Use cases

Other use cases

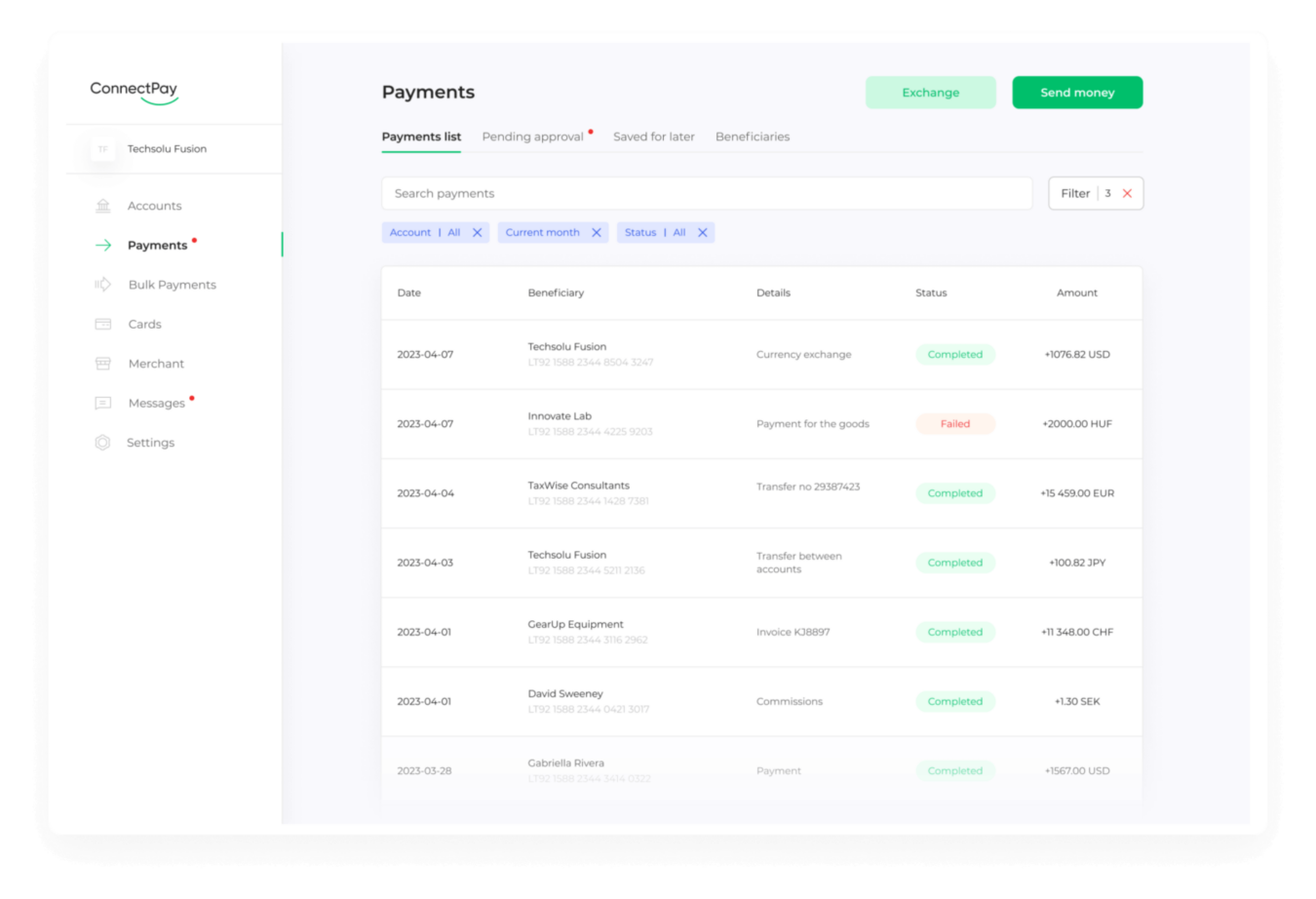

