Scale your online business by maximizing online shopping conversions through seamless card acquiring, providing your clients the security and convenience they seek.

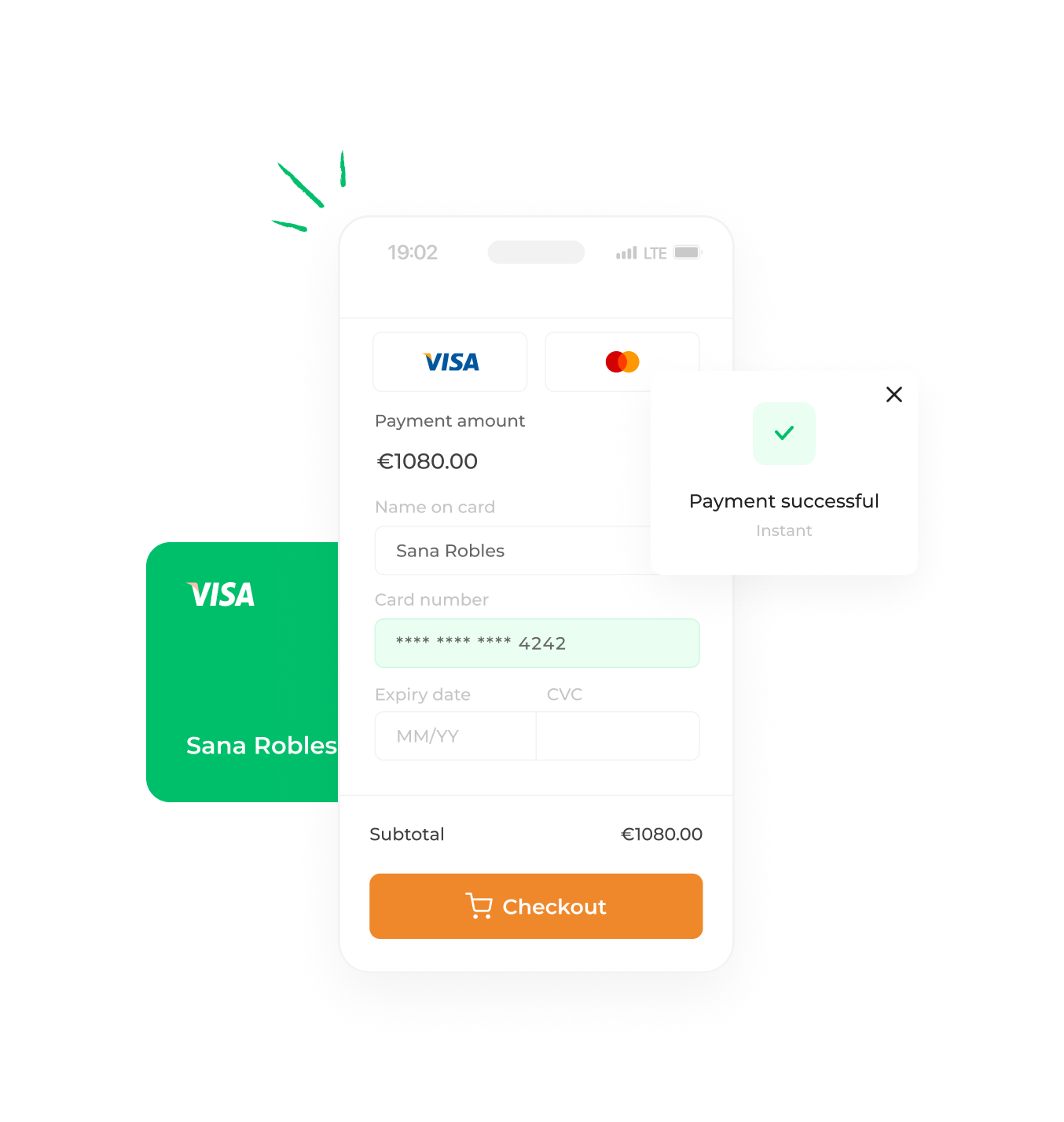

Facilitate card payments for a more convenient experience for your customers.

