Use cases

Other use cases

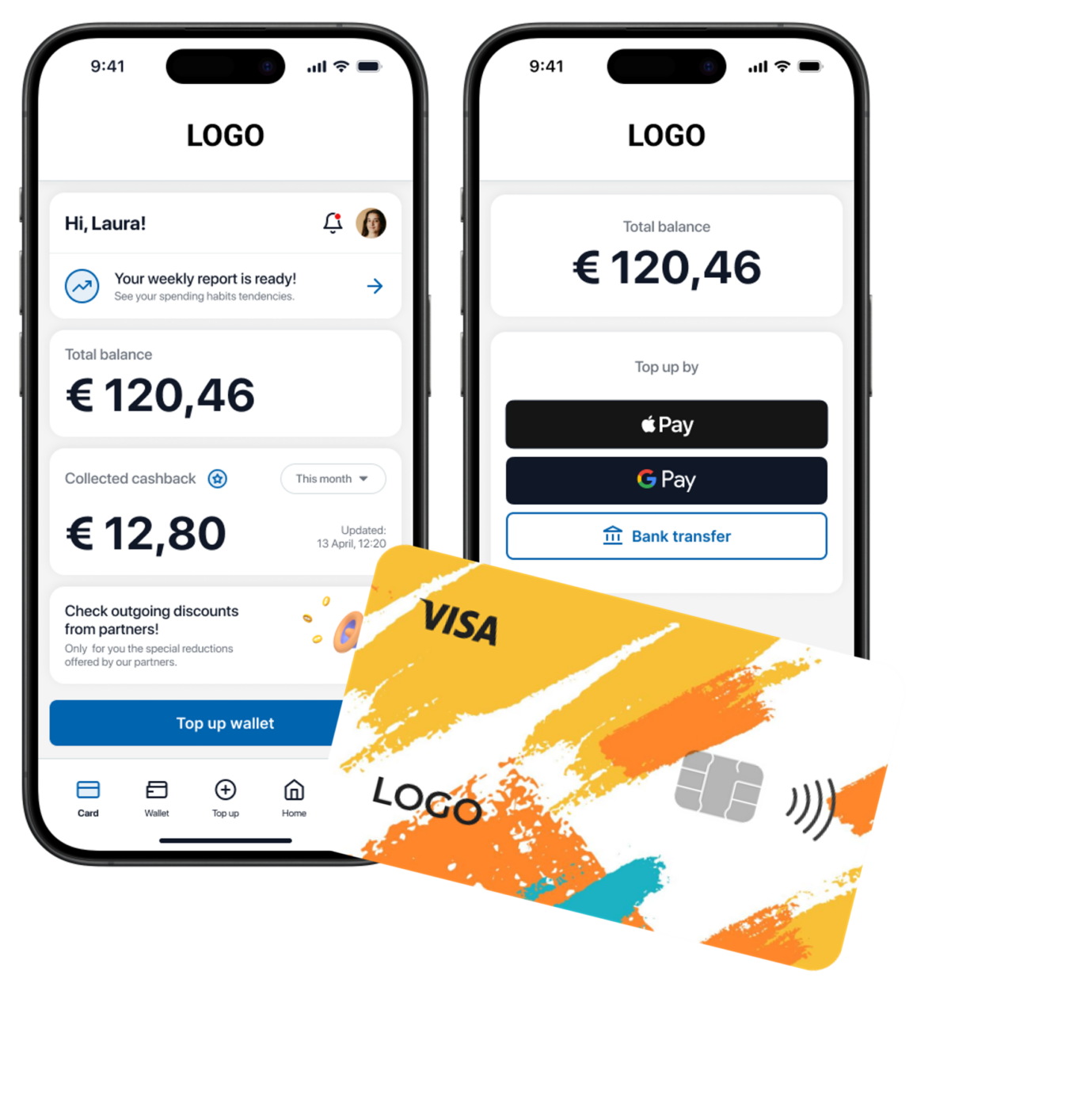

