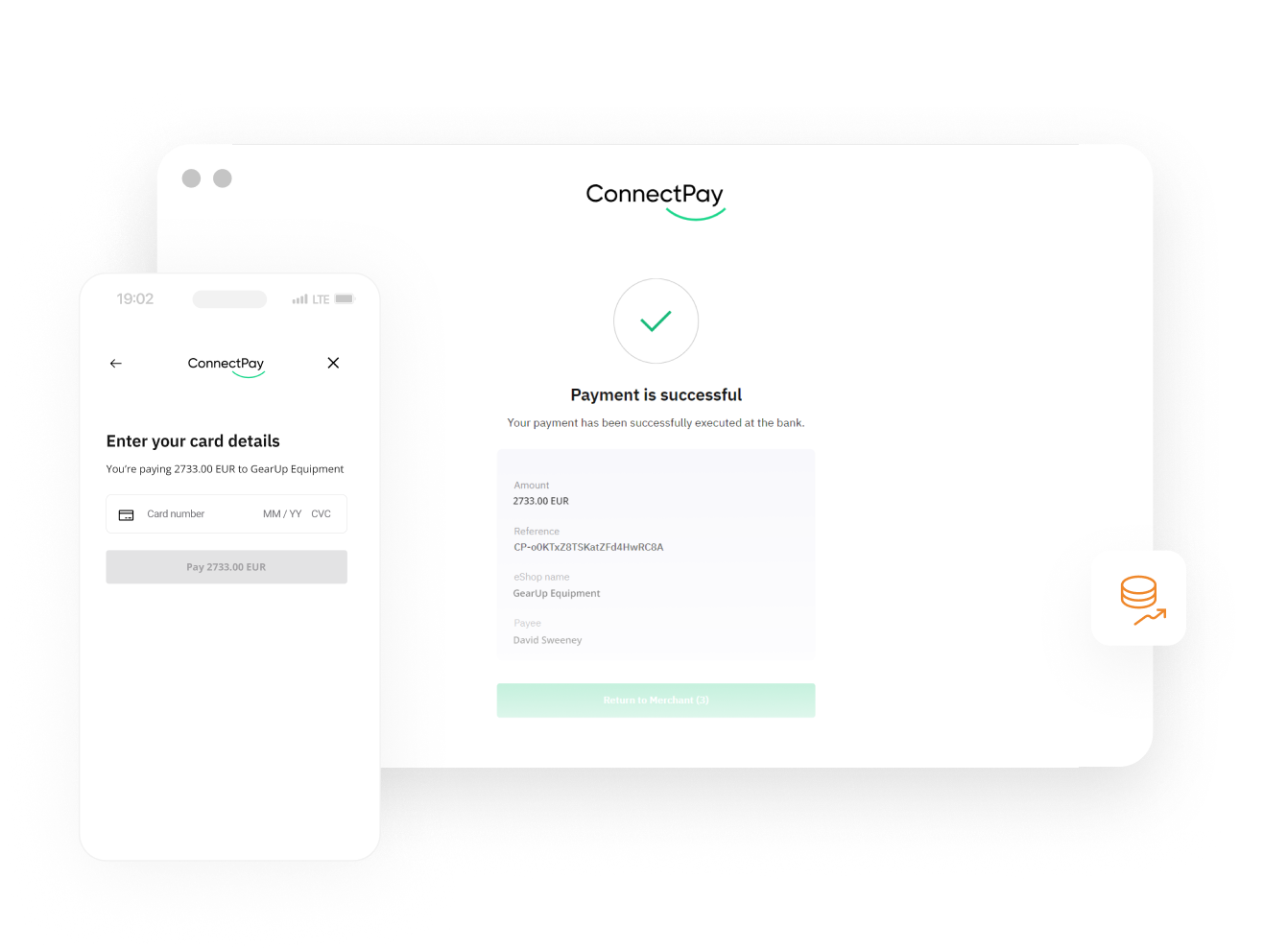

Use cases

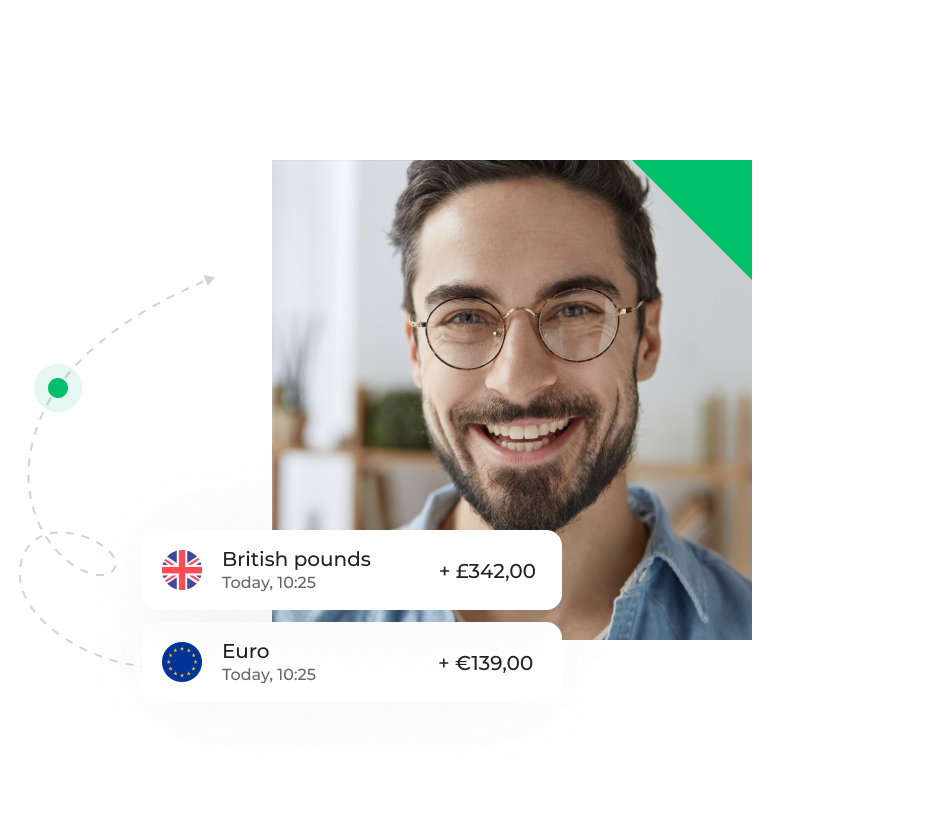

