC requirements adherence

-

Excellent customer experience

-

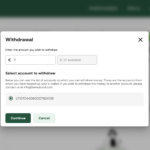

Account top-up and withdrawal

-

All financial solutions, such as investments, repayments with interest, etc., are easily accessible

-

Fast payments with digital wallets

-

Built-in compliance meeting high regulatory standards

-

Ensured a smooth customer experience

-

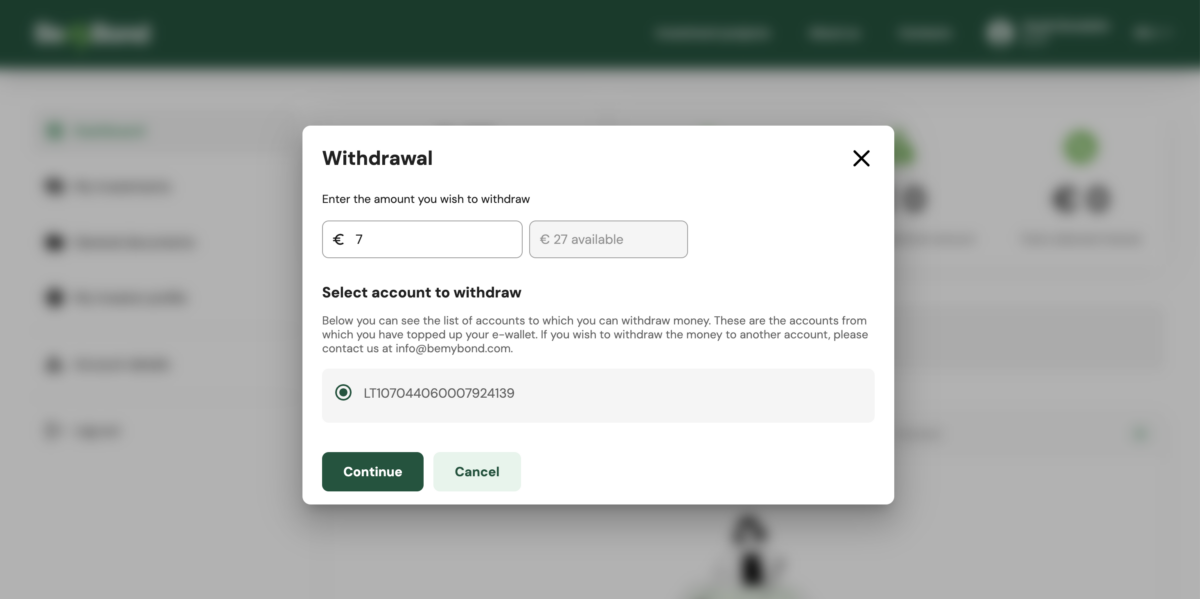

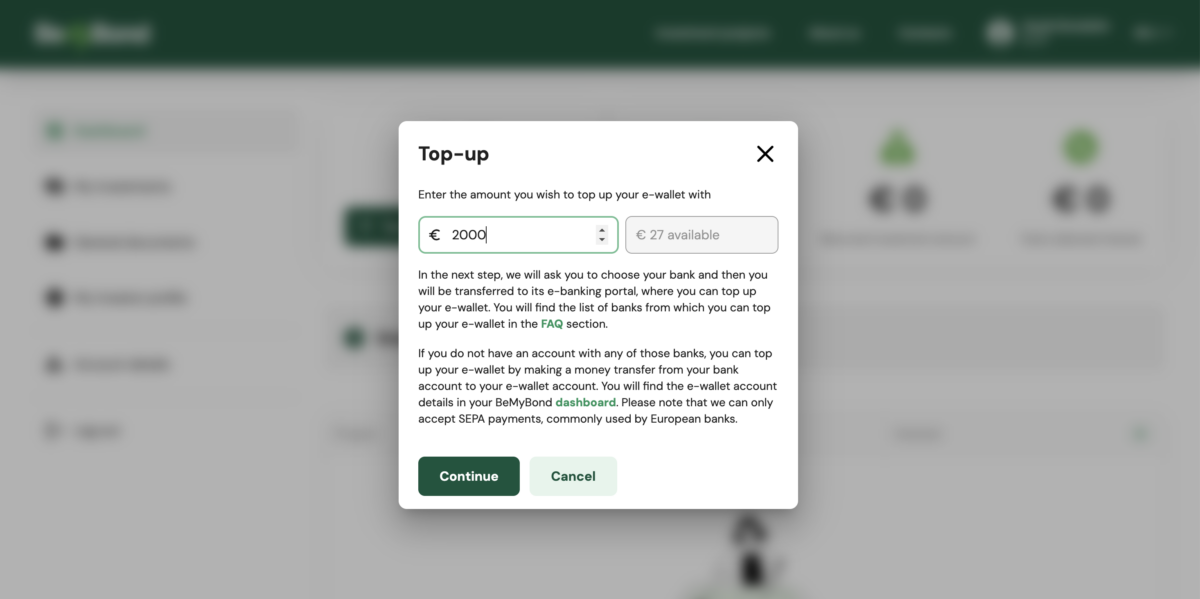

Intuitive top-up and withdrawal process

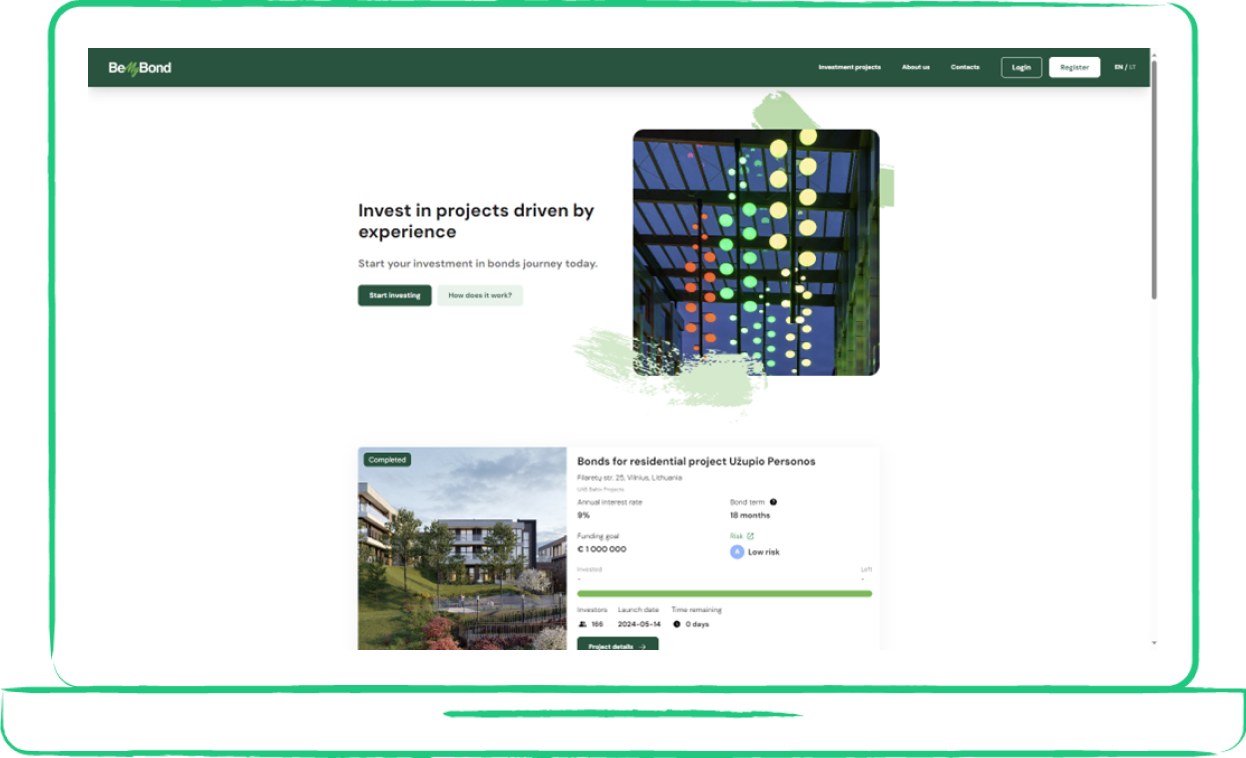

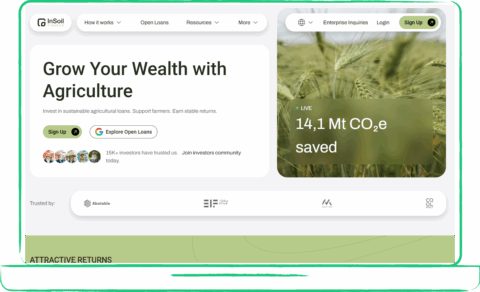

About

BeMyBond is a platform for investing in bonds. Its main goal is to encourage as many people as possible to invest wisely and to make investing in bonds affordable and easy for everyone. This becomes possible by reducing the minimum investment amount to € 100 or € 1 000, i.e., the nominal value of one bond. The aim is to offer investment projects to retail investors with a better risk/return balance and an average return of 7-10% per annum, all in a customer-friendly digital environment.

Challenge

The main challenge for BeMyBond was to build a payment flow architecture that guaranteed smooth financial solutions and a superior end-user experience while meeting all the compliance requirements set for a licensable crowdfunding business. It was also essential to have only one unified transactions flow from the end-user perspective.