Allow customer checkouts using Mastercard & Visa debit and credit cards

Easily issue refunds irrespective of the original payment amount

Enable recurring payments & subscriptions

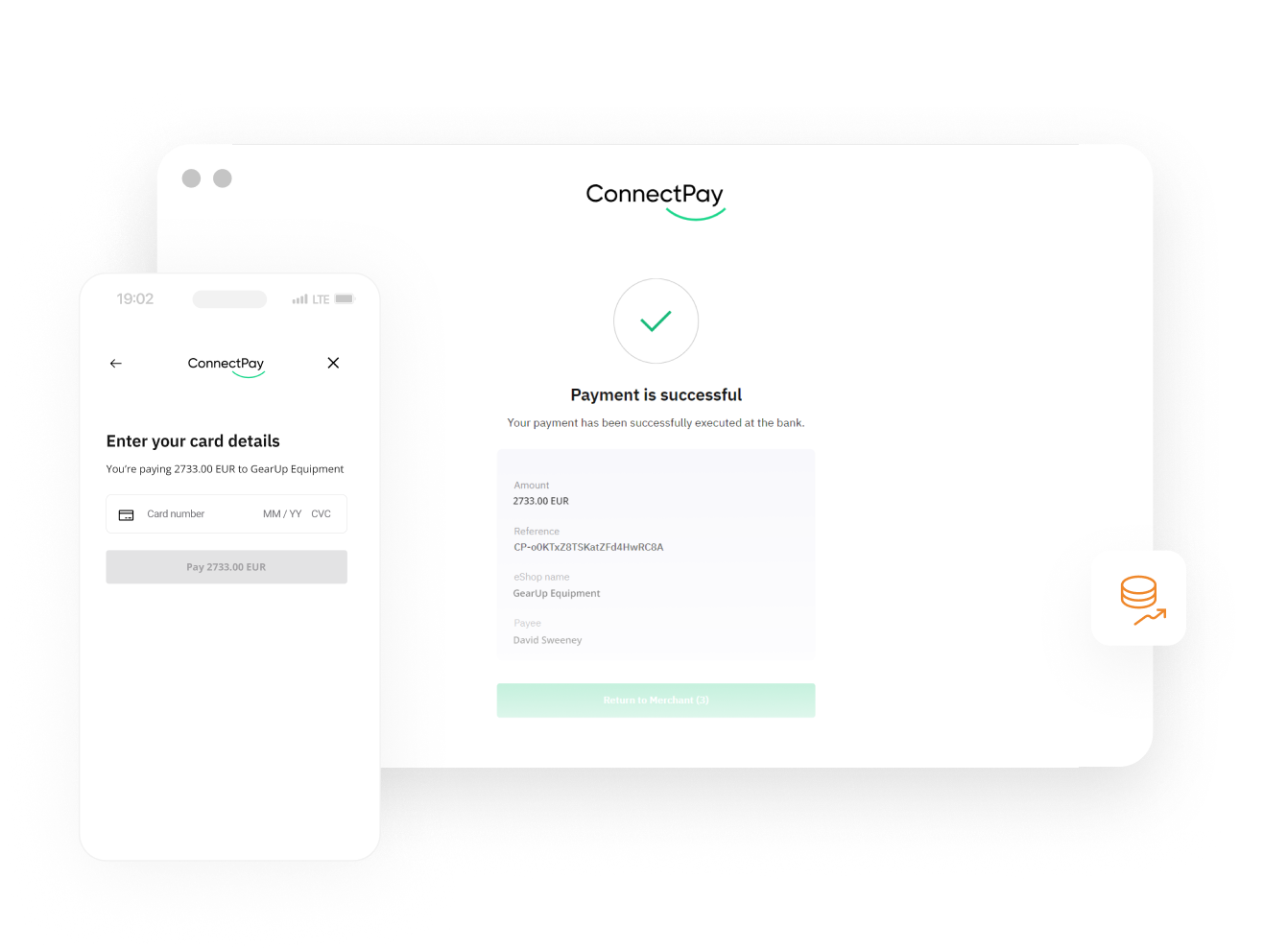

Out of the box plugin for your platform on WooCommerce, PrestaShop, OpenCart, and standalone gateway on your custom page via API

Effortlessly accept quick and secure card payments through our seamless integration of VISA and Mastercard debit or credit cards, broadening your payment options and reaching a global audience.

