Use cases

Other use cases

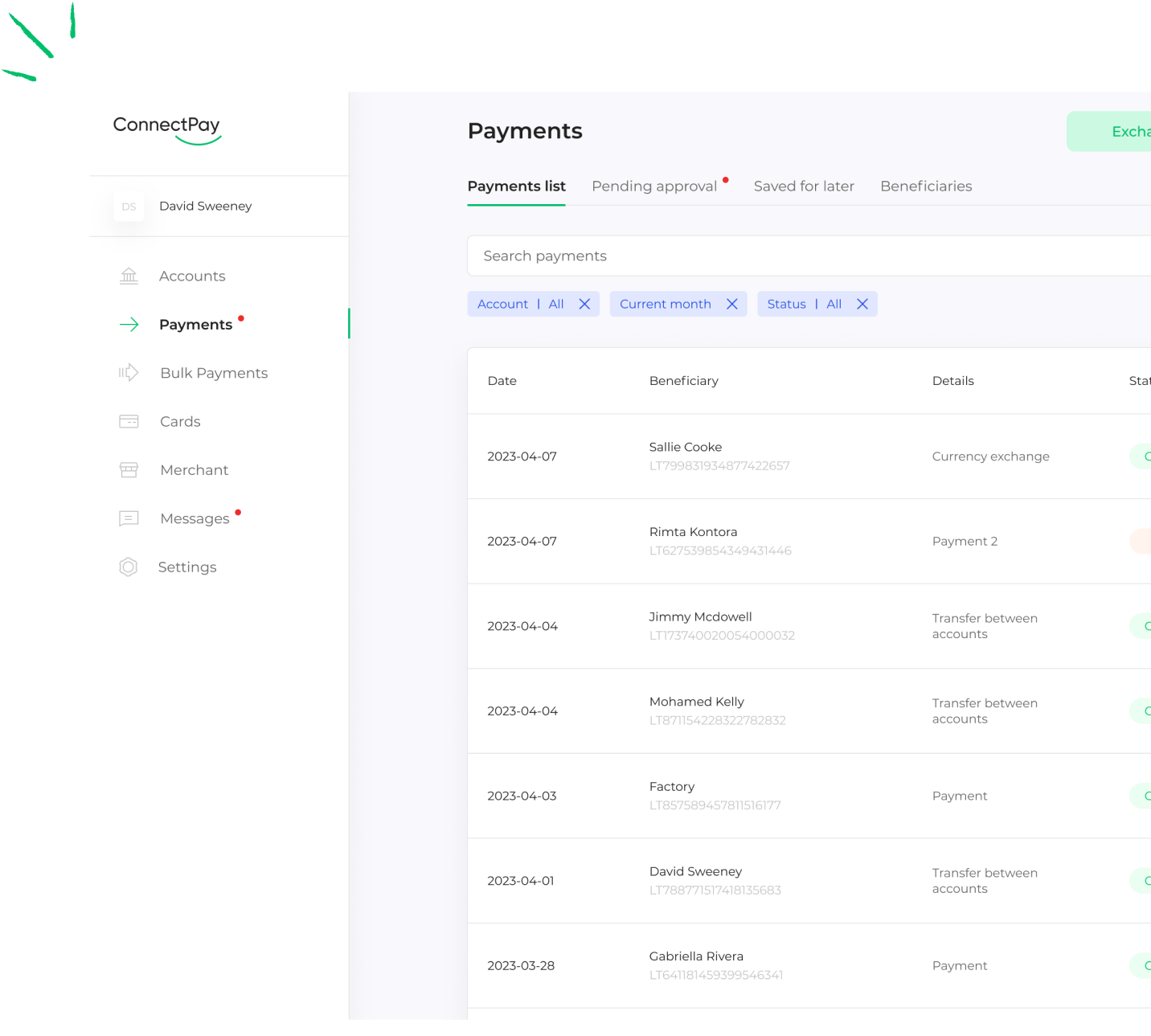