Other use cases

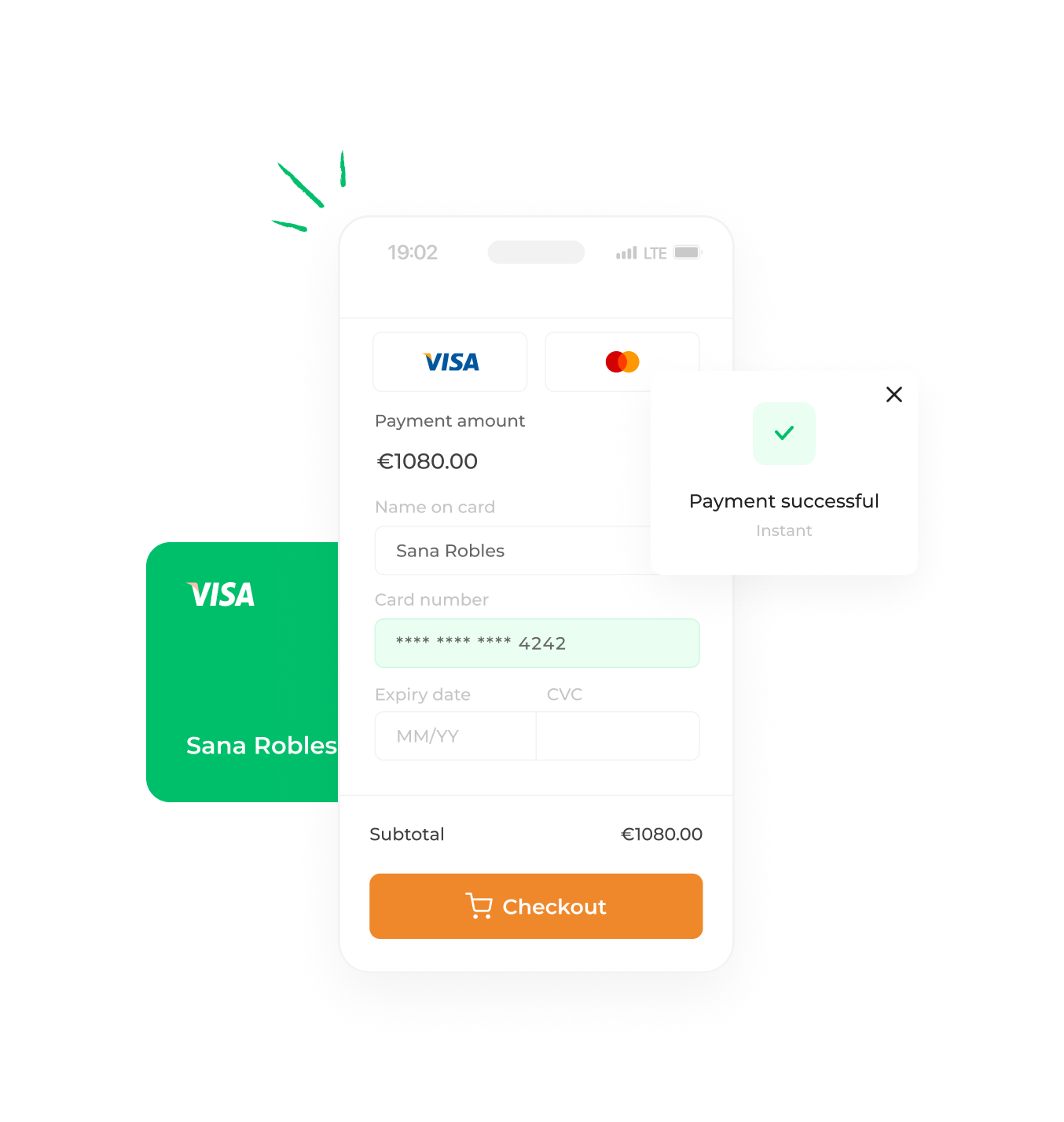

