Use cases

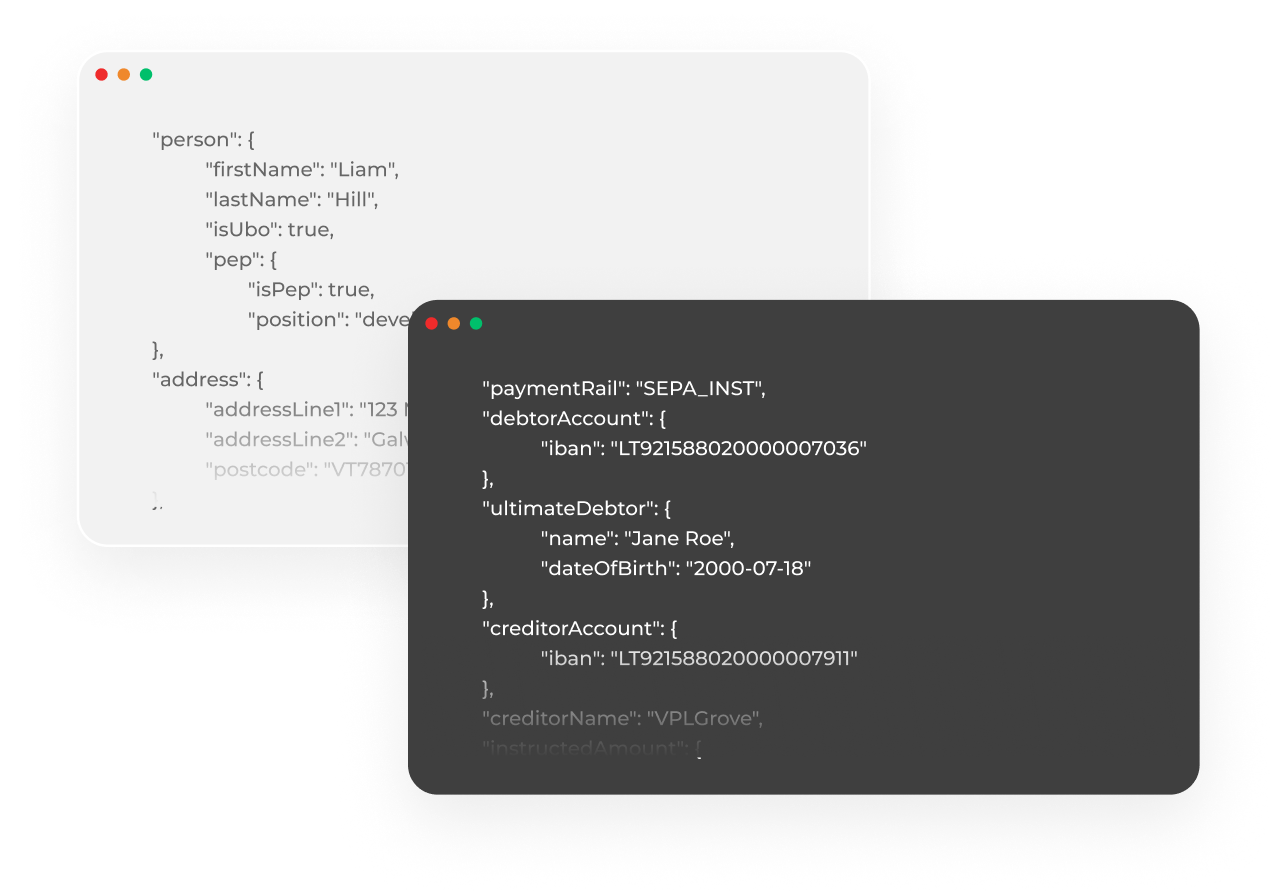

Other use cases

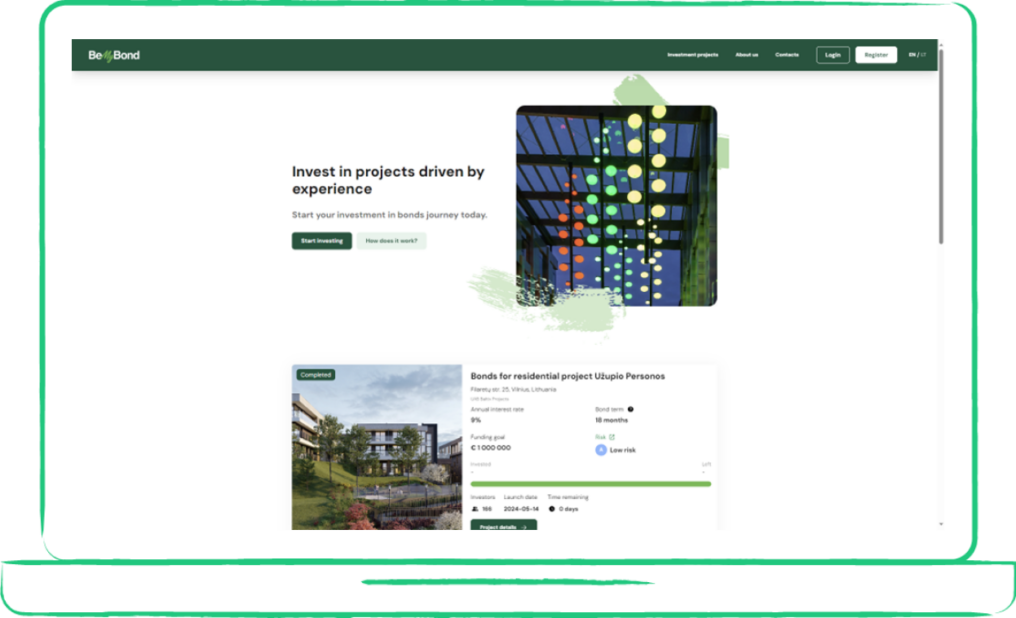

Products

IBAN accounts