-

Replace multiple providers into a faster, more flexible financial infrastructure

-

Enable auto-investment

-

Eliminate pooled accounts to meet regulatory standards

-

Cut down transaction delays

-

Simplify operations

-

One provider for a fast and flexible financial setup with full control

-

Auto-investment launched — improving user retention and platform revenue

-

Segregated accounts for clear, regulation-ready compliance

-

Instant payments for a seamless and responsive user experience

-

Consolidated all financial operations under one provider

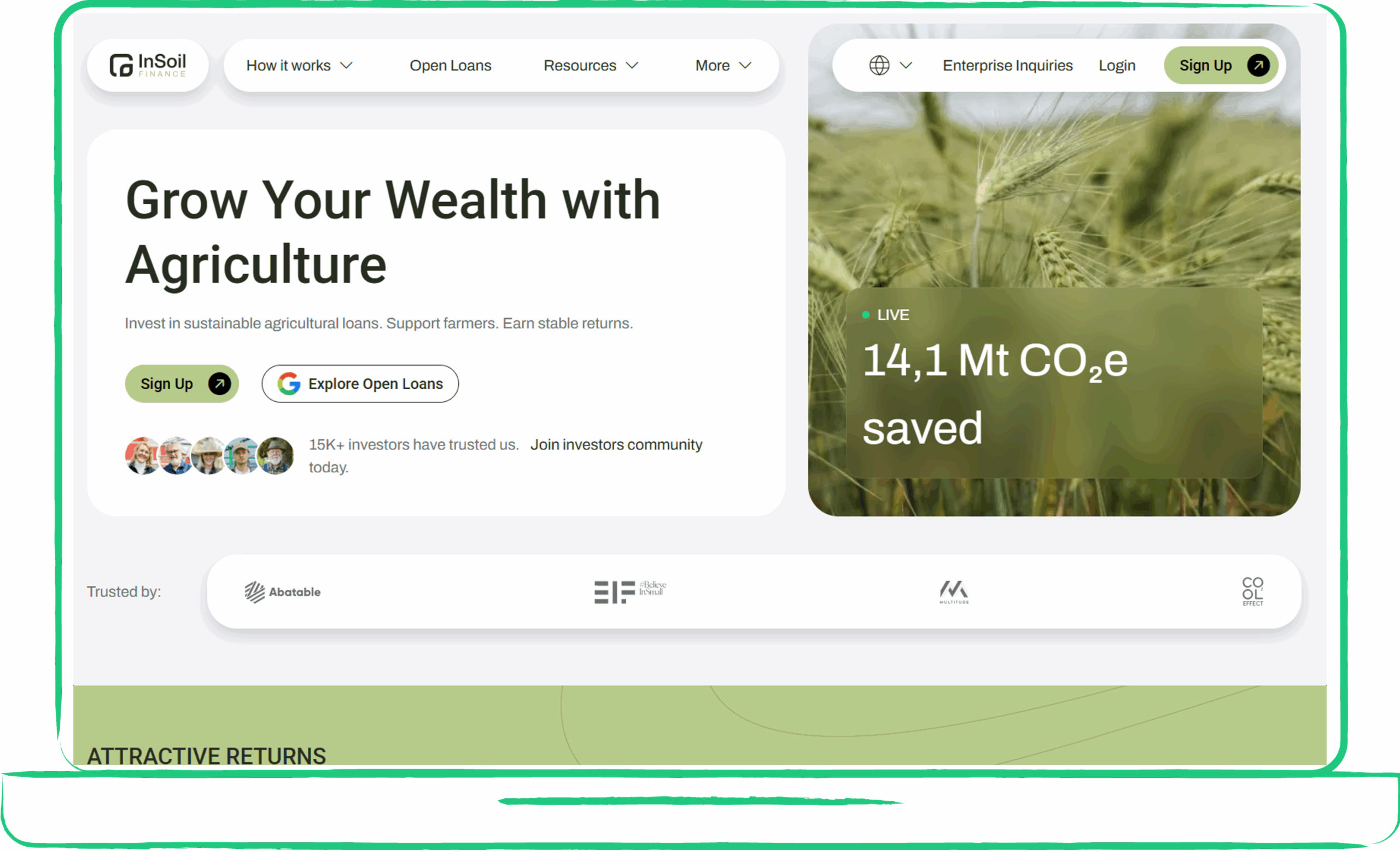

About

InSoil, a key enabler throughout the entire carbon credit lifecycle for regenerative agriculture, actively participating in farmer engagement, financing, implementation support, verification, certification, and monetisation. InSoil’s top priority is ensuring the highest integrity of its carbon credits.

Leveraging its deep data and analytics capabilities, along with close relationships with farmers, InSoil is uniquely positioned to underwrite agricultural loans. The company connects small-to-mid-size farming projects with environmentally conscious investors, acting as both a funding vehicle and a community hub. InSoil’s model depends on seamless financial flows – and their ability to offer quick, intuitive, and compliant investment experiences is essential to growth.