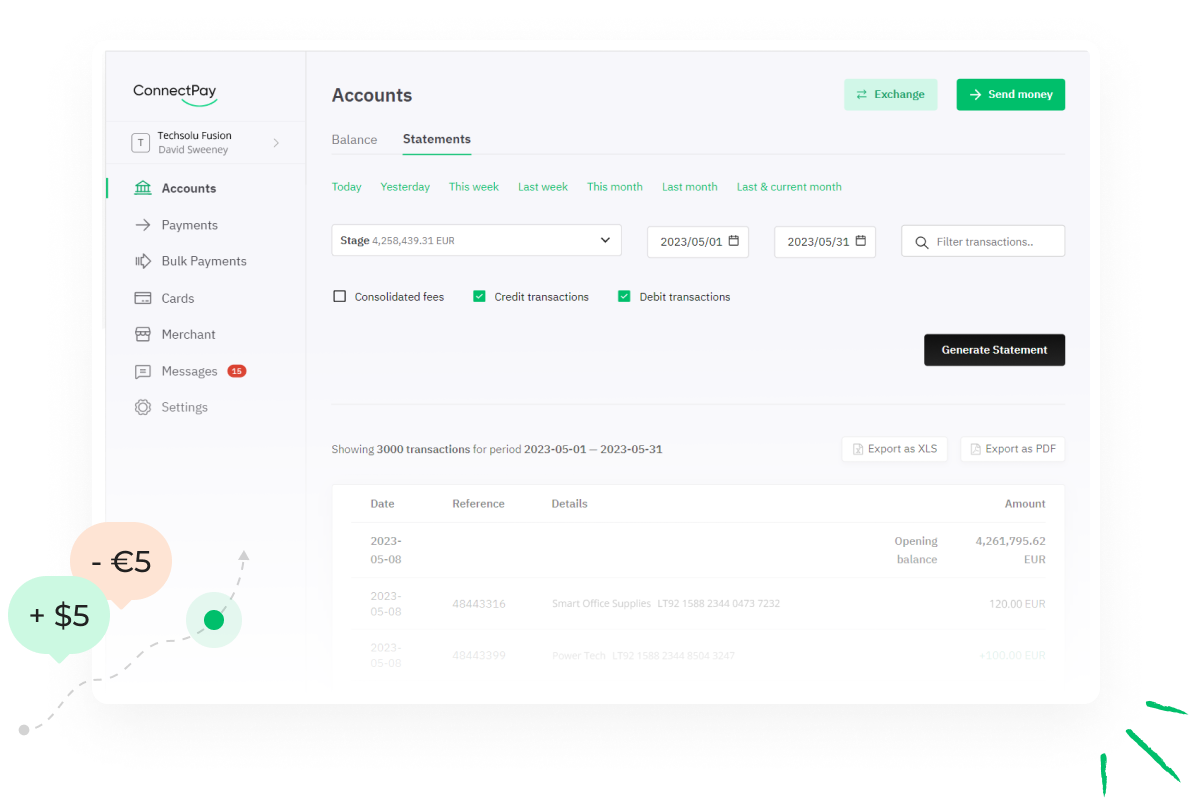

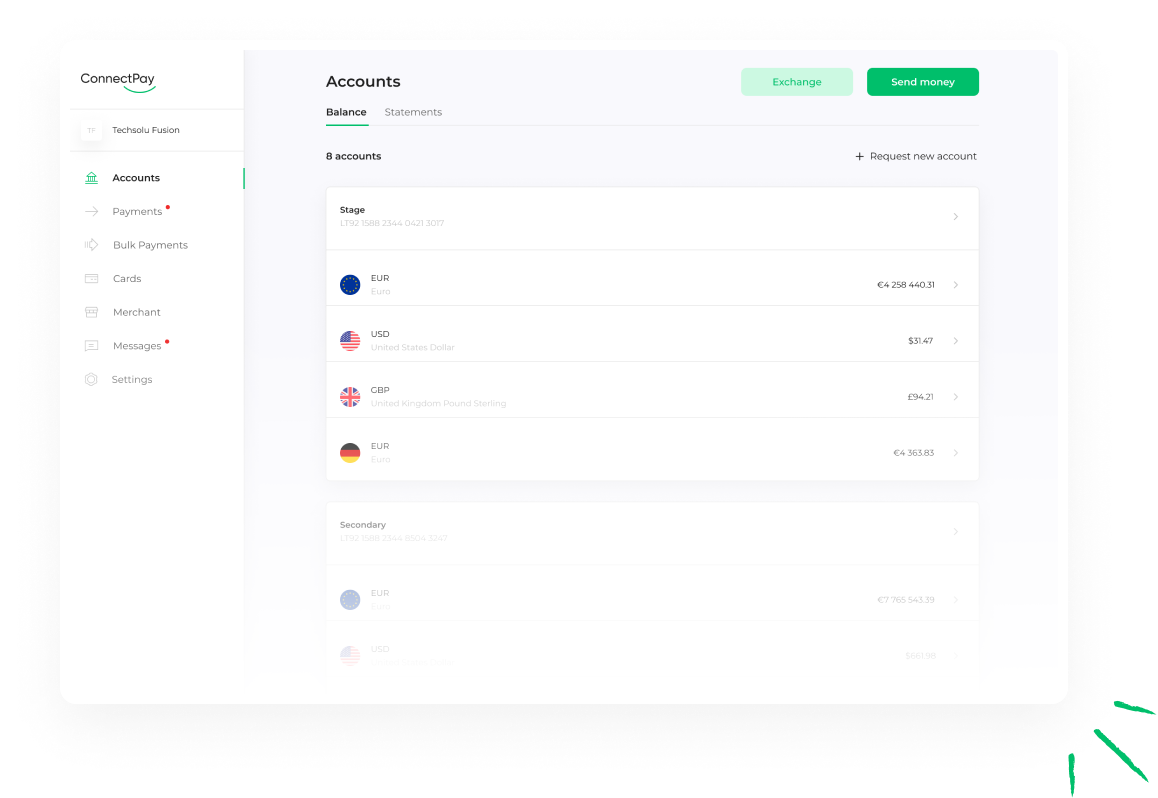