Products

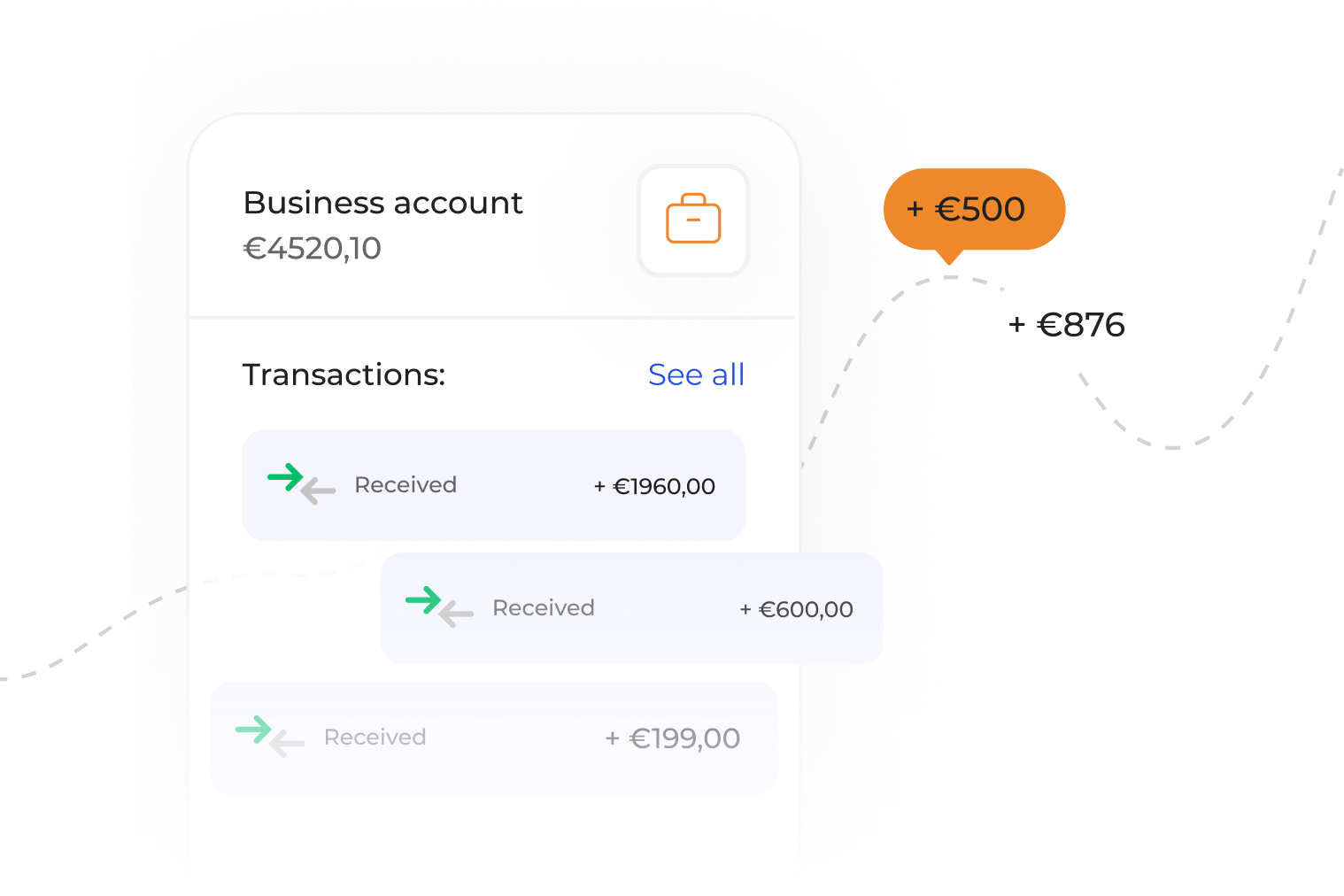

IBAN accounts