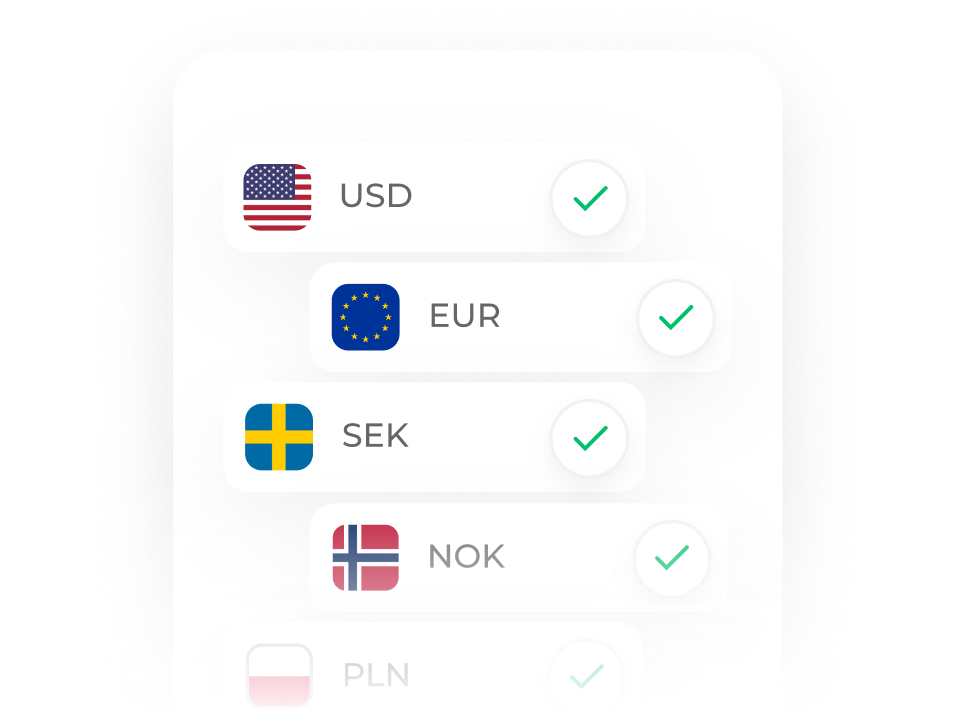

With the ability to accept payments in more than 80 currencies, you’ll be able to connect up with more markets and drive more sales.

Guarantee a smooth UX for smartphone, tablet and desktop users with a responsive checkout.

Card acquiring doesn’t have to be expensive. Allow your clients checkout smoothly with credit or debit cards and enjoy low cost card acquiring starting from 1% +0.10 € per transaction. See pricing details.

Open an account first to begin using our card acquiring solution and be able to connect more modular financial solutions along the way as your online business grows. Plus, we’re ISO certified to keep your data safe and provide 24/7 support for payment-related queries.

Fill in the IBAN account application form and pass the personal KYC process by providing basic information about your business and products.

Fill in the Merchant Application form. This step must be done by the company director but it should only take 2 minutes.

Enjoy a hassle free integration of card acquiring into your online business via API or plugin.