Products

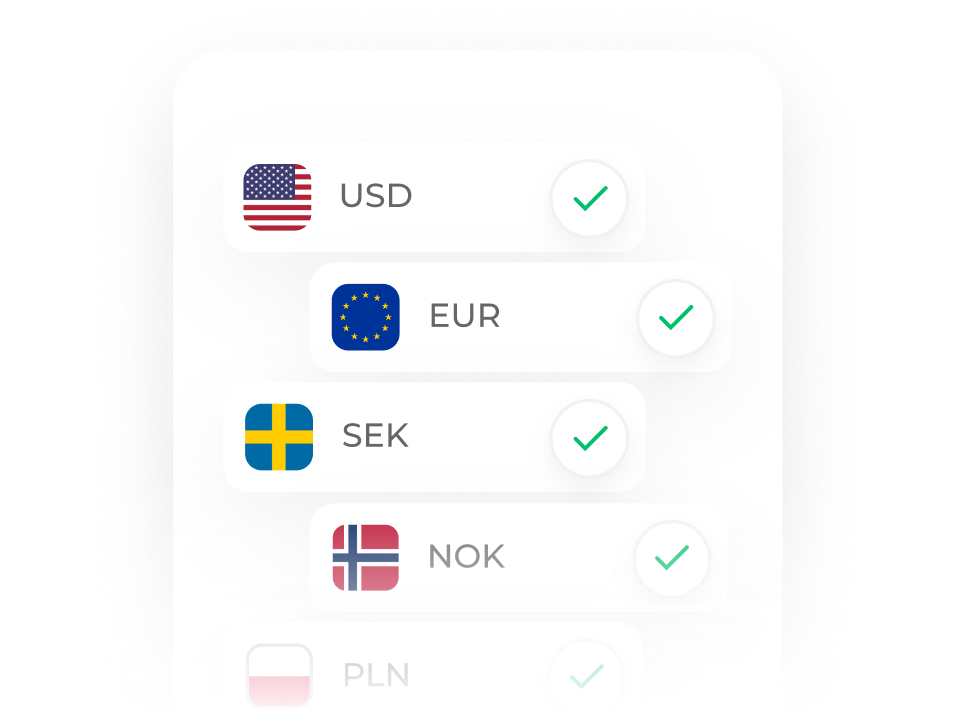

IBAN accounts