Challenge

As InSoil expanded, managing financial operations across two separate service providers became increasingly complex. While the setup served its purpose early on, it required constant coordination and workarounds to maintain stable flows. This made it difficult to adapt quickly or introduce platform improvements such as auto-investment, which remained on hold due to technical limitations.

Transaction speed was a persistent challenge. Under the previous PSP setup, SEPA payments often took up to three business days to reach investor accounts, creating noticeable delays. For a platform centered around timely access to investment opportunities, this disconnection between intent and action impacted both user experience and engagement.

In parallel, operating through pooled accounts raised compliance concerns as regulatory standards became more stringent. InSoil recognized the need for a more transparent and robust account structure to support long-term scalability while maintaining full regulatory alignment.

Solutions

To address these challenges, InSoil partnered with ConnectPay to transform its financial backbone into a scalable, future-ready infrastructure. Together, they implemented a unified embedded finance solution to consolidate operations, accelerate transactions, and support long-term growth — all while ensuring robust, built-in compliance. The result: a faster, more intuitive investment experience for users, with real-time transactions and seamless access to eco-investment opportunities.

KEY CAPABILITIES DELIVERED:

- Real-time SEPA Instant payments, replacing 3-day delays with instant transactions

- Full segregation of funds using dedicated IBANs — eliminating pooled account risks

- Auto-investment feature enabled, increasing recurring user activity

- Automated onboarding and KYC, with 90% of users verified in seconds

- Consolidated operations under a single provider, reducing technical debt and coordination overhead

- Enabled secondary market transactions – allowing users to buy and sell investments within the platform through secure, compliant flows

- Future-ready architecture, unlocking compliance, automation, and innovation

THE TRANSITION WAS STRUCTURED IN TWO FOCUSED STAGES:

- Migrating existing users to ConnectPay’s infrastructure

- Activating full payment and investment functionality

Thanks to a clear API documentation and a responsive support team, InSoil completed the migration without disruption — maintaining full front-end continuity for users while overhauling the system behind the scenes.

Results

The shift to embedded finance brought immediate improvements across user experience, operations, and compliance. InSoil gained the speed, flexibility, and control needed to scale with confidence.

USER EXPERIENCE UPGRADED:

- 15,000+ users have access to IBAN accounts

- ~90% onboarded instantly via embedded compliance

- Friction-free investments, with real-time SEPA Instant deposits and withdrawals

OPERATIONS STREAMLINED:

- Eliminated complexity from dual-provider coordination

- Reduced manual workflows, freeing IT and operations teams

- Improved system reliability, oversight, and transparency

BUSINESS GROWTH UNLOCKED:

- Auto-investment launched, increasing user retention and generating a new revenue stream

- Faster fund flow, resulting in higher transaction volume during peak activity

- Robust compliance posture, ready for audits, regulators, and cross-border expansion

The impact of embedding ConnectPay’s financial services was both immediate and long-lasting. All active users — more than 15 000 — have access to their own IBAN accounts, with ~90% completing onboarding automatically through the built-in compliance process in just 3 seconds. The remaining users are gradually being onboarded over the coming period. From the end-user perspective, the investment journey continued uninterrupted — the front-end platform remained familiar while a more advanced financial infrastructure quietly took over in the background.

Transaction speed improved significantly. With SEPA Instant in place, users no longer wait days for deposits to clear. This reduces friction during time-sensitive investment windows and creates a smoother, more responsive experience.

Another milestone is the successful launch of auto-investment, a long-planned feature that was previously out of reach. With a more flexible financial setup in place, InSoil now can offer automated investing — making it easier for users to stay engaged and for the platform to benefit from increased activity and new revenue streams tied to transaction flows.

Behind the scenes, InSoil’s internal teams gain new efficiencies. IT and operations streamline workflows and reduce the overhead of managing multiple service providers. Having a single, robust solution in place brings better visibility, simplified oversight, and more confidence in the platform’s ability to scale.

In the end, the partnership delivers exactly what InSoil needs: faster payments, a future-proof compliance framework, and the freedom to build innovative features without being limited by infrastructure.

"Partnering with ConnectPay transformed our entire financial infrastructure and unlocked growth opportunities we couldn't achieve before. Moving from a complex dual-provider setup to ConnectPay's unified embedded finance solution eliminated the friction that was holding us back. What impressed us most was how seamlessly the transition happened – over 15,000 users moved to individual IBAN accounts with 90% onboarding automatically in just seconds, all while maintaining complete front-end continuity. The regulatory compliance benefits have been equally important, giving us confidence to scale across borders with segregated accounts that meet the highest standards."

Laimonas Noreika

InSoil CEO