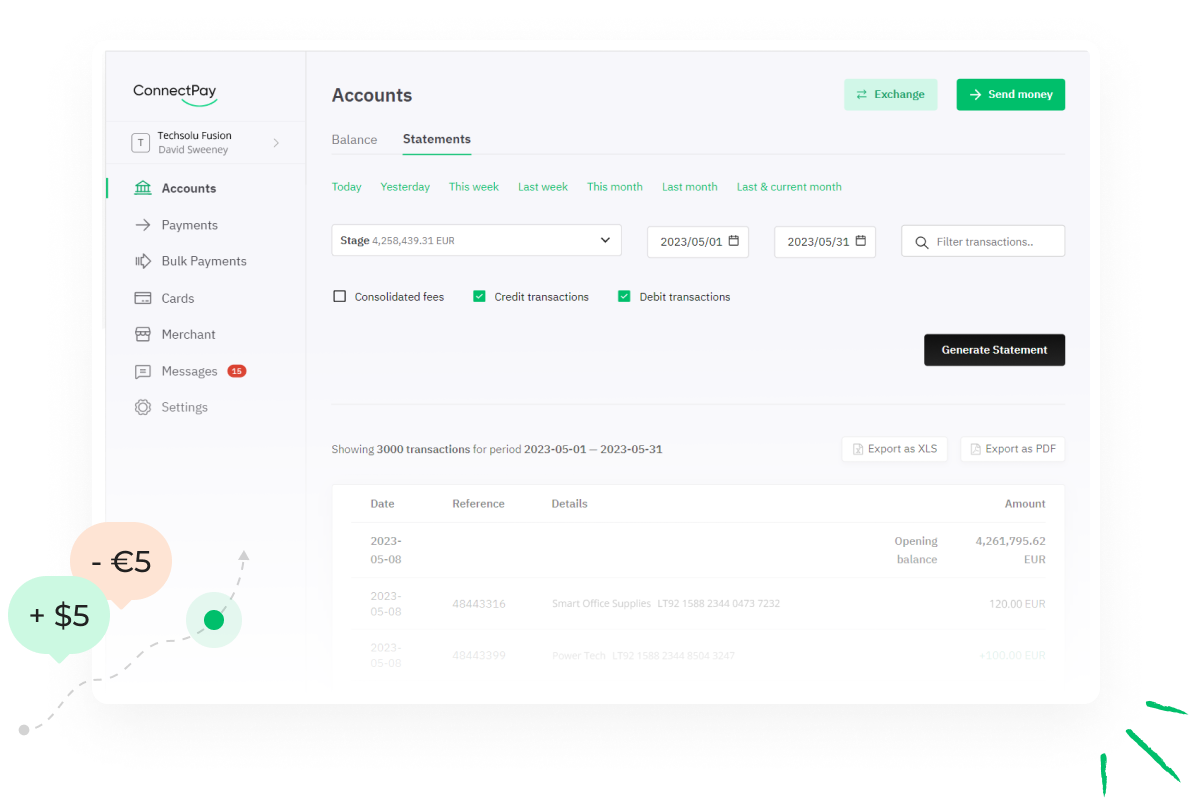

Our standardized reports on sales and declined transactions offer you all the information you need. And if you’d like a closer look, our activity log is there for you, providing a more detailed perspective.

Every transaction adheres to full PSD2 and PCI DSS compliance, ensuring constant protection for both the payer and you because we cover onboarding and ongoing due diligence. Besides, you can focus solely on scaling your business, while we take care of our solutions related transaction AML monitoring, transaction sanction/PEP screening, etc.

Whether you have a custom made website or use an eCommerce platform, integrate our card acquiring solution hassle-free

Effortlessly integrate card acquiring solution into your existing system with our easy-to-use plugin. Just install it, input the credentials we provide, and you’re ready to start collecting credit and debit card payments online.

Monthly Payment Turnover

Processed transactions a month

Client funds held by ConnectPay

Is accepting credit and debit card payments online just one of the features you’re looking for? We have you covered.

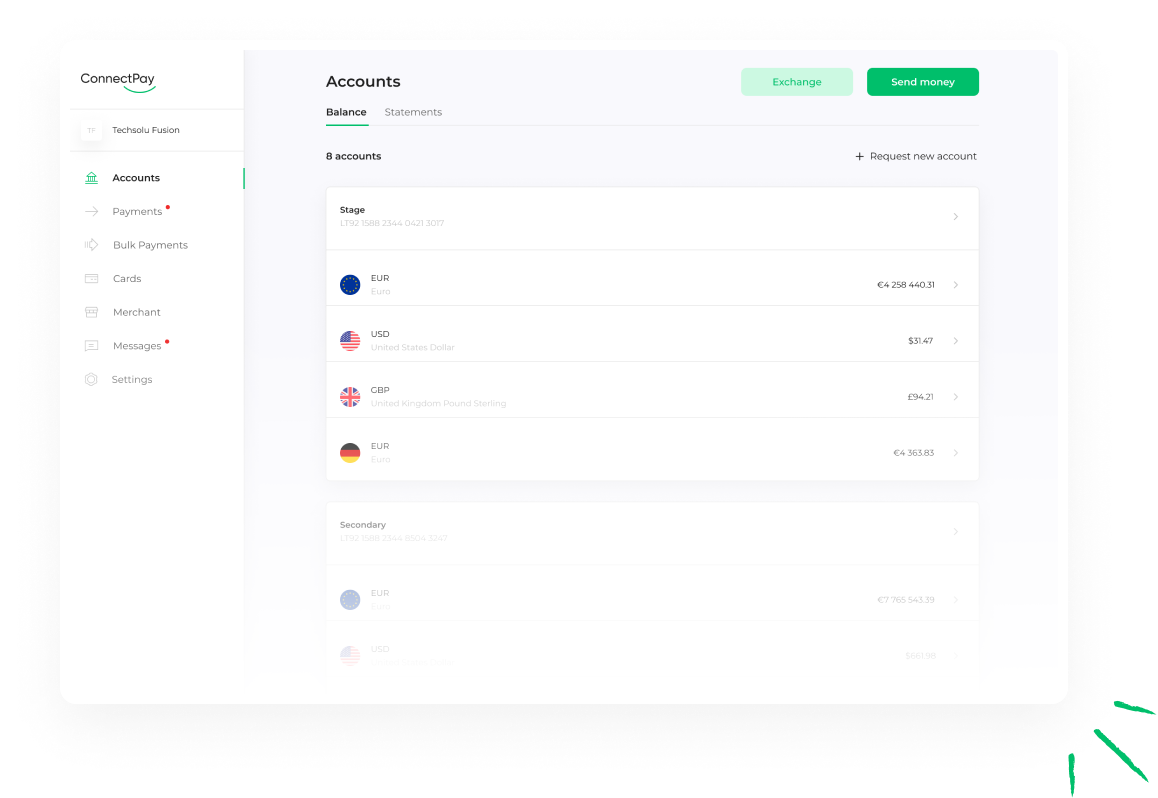

Our Merchant Dashboard is user-friendly and versatile, combining all the tools you need to handle your payment processes and solutions effortlessly.

