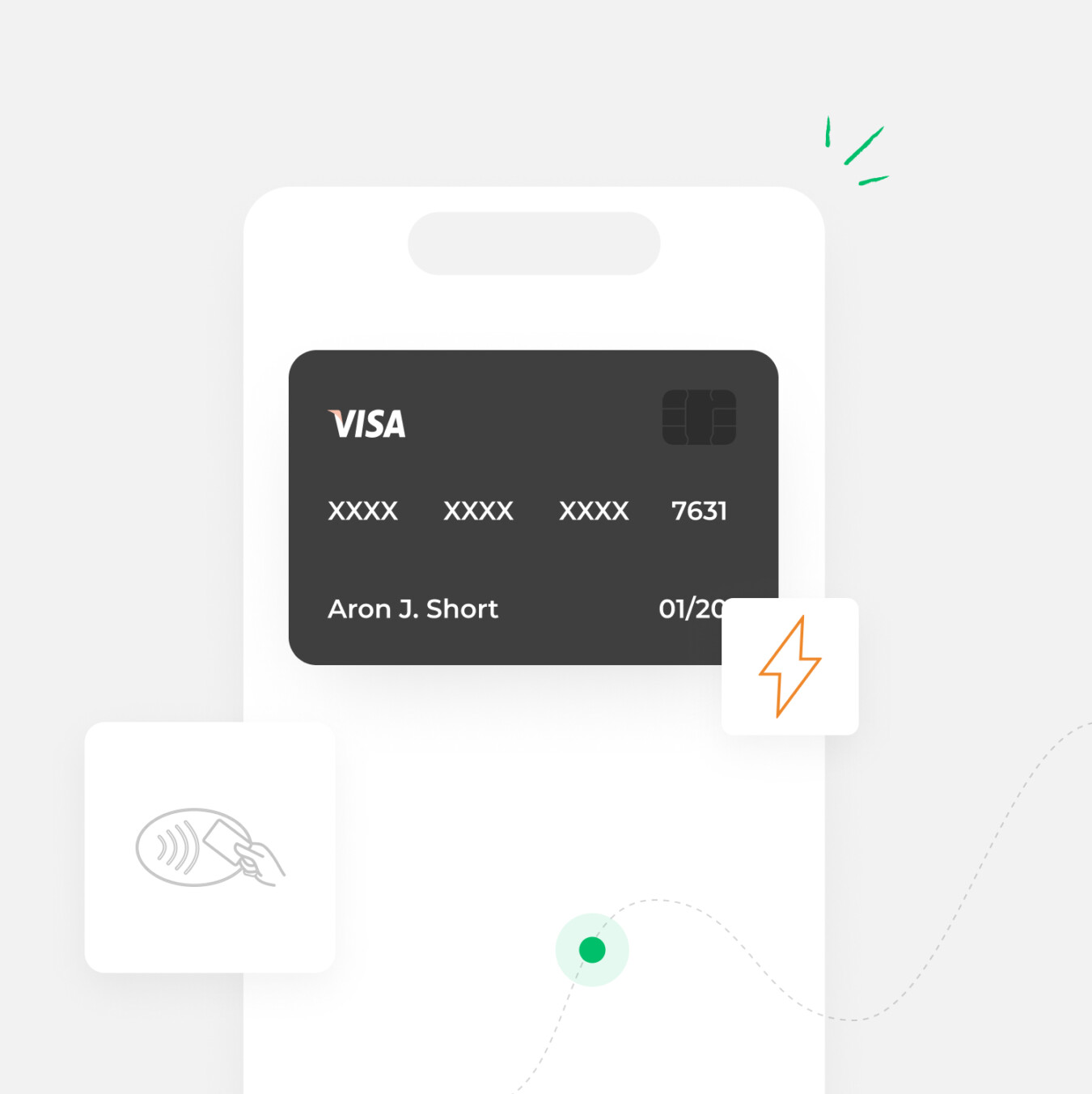

Get virtual VISA cards that match your needs, from regular payment cards for your business to personal cards, exclusively designed to mirror your brand, simplifying your client payment workflows. Let us know what you want, and we’ll create it.

Use our virtual cards to make payments in EUR with direct SEPA / SEPA Instant transfers and avoid needless layers of complexity.

Use our virtual cards to complete transactions all over the world with cross-border SWIFT payments in AUD, BGN, CAD, CHF, CZK, DKK, EUR, GBP, HKD, HUF, JPY, NOK, PLN, RON, SEK, SGD, and USD.

Our virtual cards allow you to do business globally and expand your reach to new markets with currency exchange payments in over 10 key currencies.