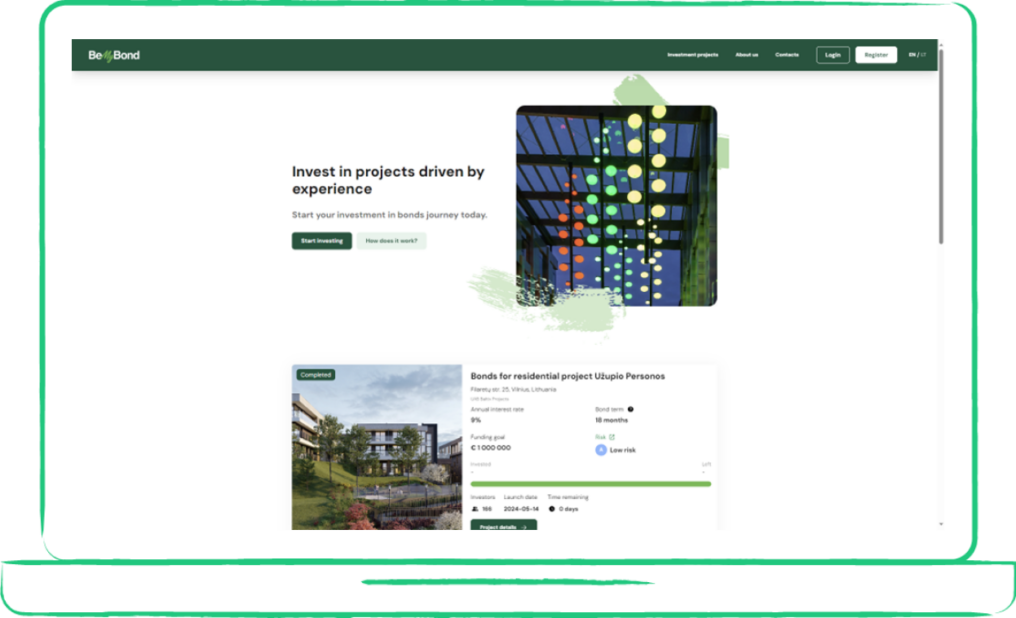

Products

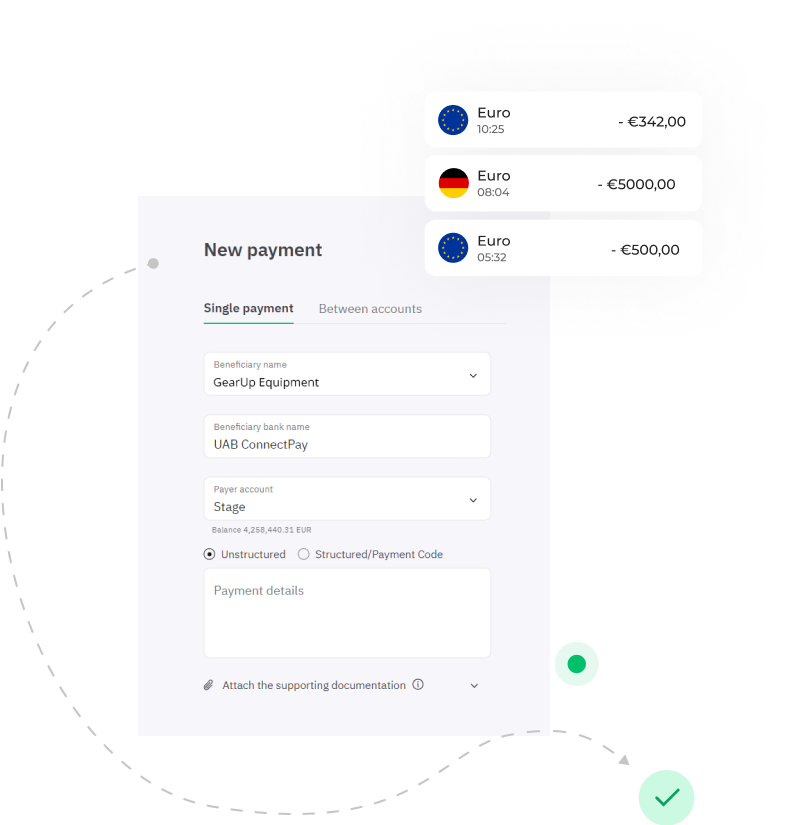

IBAN accounts