When your online business is growing, you need flexible financial solutions reflecting your expanding needs. That’s what embedded finance is for – modular solutions that can be integrated into your interfaces via API.

The convenient flows begin with IBAN accounts – they can be used by your business and personal clients, or your own business. Enjoy the speedy and seamless transactions by using it as a digital wallet or exchange, send and receive payments in multiple currencies.

Scale your online business across the globe with vast payment possibilities. From lightning-fast SEPA Instant and euro-zone payments to global SWIFT and cross-border transactions in more than 80 currencies – we have your business needs covered.

Get white-label debit cards with your own design to boost brand awareness and increase loyalty among your clients. Or make the most out of it by integrating it with your loyalty program, app, or digital wallets.

Don’t limit yourself with card acquiring, choose from open banking, multiple types of recurring payments, and flexible refunds. Find the merchant services that are best for you and your clients .

ConnectPay is an Electronic Money Institution (EMI license No. 24) authorized and regulated by the Bank of Lithuania. Payment initiation, account information services and facilitating card payments are within the scope of extended EMI license.

In order to enable ConnectPay Accept Payments service, the merchant has to open an account with ConnectPay while clients using the services of the merchant don’t need to have ConnectPay accounts.

ConnectPay doesn’t set any specific limits for transactions made via our Accept Payments service, but your customer’s bank may have its own policies regarding SEPA credit transfers or card payments. We suggest you check on those.

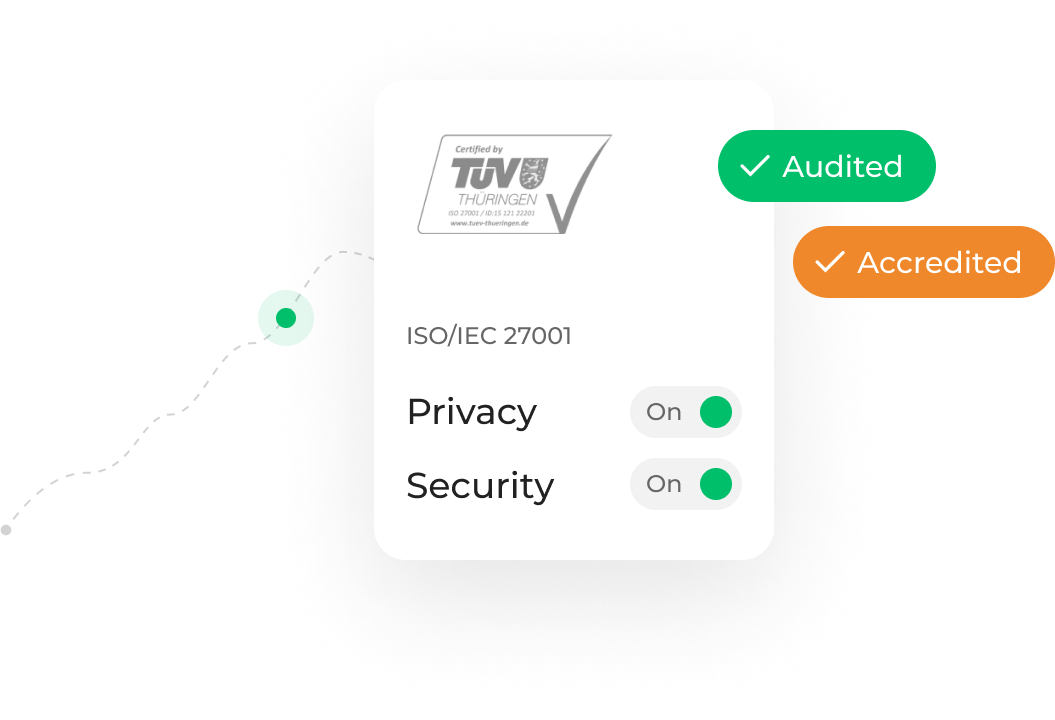

We’re ISO certified to keep your data safe. ISO/IEC 27001 is one of the world’s most robust data security certification schemes.

We’re authorized and regulated by the Central Bank of Lithuania, which is subject to the regulation of the European Central Bank.

Enjoy peace of mind with our team always ready to support you.