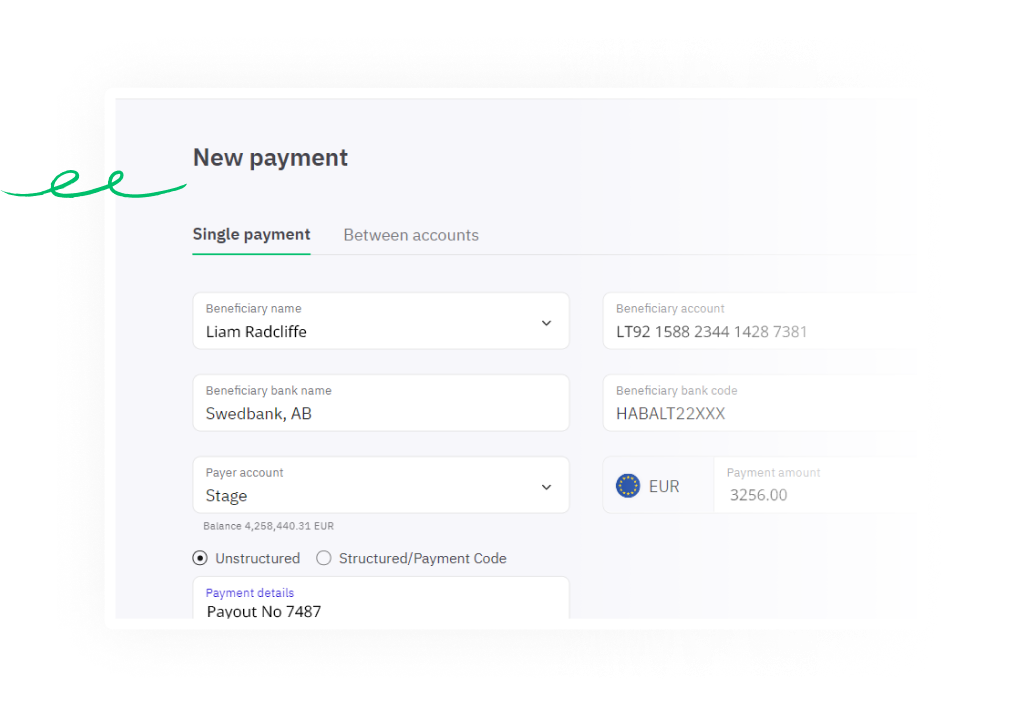

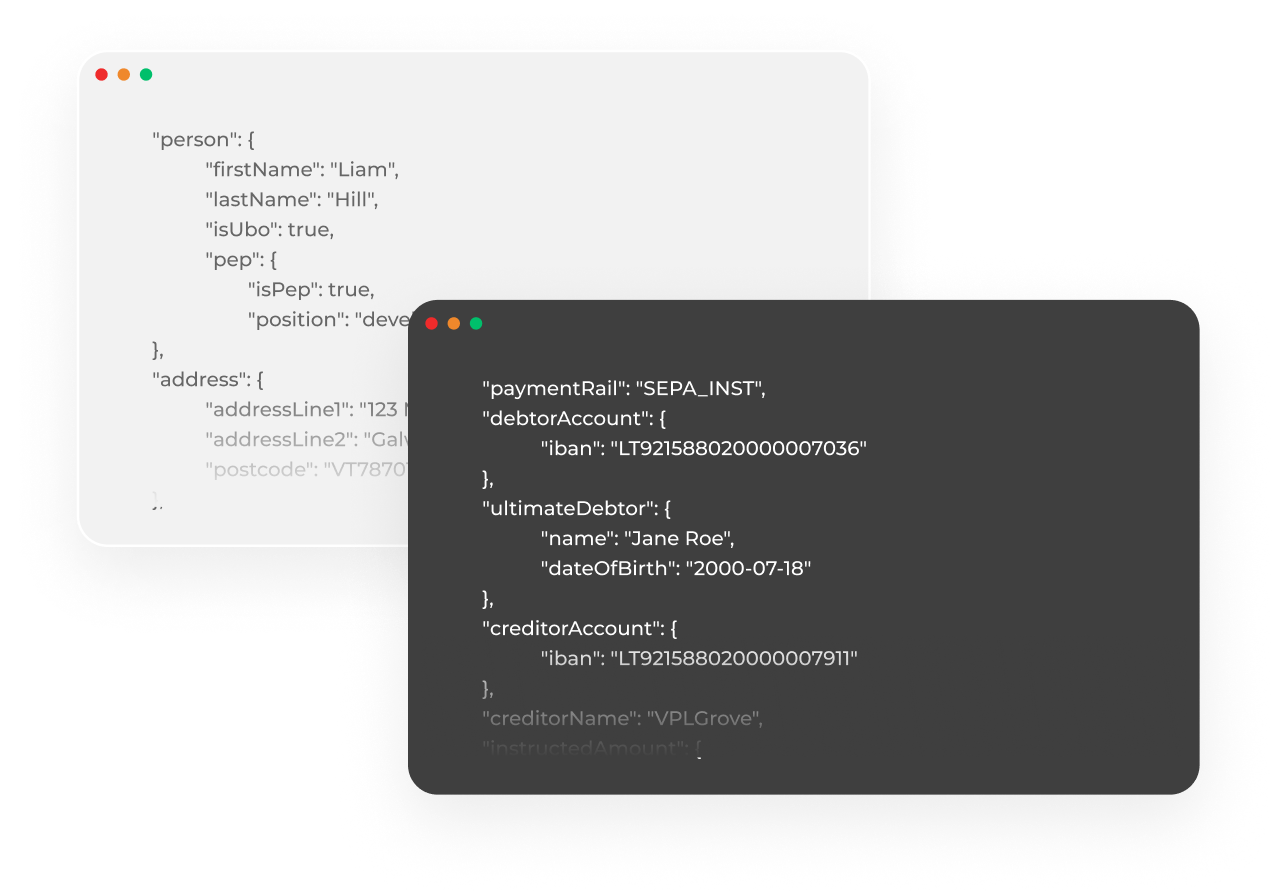

