Use cases

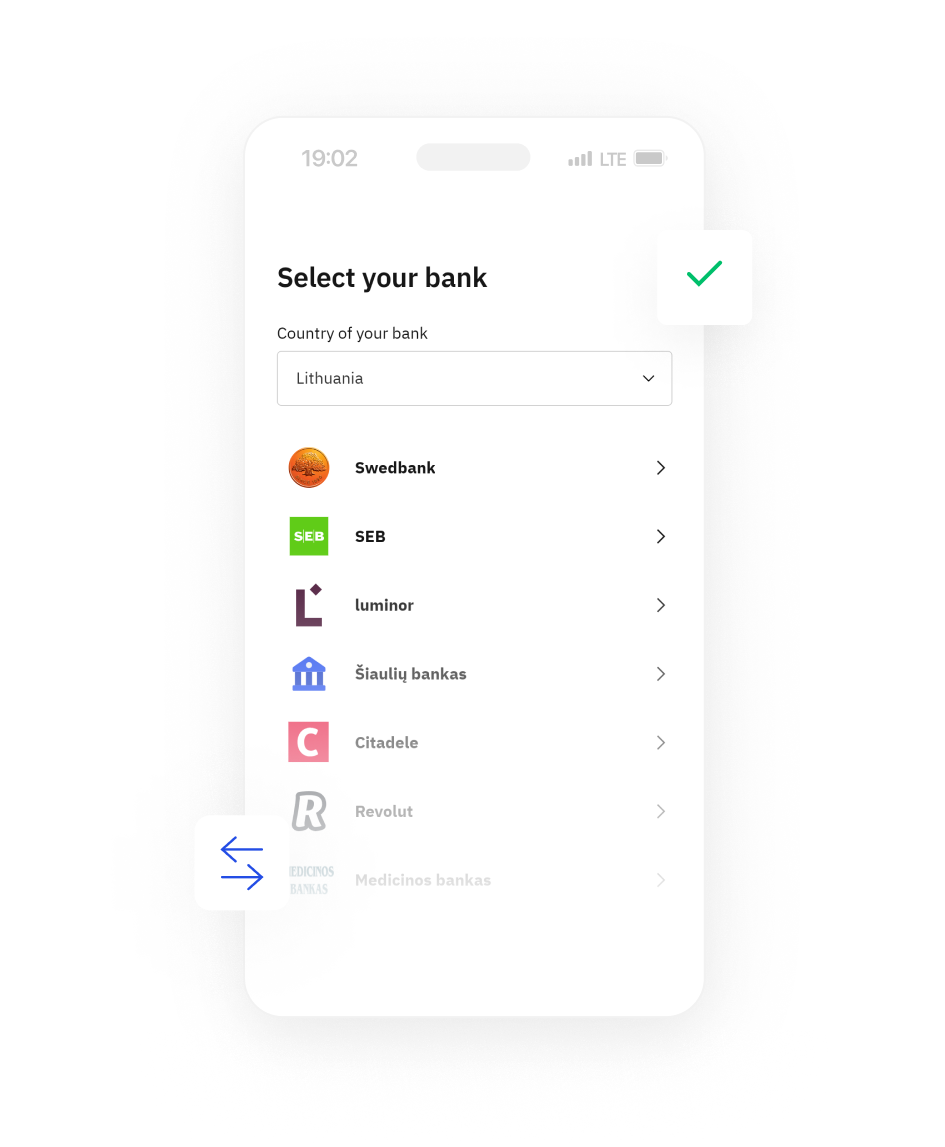

Other use cases

Products

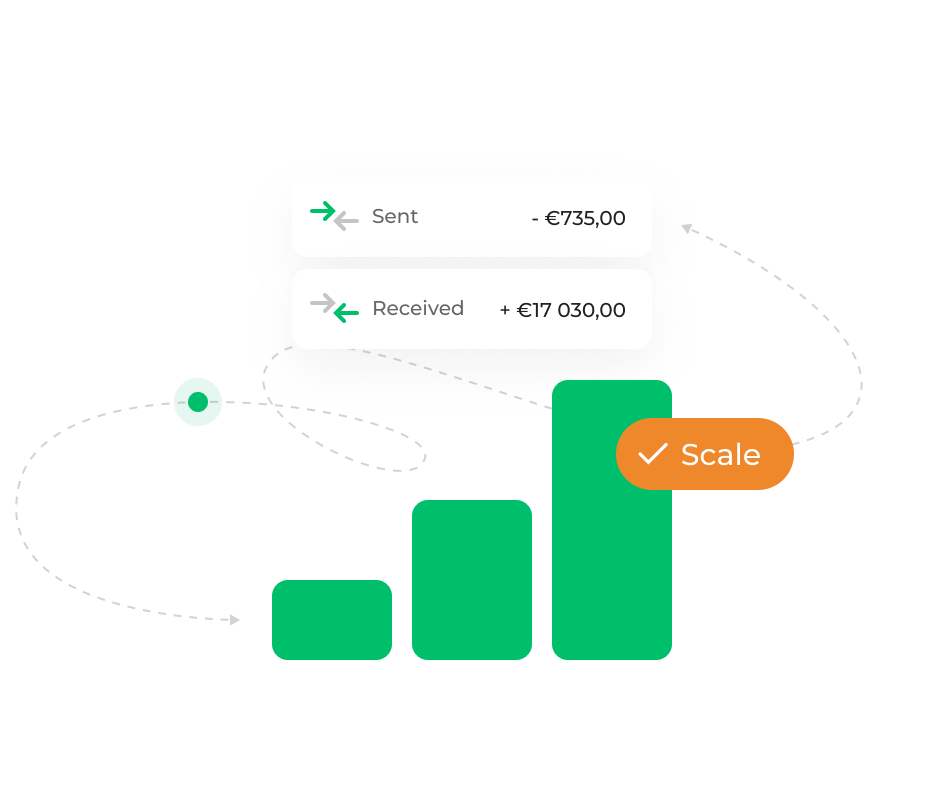

IBAN accounts