Solutions

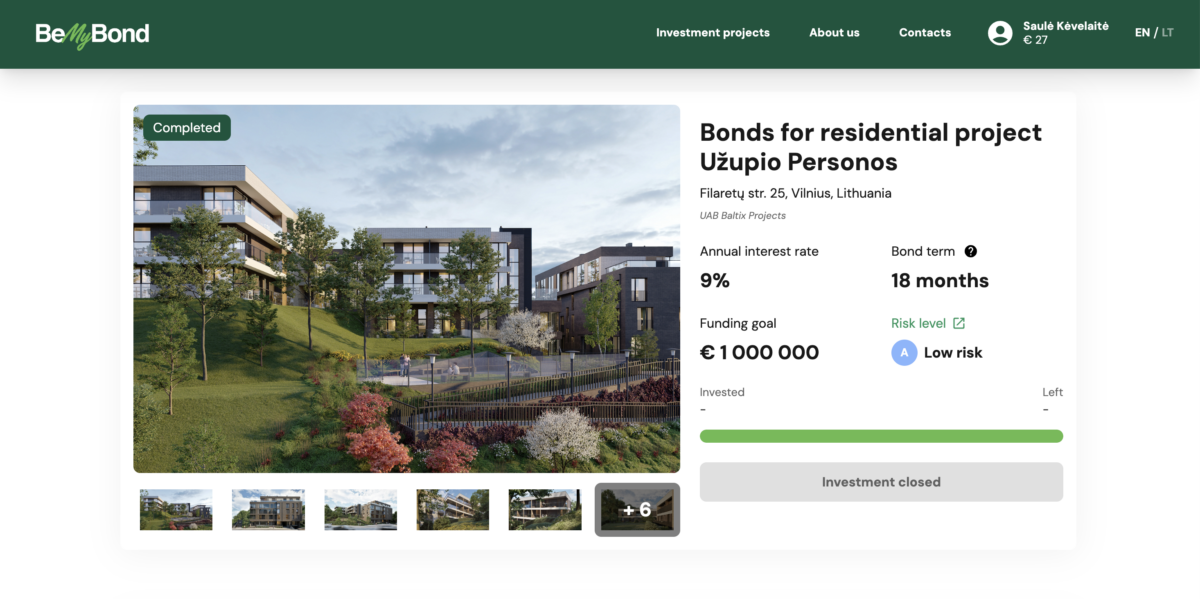

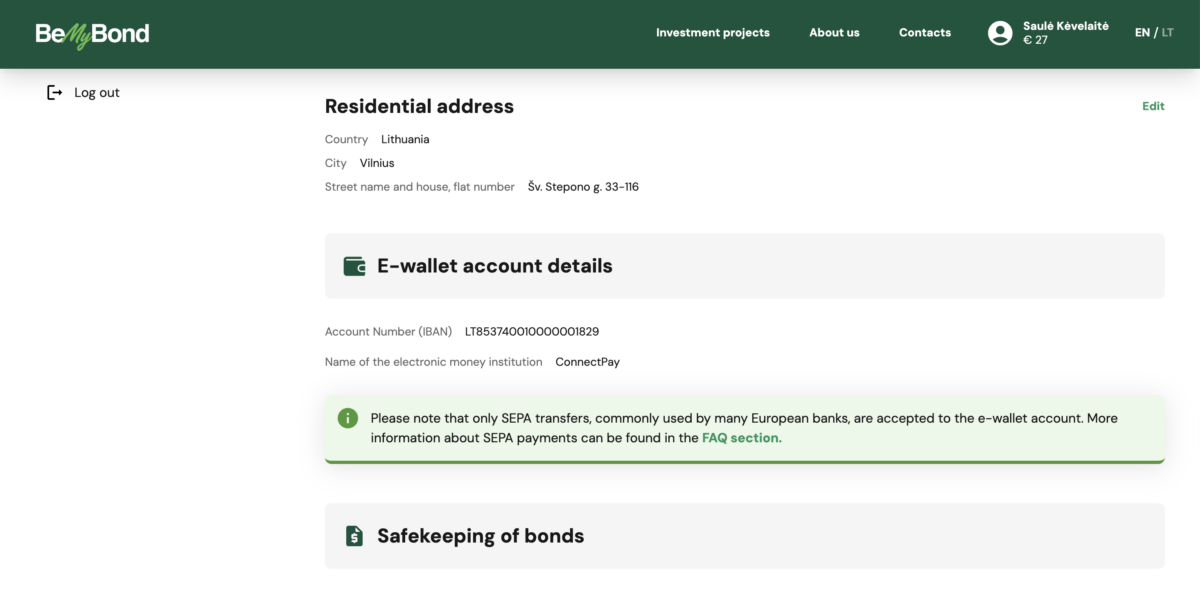

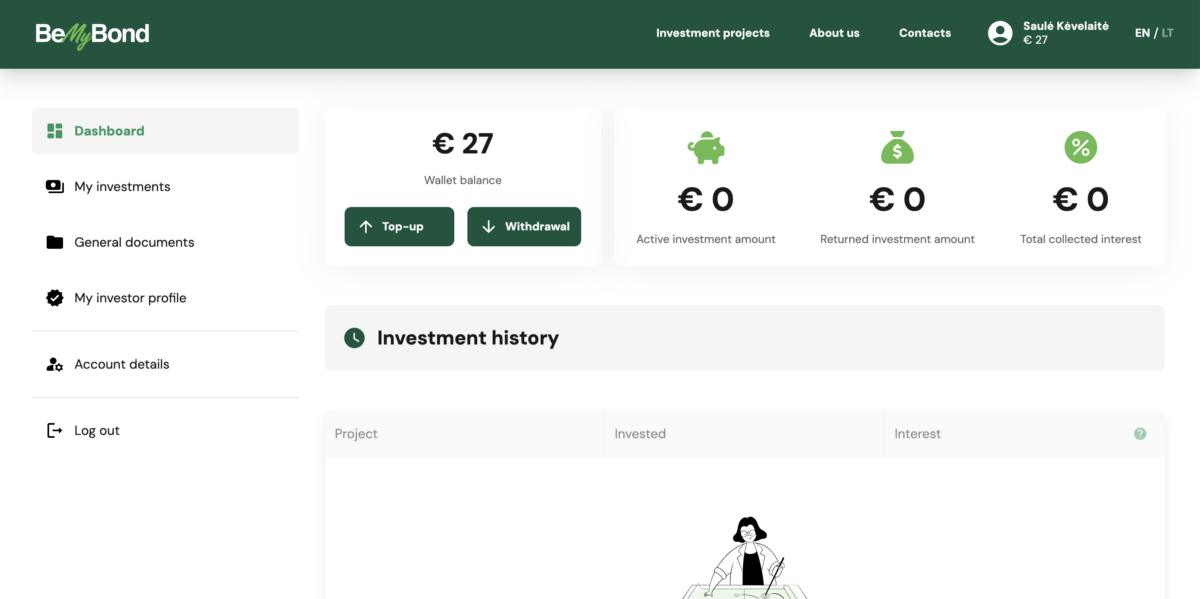

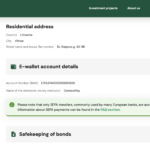

To address BeMyBond’s challenge of creating a compliant and seamless financial architecture, we suggested a specific range of embedded financial modules. Each investor and borrower can now open digital wallets, which can be topped up easily via bank transfers (Payment Initiation Services). Investing activities are conducted instantly between wallets, while payouts are executed through SEPA and SEPA Instant payments, ensuring smooth and efficient transactions.

Our solution emphasized compliance, integrating embedded finance with built-in compliance features to mitigate risks. We provided a single set of APIs with comprehensive documentation to streamline integration and operation. Given the platform’s outsourced vendors for the front-end and back-end, managing communication and expectations was complex. However, BeMyBond meticulously followed the pre-launch checklist, with support from ConnectPay teams, who responded promptly and effectively to client requests.

Results

BeMyBond’s crowdfunding platform successfully launched with embedded finance and built-in compliance, with all financial operations running smoothly and efficiently. The platform successfully onboarded over 1400 customers, each with IBAN accounts, marking a significant milestone in their growth.