Products

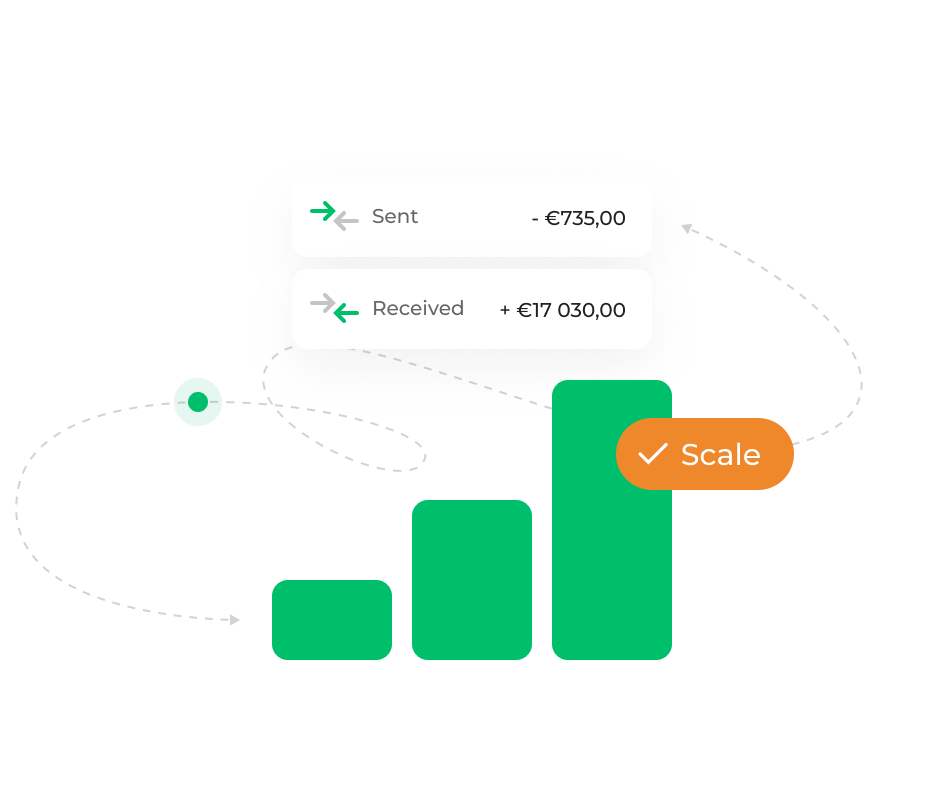

IBAN accounts