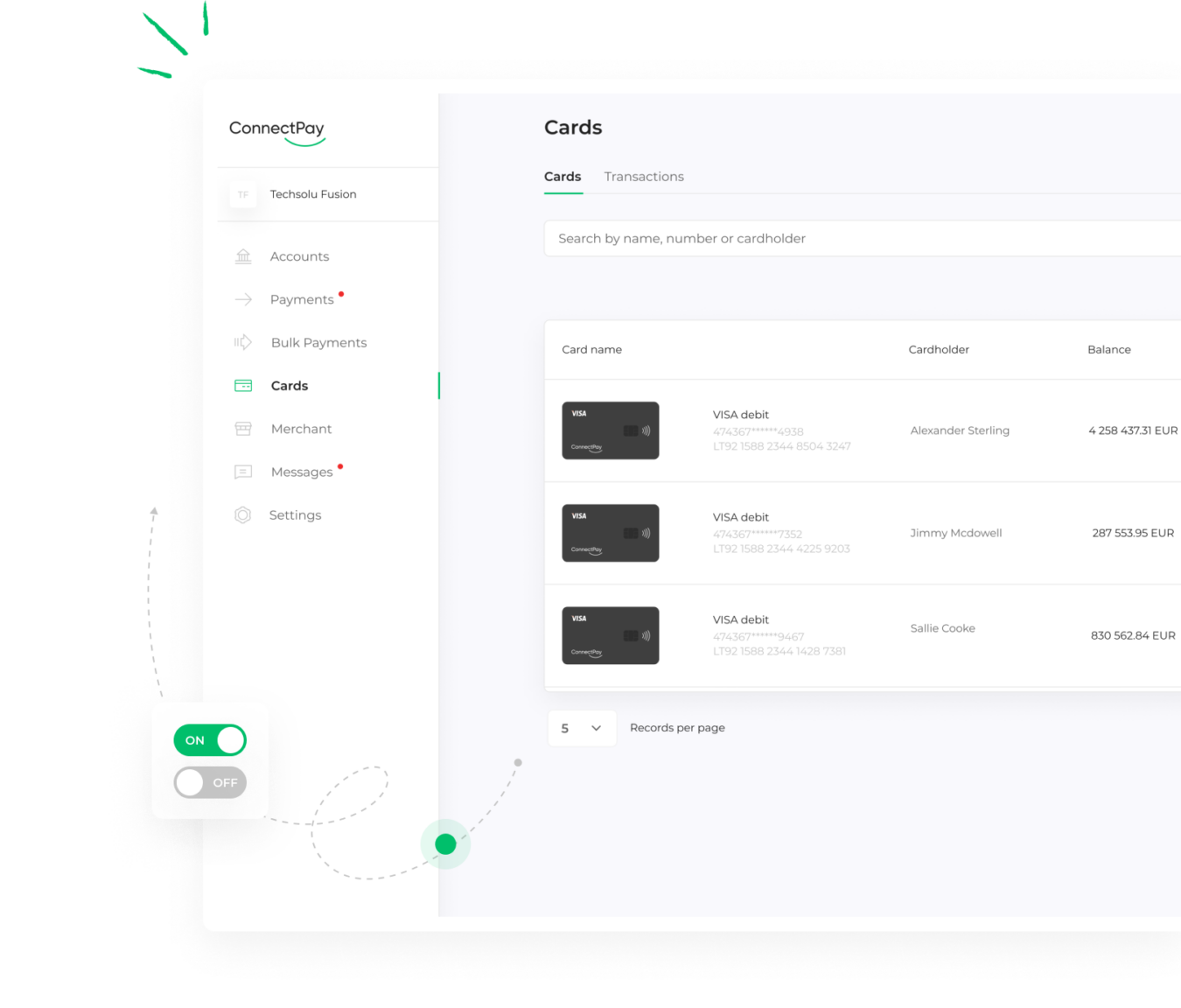

Easily manage your cards through our Online Banking for a hassle-free and convenient experience.

Order cards

Multiple cards on 1 IBAN available

VISA Business Debit cards – directly linked to your IBAN account

Control each card separately – set unique limits and payments settings for each card

Compatible with:

Experience seamless shopping both in-store and online by turning your iPhone or Apple Watch into a powerful purchasing tool with our virtual card. Simply tap and go at your favourite physical stores, or use ApplePay at online checkouts for a quick and secure payment experience. Enjoy the convenience and control that comes with Apple Pay and ConnectPay.

Experience the unmatched superiority of virtual VISA debit cards, granting you the freedom to make purchases globally without constraints.

The virtual VISA card is ready to be used virtually anywhere. Pay or purchase across the globe, with no limitations.

Having a digital business card on your phone means you don’t need to carry a physical card. So, there’s no risk of it getting pickpocketed or lost.

All card payment and transaction information is conveniently accessible via the app.

Virtual cards offer the same protection as physical cards. This means virtual cardholders are covered against theft and accidental damage on their purchases.

A virtual debit card is a digital version of a traditional debit card. It allows you to make secure online transactions without needing a physical card.

Absolutely. ConnectPay virtual debit cards can be linked to digital wallets like Apple Pay, enabling you to make contactless payments in-store using your smartphone or smartwatch.

ConnectPay virtual debit cards can be used internationally, as they are issued through major networks supporting global transactions.