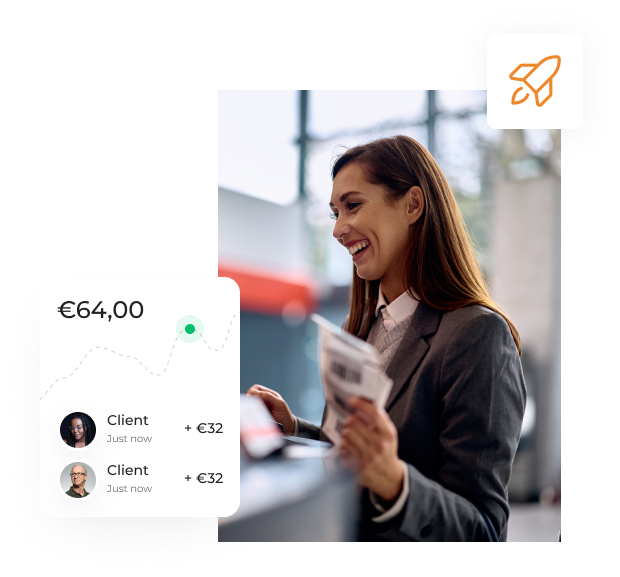

Use cases

Other use cases

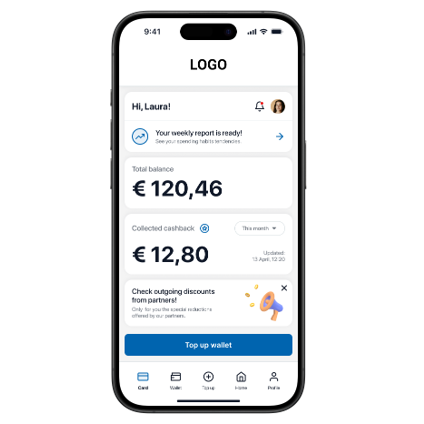

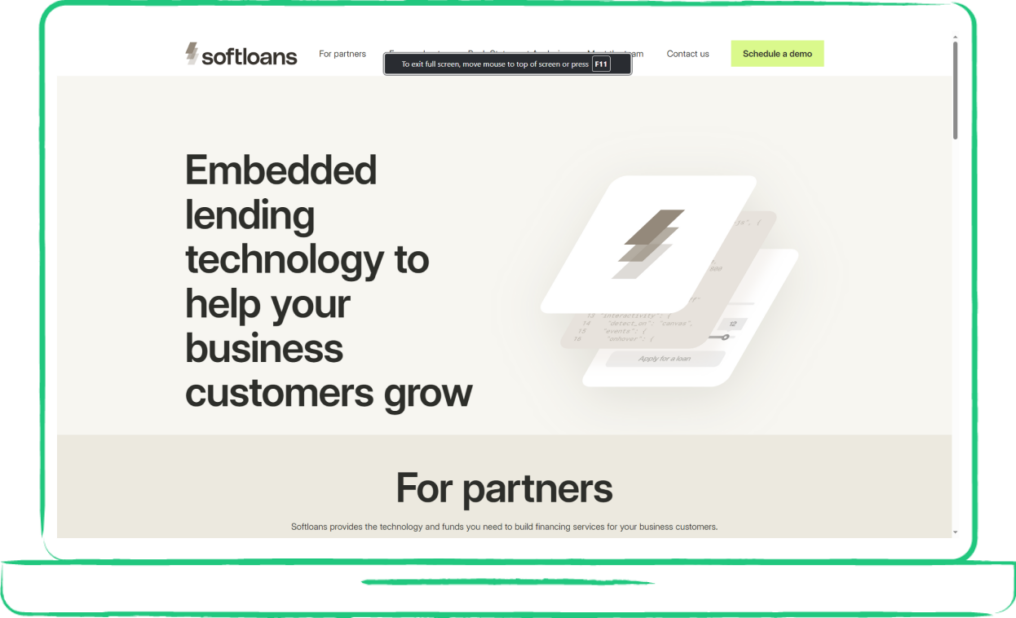

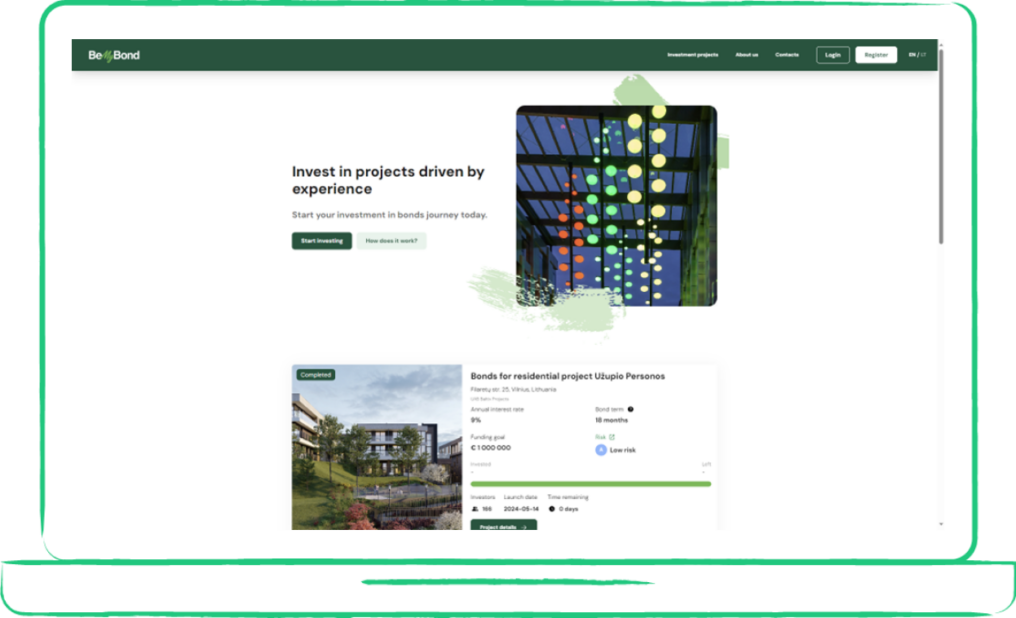

Products

IBAN accounts