Use cases

Other use cases

Products

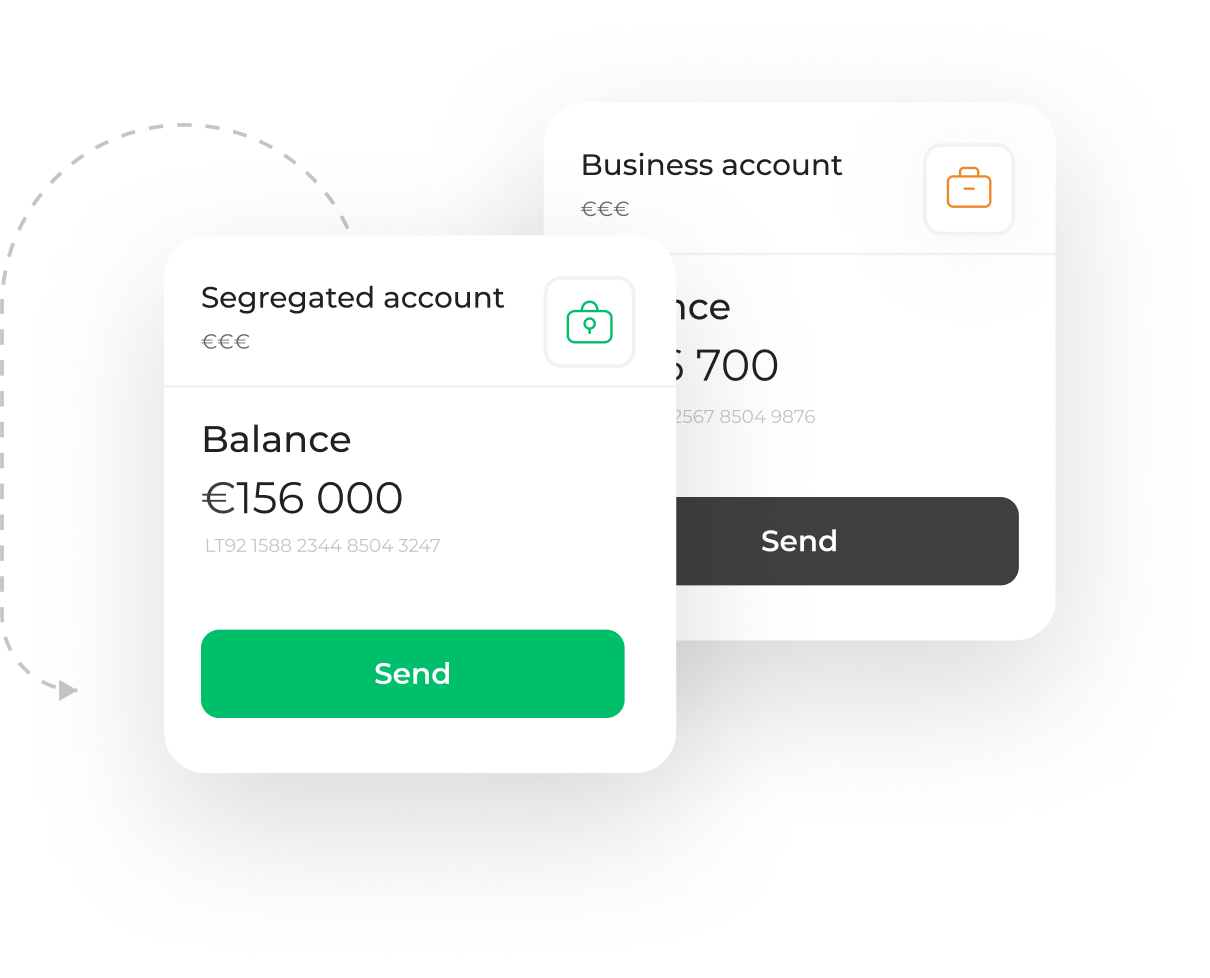

IBAN accounts