Payments within the platform are processed instantly, demonstrating the efficiency of the internal wallet system and the use of SEPA and SEPA Instant payments. This quick processing time enhances the users’ experience by providing swift and reliable transactions.

Moreover, BeMyBond can now offer tailored solutions to its end users, thanks to the ability to collect 20 distinct data items about each user. This means that the platform can create personalized offers, enhancing customer satisfaction and engagement.

One of the key advantages of our solution is that BeMyBond has less compliance headaches. ConnectPay takes additional responsibility for ensuring that onboarded clients meet all compliance requirements, helping BeMyBond with additional layer of security. This peace of mind is invaluable, as it removes a significant burden and potential risk from the platform’s operations.

Overall, the launch has been a resounding success, with BeMyBond now well-positioned to scale their business and provide exceptional financial solutions to retail investors in bonds.

We are glad to have worked with ConnectPay on our platform as they did their best to tailor their existing solutions to suit our needs and technical requirements. Despite challenging communication and tight deadlines towards the end of the project, together we managed to create a seamless and easy payment solution for the majority of our clients, which was one of our main goals and we consider it a great success. Also, we were surprised by the level of attention the ConnectPay team pays to compliance requirements. We will be happy to continue working with ConnectPay in the future.

Indrė Dargytė

BeMyBond CEO